MARKET UPDATE - Billionaire Barry Sternlicht Is Buying REITs

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on December 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

MARKET UPDATE - Billionaire Barry Sternlicht Is Buying REITs

If anybody understands commercial real estate, it's people like Barry Sternlicht.

Sternlicht is a billionaire who first began to build his fortune in the early 1990s by raising funds to buy discounted apartment buildings during the savings & loan crisis. He recognized that these properties were high-quality real estate assets that were temporarily discounted due to extraneous factors.

In the span of just a few years, Sternlicht contributed those apartment properties to fellow CRE guru Sam Zell's new REIT, Equity Residential (EQR), in exchange for a 20% stake in the company.

Since then, EQR has become one of the biggest multifamily REITs and outperformed the S&P 500 (SPY).

Sternlicht leveraged this success to make several more highly successful real estate investments in the 1990s, including the purchase of the Westin and Sheraton hotel brands.

In short, when Sternlicht speaks (or invests!), fellow real estate investors would do well to pay attention.

This year and especially in the third quarter, Sternlicht's company Starwood Capital Group has greatly increased its holdings of REITs, signifying tremendous bullishness over the intermediate and long term.

In what follows, we take a brief look at Sternlicht's overarching macro views and why he became so bullish on certain REITs, and then we'll take a look at Starwood's 13F filing to examine which REITs his company bought.

Sternlicht: "Higher For Longer" Will Bring Back Housing Inflation

The standard oversimplification is that higher interest rates, including the all-important Fed Funds Rate, should gradually bring down inflation by slowing down the economy.

But that formula does not hold true for every area of the economy. In fact, for the hugely important housing sector, virtually the opposite is true. All else being equal, higher interest rates gradually promote higher inflation, whereas lower interest rates gradually promote lower inflation.

We've seen this demonstrated over the last five years.

From 2020 to early 2022, high demand for housing (rented and owned) from a red-hot, stimulus-fueled economy came together with ultra-low interest rates to spur developers to dramatically ramp up homebuilding.

While strong demand for housing was a necessary factor in this homebuilding boom, so were the low interest rates that gave homebuyers low mortgage rates and developers cheap construction loans.

But as long-term interest rates surged higher in 2022 and 2023, financing a home purchase or new development start became far more expensive, which contributed heavily to the significant decline in housing starts.

In June 2024, Sternlicht went on CNBC to warn investors (and the Fed) that in lieu of a recession, "higher for longer" interest rates would virtually guarantee another undersupplied housing environment in a few years.

Here's Sternlicht:

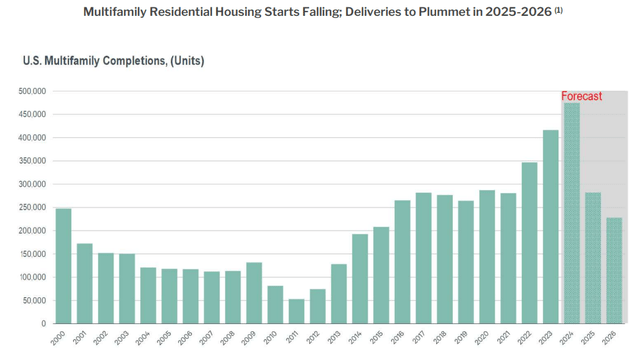

This is my problem with Powell. His policy has crushed multifamily starts. We need houses. We have a huge housing [shortage]. With only 220,000 houses coming in 2026, I will guarantee you rent is going up in '26, unless there's a massive recession.

And more recently, on the Starwood Property Trust Q3 2024 earnings conference call, Sternlicht reiterated this view:

So for real estate it means we can see the light at the end of the tunnel - not sure how long the tunnel is going to go on for. But you can see supply dropping particularly in the multifamily market from 600,000 plus units this year to 230,000 units in '26. You also see logistics starts drop nearly 70%. Both will restart at some point but it does set the pace - the page - for a new recovery.

The data backs up Sternlicht's claims. In 2025, multifamily completions are projected to plunge roughly 50% to around 2021's level, then fall further in 2026 to a level of completions not seen since 2015.

But to truly understand the degree of housing shortage the US faces, we can't look merely at multifamily completions.

Let's zoom out and think about housing holistically.

Since the beginning of 2010, the US population has grown by at least 28.6 million (not including unauthorized immigrants), but total housing units have increased by only 15.4 million. That has pushed housing units per capita to nearly its lowest level in decades.

Unsurprisingly, we see that the housing crisis of 2008-2009 was the turning point in which the rising housing-to-population ratio shifted to a falling ratio.

The population grew faster than the supply of housing, gradually creating a structural shortage.

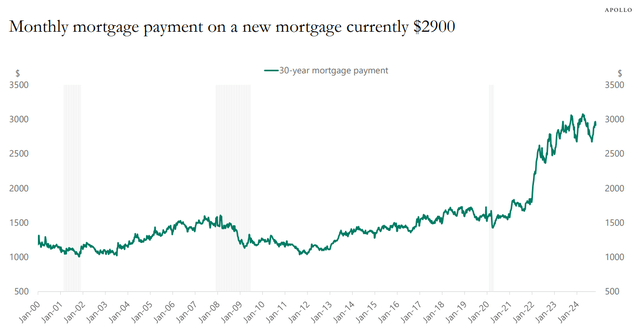

And since the rise in interest rates and, by association, mortgage rates, the average monthly mortgage payment to buy a home has soared, nearly doubling.

Homebuying affordability has rarely ever been so low, so out of reach for the majority of Americans.

The gap between the cost of buying and the cost of renting is massive. Hence we find, unsurprisingly, that a record share of Americans say they would rent rather than buy a home if they move.

Given the US homeownership rate of ~66%, seeing this share of likely renters rising above 33% is good news for residential landlords because it implies a growing share of people are and will remain renters by necessity.

Also unsurprisingly given the previous data, the share of US home purchases made by first-time buyers (new homeowners) just hit a new record low.

Less than 25% of home sales are being purchased by new homeowners, down from the historically normal 35-40% range.

Would-be homeowners are being locked out of the homebuying market, which results in more demand for rental housing.

Unless home prices fall significantly or mortgage rates meaningfully decline, this situation looks likely to remain more or less the same for the foreseeable future.

Sternlicht's Starwood Capital Group Is Piling Into REITs

With the above macro backdrop in mind, it is not surprising to find that Barry Sternlicht is highly bullish on rental housing.

And how is he expressing that bullishness? By buying multifamily REITs.

Starwood Capital Q3 2024 13F Holdings: