Interview With Joey Agree, CEO Of Agree Realty

Important Note

At High Yield Landlord, we invest very heavily in net lease REITs. To understand why you can read a separate article by clicking here, but in short, we think that at the current valuations, they offer the best overall risk-to-reward of the REIT sector. Many of them are generating far higher cash flow than pre-covid, but they are still priced at 20-30% discounts, resulting in exceptional value.

To capitalize on this opportunity, we currently hold positions in five different net lease REITs, each focusing on slightly different sub-segments of the sector:

STORE Capital (STOR): Core Portfolio

VICI Properties (VICI): Core Portfolio

EPR Properties (EPR): Core Portfolio

Realty Income (O): Retirement Portfolio

National Retail Properties (NNN): Retirement Portfolio

Should we invest in a sixth net lease REIT? If we were going to invest in an additional net lease REIT, it would be Agree Realty (ADC). It is our macro analyst's largest holding (Austin) and in what follows, he shares his recent exclusive conversation with the CEO of the company. We may invest in ADC in the future, but even if you aren't interested in ADC specifically, there are some interesting takeaways for our other net lease holdings.

Interview With CEO Of Agree Realty

In recent months, Agree Realty Corporation (ADC) became Austin's largest holding. He believes that there are few, if any, better combinations of yield, growth, and defensiveness than ADC.

Company CEO Joey Agree, the son of founder Richard Agree, was kind enough to answer some questions for an exclusive interview for High Yield Landlord. But first, let's briefly get a grasp of what kind of REIT ADC is for those not familiar with it.

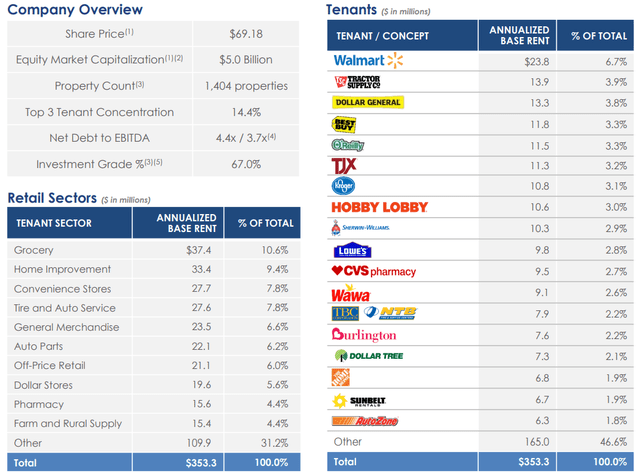

ADC is a net lease REIT that focuses on high-quality, single-tenant retail properties leased to the nation's leading retailers. Two-thirds of its tenants by rent are investment-grade rated, and over 14% of the portfolio is in ultra-conservative ground leases.

One of the aspects Austin finds most admirable about ADC (and about Joey Agree after having had extended conversations with him on the phone three times now) is the forward-thinking nature of the company and its CEO. It's an omnichannel world now, and ADC knows that only the strongest retailers will be able to compete with the likes of Amazon.

Moreover, an omnichannel strategy is best carried out via a freestanding, single-tenant building wherein the tenant has control over the whole premises and can shape them for optimal product delivery.

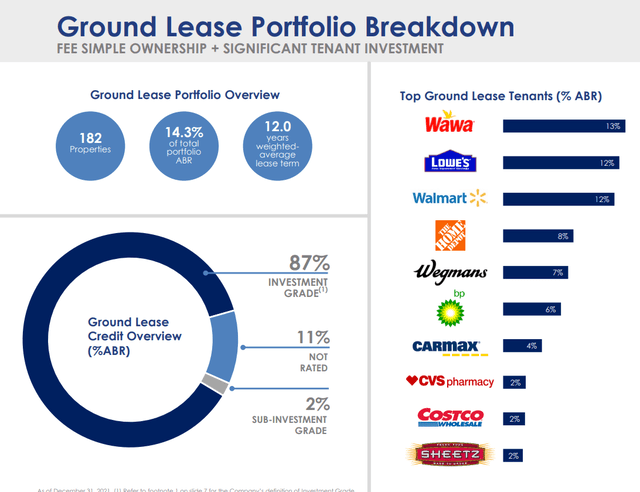

Another unique aspect of ADC is its increasing exposure to ground leases. These are not the same as the ground leases owned by Safehold (SAFE) and iStar (STAR). They are much more similar to absolute triple-net leases, only with a few additional positives.

First, rents per square foot are lower for retail ground leases than they are for triple-net leases, thereby making it cheaper for the tenant to operate at that location.

Second, its ground leases are much shorter at just 12 years remaining on average. As leases expire, the improvements revert back to the landowner at no additional cost, unlocking upside for ADC already in the mid-term.

Third, ADC's ground leases are overwhelmingly tenanted by investment-grade retailers, making them akin to a BBB bond proxy with organic rent growth of around 1%.

