Interview With The CEO Of Whitestone REIT - Strong Buy Reaffirmed

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Interview With The CEO Of Whitestone REIT - Strong Buy Reaffirmed

Today, Whitestone (WSR) is our largest retail REIT investment. We like it so much because:

(1) It owns service-oriented strip centers in some of the fastest-growing sunbelt markets. Its two biggest markets are Phoenix and Austin, which have been some of the best-performing markets in terms of retail rent growth and property price appreciation in recent years.

(2) These properties are typically anchored by grocery and/or some other essential services, and as a result, they are resilient to recessions and the growth of e-commerce.

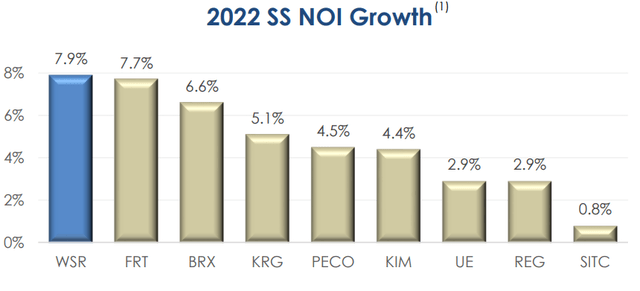

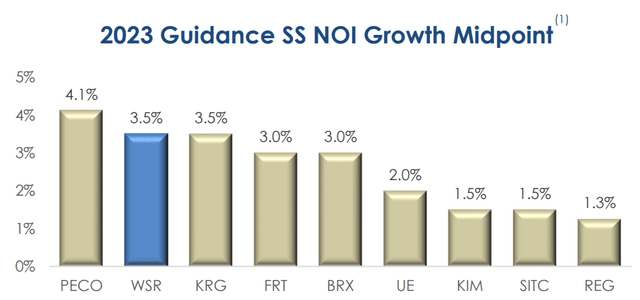

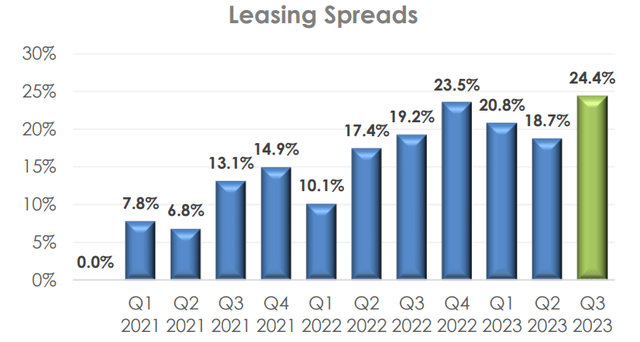

(3) Its leases are relatively short at less than 4 years on average and its rents are below market, providing it an opportunity to hike rents as leases expire. In the most recent quarters, it has managed to hike the rents of its expiring leases by ~20% - resulting in sector-leading same-property NOI growth. Moreover, its leases are typically triple-net, meaning that property expenses are covered by the tenant, and include 3% annual rent escalations.

(4) Despite owning such desirable assets, the company trades at a near 30% discount to our estimate of its NAV. We think that this is because of two fixable issues. The first one is its management. The second one is the balance sheet.

(5) The REIT had management problems in the past, but these have been mostly resolved. The former CEO was fired for cause, a new shareholder-friendly CEO was hired, and the company's governance has been greatly improved. But this problem has dragged on because the former CEO then sued the REIT for wrongful termination. This led to significant legal fees and also prevented the REIT from exiting a partnership. Fortunately, there are good reasons to believe that this drama is now coming to an end.

(6) The balance sheet is a bit more leveraged than that of its peers, but it has no major maturities until 2026 and the management is rapidly deleveraging to fix this issue.

(7) We believe that as the new management builds a track record of good shareholder alignment and further deleverages its balance sheet, the market will reprice the stock at closer to its NAV, unlocking up to 30-40% upside potential. While you wait, you earn an 8% cash flow yield, out of which it pays out 4% in dividends, and uses the rest to pay off debt.

