MARKET UPDATE - How To Make Big Bucks In REIT Investing

The performance of various asset classes can vary greatly from one time period to the next.

For example, while the S&P 500 (SPY) has delivered impressive returns in recent years, REITs have largely lagged behind.

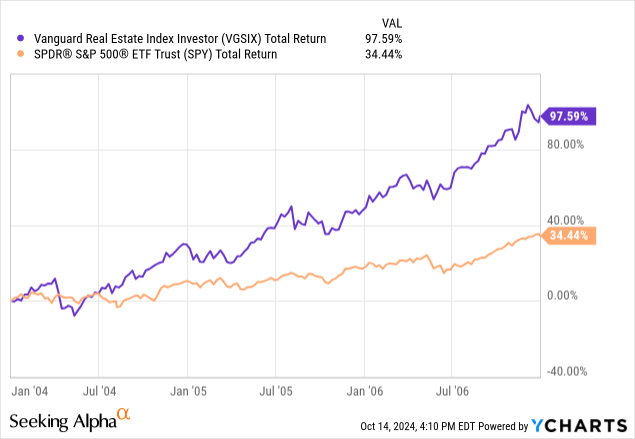

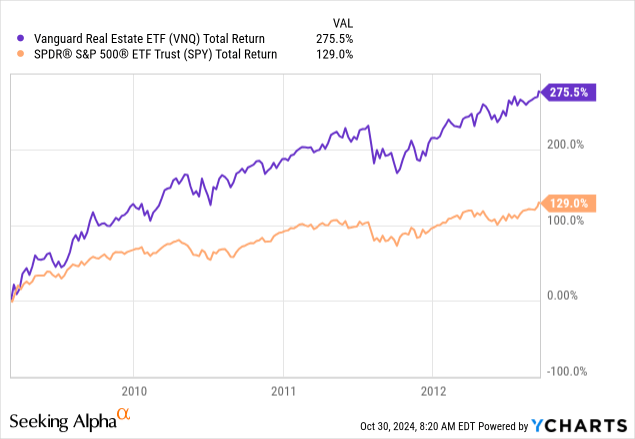

On the other hand, the last two times REITs (VNQ) were so cheap relative to the S&P500, they then massively outperformed in the following years:

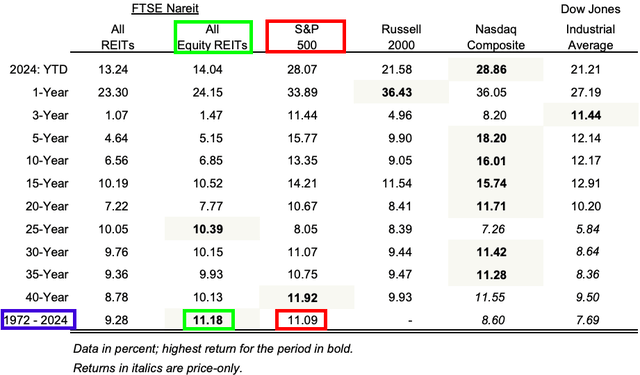

Extending the time frame to the longest possible, we find that REITs have actually done very well over the long run, slightly outperforming even the S&P500 (SPY) over the past 50+ year time period:

REITs earned a ~11% annual return on average and we think that this should be easily achievable for a lot of REITs over the coming decade.

But that’s not why you are an active investor. If you were content with average market returns, you’d simply park your money in a REIT ETF or index fund and enjoy your time on the golf course.

Instead, being part of a service like High Yield Landlord suggests you’re seeking to outperform the market and achieve superior returns.

And how do you achieve that in the REIT sector?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.