MARKET UPDATE - Is Inflation Rebounding?

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

MARKET UPDATE - Is Inflation Rebounding?

There is a school of inflationistas in the investor community that has been saying for a while that a resurgence of inflation is just around the corner.

They say the combination of excessive government spending, deglobalization, the Fed rate-cutting cycle, and optimism about coming tax cuts are already in the midst of triggering another widespread wave of price increases.

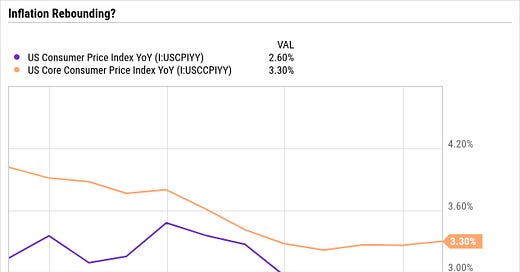

The October CPI report gave those inflationistas some fodder to support their thesis:

As you can see, headline CPI rebounded a bit in October, while core CPI has remained stubbornly flat for the last several months.

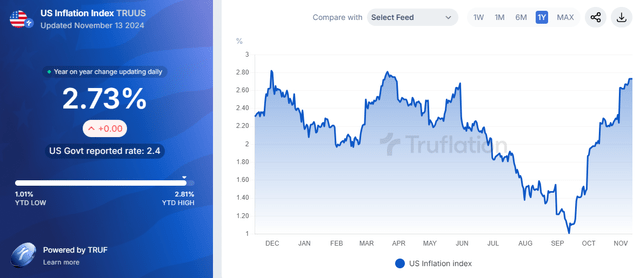

Truflation's consumer inflation gauge is likewise rebounding, beginning in mid-September and continuing through October and into November.

On the other hand, the major components of Truflation's index, like housing and food, are not rebounding. It is a handful of smaller components like apparel, other lodging, and gas utilities that are surging right now.

This surge in a random smattering of small components in Truflation is somewhat baffling, since those same components in the CPI are not rising significantly.

Moreover, input prices for the supply side of the economy are not surging. In fact, PPI inflation remains tame and on the decline:

Likewise, real disposable personal income is back to growing at 3% YoY, which is right around its long-term average level.

The money supply is growing at around the same pace of 3% YoY, below its historically average range of 5-6% per year.

Also, historically, the CPI has always ended Fed rate-cutting cycles lower than where it was before the first rate cut of that cycle. This throws some cold water on the notion that Fed rate cuts per se drive inflation higher.

And as we have explained in the past, government deficit spending does not necessarily generate noticeable inflation, because it depends on the nature of the spending. Government spending in 2020 and 2021 was inflationary because it directly, suddenly, and massively increased consumer demand. Today's government spending growth is mostly coming from entitlement programs, interest expense, and tax credits for the construction of semiconductor and green tech manufacturing facilities. These do not generate meaningful inflation.

In short, we disagree with the inflationista argument.

We are not in the midst of a sustained rebound in inflation. We are still in the midst of an overarching disinflationary trend.

So why did the YoY CPI rate pop in October?

In a word: Hurricanes.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.