(8) Finally, strip center REITs have recently become the target of M&A with Regency Centers (REG) buying out Urstadt Biddle Properties (UBA) and it wouldn't surprise us if Whitestone REIT (WSR) was next in line.

Recently, I had a phone call with the company's CEO, Dave Holeman, to discuss their recent performance and their plans to unlock value for shareholders.

Below, I first share my main takeaways from the conversation and I then share the transcript of the interview as well.

My Takeaways From The Interview:

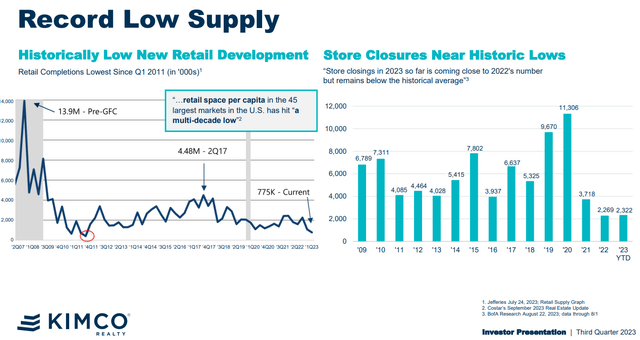

Neighborhood centers such as those of Whitestone are uniquely attractive today because, unlike other property sectors, there has not been much new supply of retail space in recent years. As a result, their NOI continues to grow at a good pace even as other property sectors like multifamily are starting to feel the pressure of the new supply.

Sunbelt retail neighborhood centers are arguably more attractive than multifamily today because they benefit from the same population growth, but don't face the same wave of new supply, and yet, WSR is priced at a similar discount to NAV, which is also based on higher cap rates.

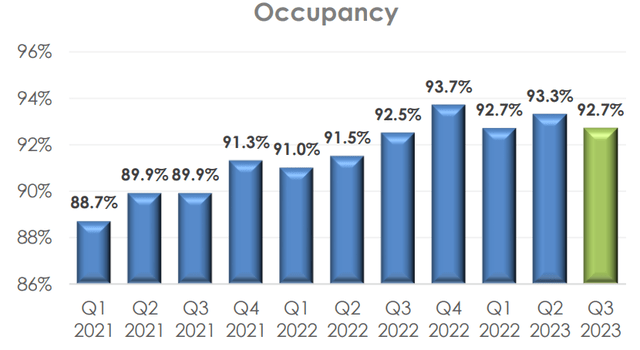

WSR's current lease rates are about 15-20% below market rent levels and as its occupancy rate gets near 95%, it should be in an even stronger position to aggressively hike rents in the coming years.

WSR expects to get $50-60 million as it exits the Pillarstone partnership, which today isn't earning it anything. Reinvesting that at a 7.5% cap rate would result in over $4 million of new NOI.

WSR also had $4 million of legal expenses in 2023, which will disappear as the legal cases with its former CEO come to an end. Removing $4 million of expenses all while adding $4 million of NOI should push Whitestone's cash flow significantly in 2024 and 2025 and significantly reduce its leverage, making it more similar to its peers. These numbers are significant considering that the REIT has guided to earn ~$47 million of FFO in 2023.

Selling the company today or liquidating it would likely not maximize value. Doing that would make much more sense after interest rates have come back down, transaction activity has picked up, WSR has resolved its legal case, paid off some debt, and realized some of the mark-to-market in its leases. Liquidations and buyouts also involve significant transaction fees and the buyers typically want a discount. But it is not long since BSR REIT, a Texas-focused small-cap apartment REIT, actually traded at a 10% premium to its net asset value. As WSR fixes its issues and the market sentiment for REITs recovers, its valuation could rise significantly as investors finally recognize that WSR is one of the most desirable sunbelt-focused portfolios in the entire REIT sector. The current path is likely the best to maximize shareholder value.