ADC insists that, somehow, they are consistently able to buy these ground leases for around the same cap rate as their total acquisition volume (6.2% in 2021). Often, they do it by buying a property with only a few years remaining on the lease and negotiating a lease extension directly with the tenant while the property is under contract.

Moreover, as you may have noticed from the net debt to EBITDA multiple of 4.4x, ADC is also very conservatively leveraged. Its BBB credit rating has recently afforded it unsecured bond interest rates below 3%, but the company has recently priced debt in the BBB+ range, and management believes that another credit upgrade to BBB+ is only a matter of time.

Despite doubling its portfolio size over the course of the pandemic as well as generating 6% AFFO per share growth in 2020 and 10% AFFO/share growth for the first three quarters of 2021, ADC's stock price remains over 20% below its all-time high and 14% below its 2021 high:

Data by YCharts

Fortunately, ADC just recently expanded its credit facility to $1 billion (maturing January 2026) and executed a fortuitously timed, 5 million share forward equity offering locked in at $68.15 per share (~$341 million of proceeds) that virtually ensures the REIT will not need to issue any new bonds or at-the-market equity for at least the next few quarters.

In fact, as we'll find out in the interview, ADC has $1.5 billion of total liquidity available to pursue acquisition opportunities. That exceeds its total investment volume in 2021 of $1.4 billion.

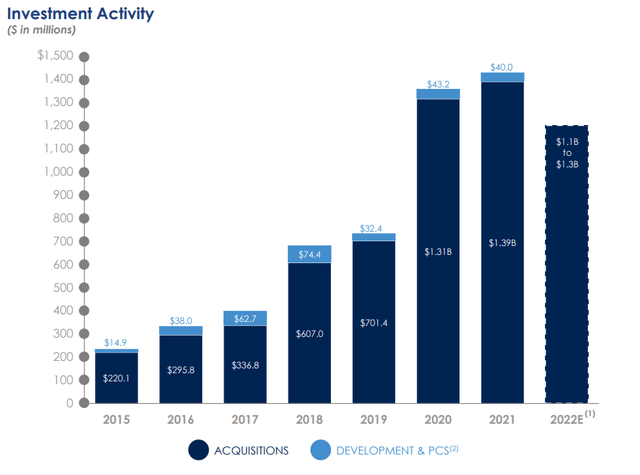

Since the beginning of the pandemic, ADC has massively ramped up its acquisition volume, nearly doubling its pace of investments in the COVID era.

Though management has conservatively guided for acquisition volume of $1.1-$1.3 billion in 2022, ADC has established a track record over the last two years of raising acquisition guidance quarter after quarter as management uncovers attractive investment opportunities.

This rapid but defensive growth has translated into an uptick in the dividend growth rate. The last dividend hike in December 2021 represented 11.5% year-over-year growth. Compare that to the average dividend growth rate of 6.5% during the 2010s.

Toward the end of the interview, Austin asked Joey Agree what he believes the dividend growth rate will average going forward. His answer: One of the highest in the net lease REIT sector.

Without further ado, here was Austin's interview with Agree Realty's CEO, Joey Agree.

Austin: Inflation is running hot at the moment with CPI rates around 5-7%, while ADC's weighted average annual rent escalation is around 1%. Do you view inflation as a long-term risk for ADC? Is there anything ADC can do to mitigate inflation eating into the real value of its rental revenue streams? For example, can ADC capture higher rents commensurate with inflation when leases expire?

First, I think people misunderstand that in the net lease sector, the lease structure allows us to pass through CAM [common area maintenance], taxes, and insurance to the tenant, so we have no expense creep or leakage related to inflation because the tenants bear the burden. That's first.

Second, the underlying assets are hard assets in the form of real estate that are constantly appreciated in an inflationary environment.

And then, third, you're correct, we anticipate in an inflationary environment being able to, upon lease expirations and/or any potential vacancies, being able to catch a higher rental rate.

But, first and foremost, we think it's important for people to understand the net lease structure, and that the landlord, in this case, Agree Realty, isn't responsible for extra costs in the form of CAM, maintenance costs, taxes, and insurance.

Austin: To follow up on that, your tenant base is made up of extraordinarily strong retailers like Walmart, Tractor Supply Co, Kroger, and others. Would you have the negotiating power to raise rates for these kinds of retailers?

Well, most of them have contractual rent increases embedded in numerous options [typically multiple 5-year option periods after the initial lease term of 10-20 years]. If they do not have options and/or it is a property that is currently untenanted, yeah, we think we are in a position, just based on the high-quality nature of our real estate, to lease things at market rents.

Now, [tenant] credit, rental rates, rent growth, lease structure, term, these are all important facets of a commercial lease structure. So, it's obviously a balance. But we would much prefer to have the likes of a Walmart or Tractor Supply or TJ Maxx or O'Reilly or AutoZone than a "Joey And Austin's Discount Store" or "Joey And Austin's Tire Store."

Austin: Has ADC changed anything about its acquisition strategy in response to high inflation rates? For example, are you targeting leases with higher rent escalators?

