Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on January 6th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

MARKET UPDATE - Latest CPI Data Shows That Structural Disinflation Continues

Going into 2025, the market has been very nervous about inflation.

Between tariff and deportation plans from the new presidential administration and rising oil prices, the market has been bracing for higher inflation. Hence the surge in the 10-year Treasury yield over the last several months.

Fortunately, the December 2024 CPI report just dropped and gave some relief to an anxious market.

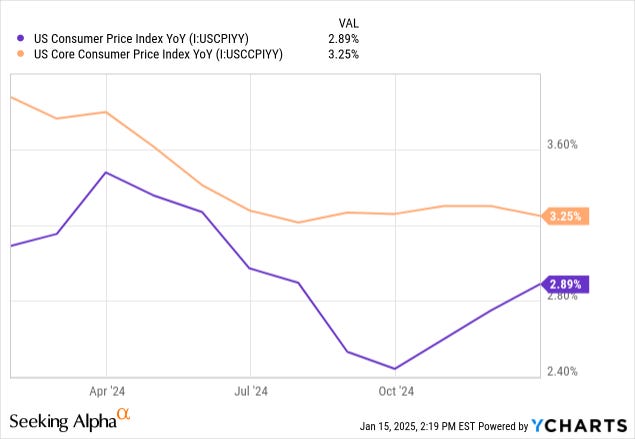

Though the year-over-year CPI rate increased to 2.9%, core CPI (excluding food and energy) fell to 3.3% YoY.

Why was this good news? The headline CPI rate seems to be rebounding, while core CPI remains well above the Fed's 2% target level.

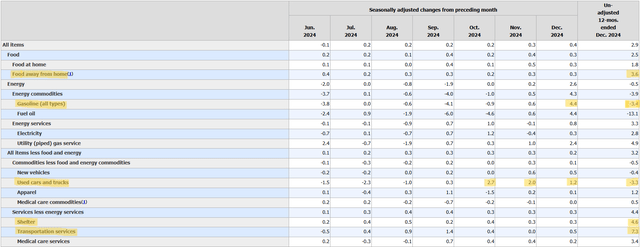

There are multiple reasons why the December CPI report was good news:

The shelter component of the CPI continues gradually coming down and will continue to do so for the foreseeable future, given recent residential rent data.

Despite the increase in oil prices in December, the long-term trajectory remains downward, and YoY gasoline prices were down in December.

Used vehicle prices slowed their increase in December after two months of rising prices following the Fall hurricanes.

Car insurance inflation continues coming down.

Food prices overall are coming down, even though another bird flu epidemic is causing a spike in egg prices.

(Click on the following image to enlarge it on your screen.)

Let's go through these points one by one to show how a disinflationary trend continues to pervade the economy.

Shelter CPI Gradually Converges Toward Real-Time Rent Inflation

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.