Interview Transcript

1) In recent years, sunbelt markets have enjoyed rapid growth, but this growth was then met with a boom in construction activity in some property sectors, particularly in multifamily and industrial. But it seems to us that neighborhood centers like yours have not experienced this same boom in construction activity, and this explains why your occupancy has kept on rising. Is this true?

Yeah, absolutely. I think one of the great dynamics we're experiencing right now is limited supply, and really there's been no retail neighborhood centers built really since the financial crisis. I do think retail has a little bit of a stigma with it because of the malls and e-commerce and so you continue to see minimal development activity. Then you combine that with our geography where you have great migration and it's a nice dynamic.

Ultimately, it's also important that it's the right type of retail. We tend to have centers that are a little smaller and more embedded in their neighborhoods.

I think you're right on the multifamily side. We saw a real run of capital going there, but in retail, you still have a little bit of the mall stigma, the big box stigma, the e-commerce stigma. I think frankly that's benefiting all of us that are in the right markets with the right type of products.

I would add that we are a little behind in putting a slide on this in our investor presentation, but if you look at Kimco, their slide 11 hits it. So there are some folks with some pretty good data out on that and we'll need to make sure we've got a slide hitting that the next round

2) Your releasing spreads also remain particularly strong. Would you have an estimate of how much your current rents are below market at the moment?

Yeah, that's a great question. I feel like the best indicator of a mark-to-market in a portfolio is your leasing spreads. That's the rental rates you're getting on the releasing activity compared to what was there before.

I think it's very important in our product that you find the right tenants and the right operators. It's something we've focused on heavily this year. Quality of businesses that are very successful and able to pay premium rents. So we don't have an official mark on our portfolio, but I think the best indicator is the leasing spreads that we've put together for the last six or seven quarters. I think they have all been at least 17% I think for seven quarters in a row is the number I remember.

Then one thing about us that makes us also a little different is the shorter leases enable us to capture that spread more quickly than some of our competitors. We have about 20% of our square footage rolls every year, so we're able to move those rental levels.

3) Your occupancy has kept on rising and you are guiding for it to reach around 94% by the end of the year, up from 91% in 2022. Do you think that this higher occupancy level will put you in an even stronger position to push for higher rents when signing new leases in 2024?

Yeah, absolutely. I think we need to give a lot of credit to our team that has been very focused over the last couple of years in really knowing the markets... knowing the customers... It's important in retail to look for trends and they spent a lot of time on that and we've been able to lease up our centers pretty substantially over the last couple of years.

You're right, as you get a center in that 95% range, you start to really have more power. And if you have businesses that serve the community well, they typically succeed and we benefit from that as well. So I do think as we get our occupancy probably where it should have been for a number of years, given the quality of our portfolio, we'll be in an even stronger position to continue to strengthen our tenant base and continue to push the rents by having successful tenants.

4) You have had quite a bit of legal expenses in 2023 related to the lawsuit with your former CEO. But recently you announced that the court had dismissed all claims made by the former CEO. Do you know already what will be the next step? Do you think that there will be an appeal? Would you be able to seek some damages from your former CEO to compensate for the losses that he caused with this meritless lawsuit? How does this relate to Pillarstone?

Yeah, it's hard to give you a whole lot. I will say that there are two cases. They really are not connected, but one was the termination of the CEO, and the other one was exiting a partnership (Pillarstone) that he is in control of. So we're very pleased with Harris County's decision to basically throw out all of his claims for wrongful termination. He has legal steps available to him, so I don't know what he would elect to do. I feel like it was very clear in the steps that were taken that his claims were without merit. I think one of the comments we made in our press release was we look forward to moving ahead. We've spent a fairly significant amount of legal defense costs on this matter over the last couple of years and when you take those out of our G&A, you really improve our FFO significantly.

