MARKET UPDATE - The August CPI Report Brings More Good News For REIT Investors

Important Note

This week, I’ll be attending Europe’s largest REIT conference, where I’ll have the opportunity to meet with the management teams from companies such as Vonovia, Segro, Cromwell European REIT, Dream Industrial, and Realty Income, among others. I’ll be sharing insights and key takeaways from these meetings with you later this week.

Please excuse any delays in my responses to direct messages during this time. I’ll make sure to catch up on them by Thursday at the latest.

=============================

MARKET UPDATE - The August CPI Report Brings More Good News For REIT Investors

There will come a day when the market no longer pays much attention to these monthly CPI inflation reports put out by the Bureau of Labor Statistics.

We believe that we are providing a service to High Yield Landlord members by explaining what is going in with consumer inflation each month. At the same time, we imagine that some readers are getting tired of this incessant focus on inflation.

Why not simply stick to analysis about commercial real estate and REITs?

Put simply, what happens with inflation has a significant effect on commercial real estate and REITs. That is because the general level of inflation affects the level of interest rates, and interest rates affect real estate.

Like it or not, REITs are one of the most, if not the most, interest rate-sensitive sector of the stock market at the moment. We painfully witnessed that as inflation and interest rates soared from 2021 through 2023, and now we are pleasantly witnessing it again as inflation and interest rates are falling.

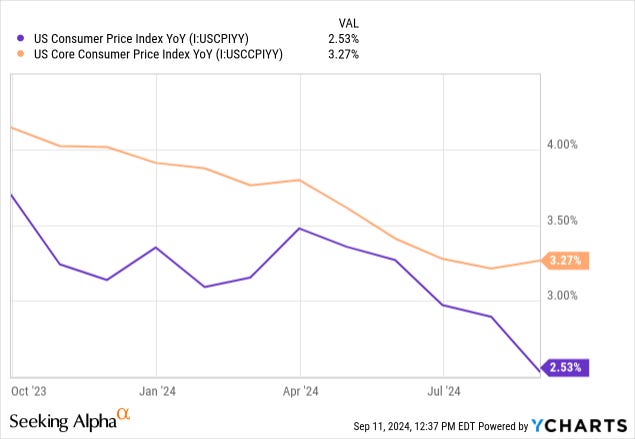

In August, the CPI shows that year-over-year headline CPI continued its precipitous drop, declining from 2.9% in July to 2.5% in August. Core CPI (excluding food and energy), however, slightly rebounded from July to August.

The decline in gasoline prices in August played a big part in this difference. The headline CPI includes gasoline prices, while core CPI does not.

The slight uptick in core CPI was due entirely to an inexplicable increase in one lagging shelter sub-component: Owners' Equivalent Rent. More on that below.

Suffice it to say, the lagging shelter component of the CPI is distorting the government's official CPI and PCE inflation metrics and causing them to come in significantly higher than real-time inflation as measured by reliable private sector data.

Here's Truflation, for example, which currently shows YoY inflation of 1.1% but put August inflation at about 1.5%.

That is a full 100 basis points below where the CPI puts consumer inflation!

During late 2021 and 2022, Truflation showed inflation significantly higher than the CPI. Back then, lagging shelter metrics within the CPI suppressed and delayed the rise in the CPI, while Truflation showed real-time inflation reaching the double-digits.

Today, the opposite problem is occurring. Real-time inflation is falling off a cliff, and the CPI is reacting very slowly and with a lag.

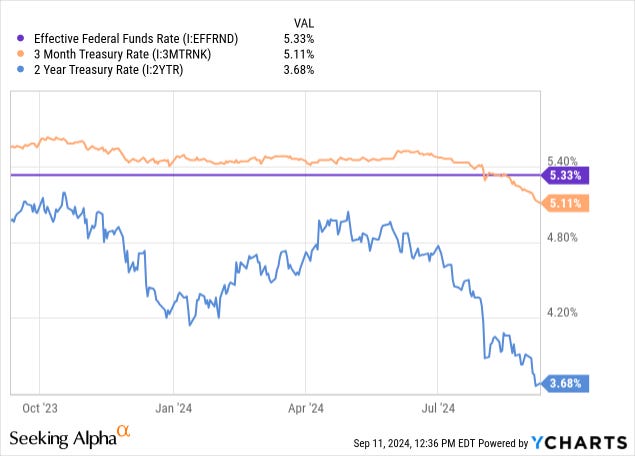

The good news is that, in any case, the Fed recognizes the declining trends in inflation as well as the cooling of the labor market and are determined to begin their rate-cutting cycle this month (September 2024).

Hence why the 3-month and 2-year Treasury yields have declined considerably over the last month.

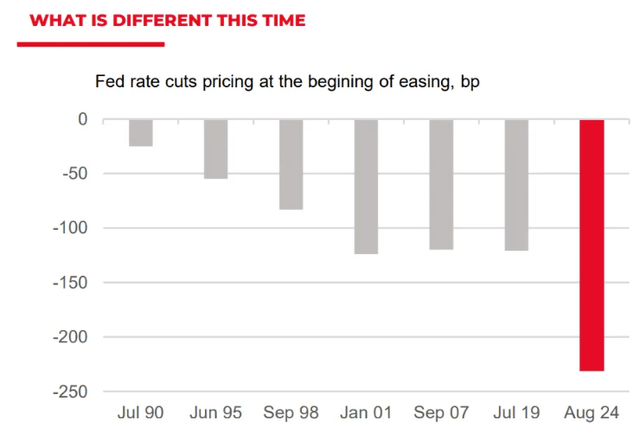

What is truly remarkable is the degree of rate cuts that the market expects over the next year.

The 225 basis points of cuts the market expects to see in the near future is roughly double the levels priced in prior to the last three Fed-cutting cycles.

This is yet another signal of the degree to which inflation (the main reason interest rates have risen so much in recent years) has come down.

The post-COVID inflationary surge is over, and now interest rates and Fed policy are beginning to reflect that.

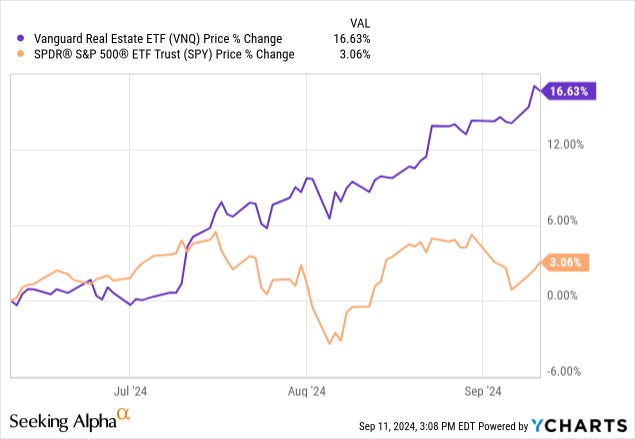

This creates a phenomenal setup for REITs, as we have been predicting for a while now.

The real estate sector (VNQ) has massively outperformed the S&P 500 (SPY) on a price basis alone over the last three months, and we expect that outperformance to continue for the foreseeable future.

In what follows, we'll dig in to inflation, starting with the big picture and then zooming into the August 2024 CPI report.

The Primary Drivers of Inflation Are Gone

There were three primary drivers of the surge in inflation from 2021-2023:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.