Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

Easterly Government Properties (DEA)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Safehold (SAFE)

Cibus Nordic (CIBUS)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

Interview With NewLake Capital Partners (Strong Buy Reaffirmed)

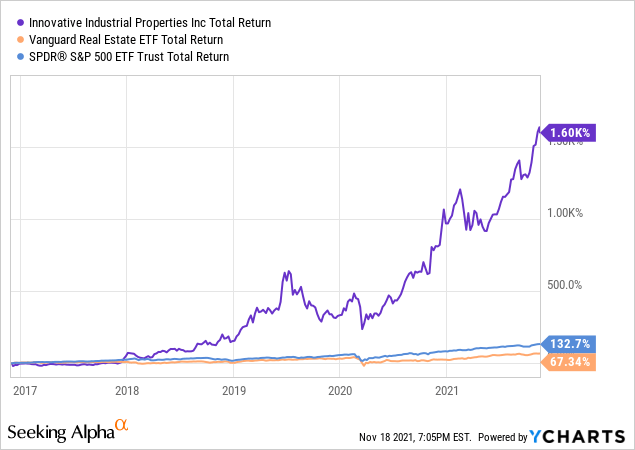

One of the most rewarding REIT investments of all time has been Innovative Industrial Properties (IIPR).

From its IPO till the start of the recent bear market, it earned investors a 17x on their initial investment:

You may wonder how is that possible? Aren't REITs supposed to be relatively boring income investments?

IIPR was the opposite of that.

It specialized in a new property sector—cannabis cultivation facilities—that offered exceptionally high cap rates, allowing it to acquire properties at significant spreads over its cost of capital.

It would raise equity by selling shares, then add some debt, resulting in a weighted average cost of capital around 6-8%. This capital was then used to purchase properties at a 12-14% cap rate, generating substantial initial spreads of 6-8%. These spreads helped rapidly expand its FFO per share, even with an increasing share count.

Rinse and repeat.

It was particularly rewarding in its early days because the company was very small in size and each new acquisition had a big impact on its bottom line.

This brings me to NewLake Capital Partners (NLCP).

It came public years later with the intention of replicating IIPR's successful model. But unfortunately, it got unlucky with its timing.

It had its IPO in 2021 and shortly after, REITs went into a bear market and the cannabis sector also started to face growing difficulties.

This has led to its equity trading at discounted valuations for most of its existence, limiting its ability to raise capital and preventing it from growing at the rapid pace that IIPR experienced in its early years.

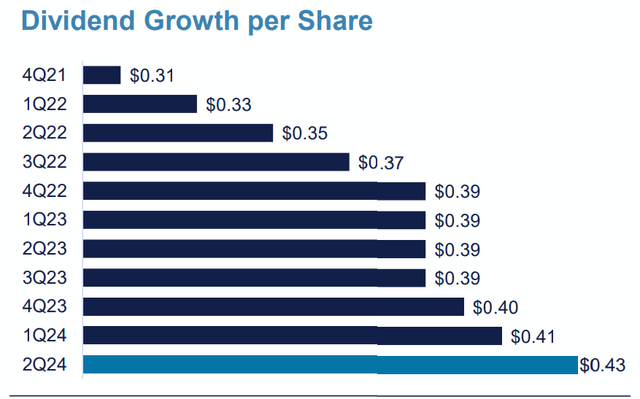

Even then, NLCP has still done surprisingly well. The REIT took advantage of its low valuation to buyback shares and also managed to hike its dividend in nearly every quarter since going public:

And we think that its future looks bright.

The REIT today owns a diversified portfolio of cannabis cultivation facilities in limited state jurisdictions. This puts a limit on the supply of these properties, but the demand for cannabis is expected to keep on growing.

It has strong triple net leases with 14-years left on them on average, no landlord responsibilities, and nearly 3% annual rent escalations.

Unique to NLCP is also that it is net cash positive, meaning that it has more cash than debt. The lack of leverage greatly reduces risks, especially today.

But it also provides optionality for future growth because if it wanted to, it could take on some debt and buy properties with a large positive spread, which would immediately boost its FFO per share.

Finally, REITs have now began to recover and with that, NLCP's cost of equity has also started to decrease. This could soon allow it to adopt a more aggressive acquisition strategy, potentially replicating IIPR's success story.

Even then, this opportunity is still offered at a compelling valuation. It trades at 9.5x FFO, it offers an 8.5% dividend yield, it is expected to grow at ~5% per year in the near term, and this growth could soon accelerate.

How many REITs do you know that offer such an attractive combination of high yield, growth, and upside potential?

There aren't many and this is why NLCP is one of our biggest holdings at High Yield Landlord.

What's the catch?

I recently had the chance to speak with the CEO of the company, Anthony Coniglio. I asked him questions about their future growth prospects and key risks that we might be missing.

Below, I first share my takeaways from the conversation and I then share the transcript of the interview as well.

My Takeaways From The Interview:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.