So we feel very good about where we are on that case and can't predict potentially what he would do. There still are claims by us against him for some damages that we'll continue to evaluate as we go forward. And then on the other case, very important as well, I think we've commented that we expect to get a ruling from the Delaware court hopefully any day with our plan to exit that partnership, which would bring significant proceeds back into the company on which we have not been getting any returns for the last couple of years. Day one, we would improve our debt metrics significantly by paying down debt. So those things are very meaningful and I think we are getting close. Getting the Harris County decision was a very important step and we look forward to wrapping up the rest of the matters. I'm really pleased that while these legal matters hit the headlines, we've taken them out of our operations over the last year. As you can see from our results, we've been able to get the team focused on what matters and had just a few of the legal folks and myself try to clean up some of the legal matters. We're now getting close to putting that behind us.

5) My understanding is that there is a separate legal case still pending here with WSR suing Pillarstone to invalidate a poison pill. But since this was caused by your former CEO, am I correct to assume that this recent court victory also increases the odds of a positive outcome in this legal case?

Yeah, I don't think the two are related that way. Okay. I think in Delaware in our partnership, we had typical usual and customary contract terms for people that own a partnership interest in their way to monetize. Our partner attempted to block that. We've tried that case with Delaware. I think the facts are very clear and so like I said, we're hopeful we get some help in that. I don't think the Harris County ruling has anything necessary to do with the Delaware ruling

6) If I recall correctly, you are not getting much cash flow from the Pillarstone vehicle, but you think that your stake is worth about $50 million. Is that correct? And so am I correct to assume that selling this stake and paying down debt should be accretive to your FFO per share?

Yeah, so the real simple answer is there's no cash flow coming to Whitestone.

So the partnership owns, actually owns six kind of warehouse flex properties in Houston and two office buildings in Dallas that have cash flow. But our partner, which is our former CEO, has basically shut off any cash flow to Whitestone, and that happened probably almost three years ago now. So the interest of Whitestone is to just move on, get fair value for our investment and move on. And so that's where we are. But the properties themselves have value, I think that our share, as part of our lawsuit, was appraised by our expert being worth north of $50 million. We have them on our books for about 35 million and we continue to believe that those assets are worth more than that and look forward to the court helping us exit this partnership.

7) The continued surge in interest rates coupled with the legal expenses seems to have delayed your deleveraging plans. If I recall, you were planning to bring your debt-to-EBITDA below 7x by the end of this year. Do you think that you will get there in 2024?

Yeah, so it absolutely is our plan. We haven't given any guidance for 2024 yet, but we will do that with our year-end earnings. But just real simply, if you look at our EBITDA has about $4 million of legal expenses in it this year related to this litigation. So if you were to remove those, it's pretty easy to kind of calculate the debt to EBITDA just without that impact. And then the second part of that is the ebitda, which is if you take $50 or $60 million assets and have a return on those, it increases both. So I think we're actually probably might even be a little ahead of our plan on the debt reduction. It's just overshadowed by the cost that will be gone shortly.

8) Finally, I wanted to touch on the recent report that a company had approached you to potentially buy out the company, and the report that another investor had offered to liquidate the company.

First of all, we always welcome shareholder feedback. I mean, I think I, David, the board, all of us love to have thoughts about things we can do better. The most recent filing has all of the facts in there. I believe that the thought after discussions was that there was a belief from that party that the only course of action if you were a small company is to sell. And frankly, I think every company was a small company at some point in time. So I believe there are a number of other alternatives that make sense. So I believe the offer to assist us, which I'm not really sure what that means other than just potentially playing a part in something our board felt wasn't in the best interest of the company.

We're going to continue to look at what's the best course of action. If you look at the macro environment right now, and the number of levers that Whitestone has internally to push, I think it's probably not the right time to sell. It's the right time to continue what we have been doing. If you look at our total shareholder return in the last two years, I think that the peer average is about -7% and we're +25%. So I believe what we're doing is working. We are improving the valuation. We are narrowing the gap to what we should trade for.

We have advice, we look at data, we'll continue to evaluate and that's a dynamic process. But right now, given a number of factors, we think that the market is probably not right.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.