No, we start with a core sandbox of the 30-35 best retailers in the country, and we work from the bottom up, doing a ground-up real estate analysis from there, looking at competition and demographics, retail synergy, fungibility of the buildings, market rental rates.

And so we're not going to go up the risk curve, or to highly levered private equity-sponsored businesses. We target the largest retailers in the world today with the balance sheets to invest in labor, competitive prices, and an omnichannel platform. We don't see that changing.

Now, I will tell you, the focus is clearly on our acquisition platform. It puts out the most capital and frankly moves the needle the most relative to our partner capital solutions and development platform. We have the ability to ratchet up our focus on either or both of those programs in conjunction with our acquisitions platform in order to generate higher yields and higher returns. So, we focus on all three platforms. Although the street's focus, just because of the sheer dollar volume, tends to be on acquisitions.

Austin: In the past, you've stated that ADC is a sharpshooter and doesn't engage in sale-leasebacks, but you recently completed a multi-store sale-leaseback deal with Kroger. What changed? Was this an opportunistic one-off transaction or the start of a new growth channel for ADC?

The Kroger sale-leaseback we executed under unique circumstances. We had the ability to work with a long-term partner in Kroger, for whom in the past we've developed one-off stores, and then the Kroger opportunity came to us to transact a geographically diverse portfolio of stores.

We'll continue to look at sale-leaseback opportunities within our sandbox of the best retail tenants in the country, whether that's Kroger or the Sherwin Williams transaction we did a number of years ago or the National Tire & Battery transaction we did in, I believe, 2020, if I'm not mistaken.

So, when those retailers look to monetize their real estate through a sale-leaseback transaction, we'll be there to answer the call with what we call a full, comprehensive partnership or value proposition to those retailers.

Austin: At the end of 2021, 14.4% of ADC's portfolio was in the form of single-tenant retail ground leases. Can you explain how your ground leases differ from those of Safehold Inc. (SAFE)?

Very different construct. Safehold is a finance company that is providing finance solutions for owners or purchasers of buildings.

Our ground leases are two-party leases where we own the underlying dirt and the tenant owns the building on their balance sheet. Our ground lease tenants are nearly 90% investment grade, the best retailers in the world. So it's a very unique portfolio. We believe it's emblematic of our broader portfolio quality.

Austin: You've called the retail ground leases you buy one of the most attractive risk-adjusted investments on the commercial real estate market. But for these assets, you don't get the tax benefits of depreciation, and the market seems to treat them like absolute triple net leases rather than corporate bond proxies. Can you explain what ADC sees in its ground leases that perhaps the market does not?

I think, one, they're missing the nature of the bond proxy. It's hard to tell if the market is missing it, really. The market values the whole portfolio. There's no sub-portfolio valuation broken out. But we try to compare and contrast it to the BBB index.

If you look at our ground lease portfolio, you have long-term leases, longer than a BBB bond, you have embedded growth of approximately 1% annually, you have superior credit. The average credit profile of our ground leases is BBB+.

It's also very rare to see a tenant default in the case of a ground lease. They never want to give that building back to the landlord. So, it provides exactly what you'd like to see from a net lease asset and does so on a superior basis. It provides consistency and rarity of tenant defaults.

But in that instance when you get a tenant default or lack of additional options to exercise, you're getting a building for free. There are very few things in this world that are free, but our ground leases provide for us to receive the building for free in the case that the lease is not extended or in the case of a default.

Austin: In the past, I've written that these ground leases are "anti-fragile," because if you get a giant Walmart property back, you can put three or four outparcels in the parking lot and then re-tenant the building.

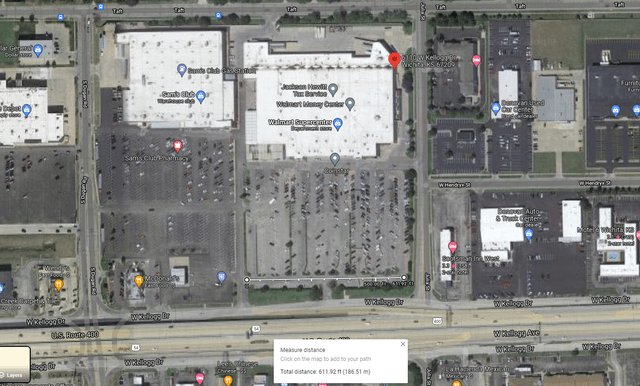

That's a great example. We bought a Walmart in Wichita, Kansas, that had a shorter-term lease, directly across from the airport. The store itself is paying well below $3 per square foot.

But the more interesting thing is that you have a 220,000 square foot Walmart Supercenter, and you have 680 feet of frontage on the major thoroughfare directly across from the Wichita airport. Sam's Club is immediately adjacent to it, and there are no out-lots to it.

So, directly to your point, not only would we get the building back for free, we would get almost 700 feet of frontage that we could recapture. Two doors down from it is a McDonald's. A McDonald's building with a double drive-through requires approximately 185-200 feet. That's a new prototypical McDonald's store.

And so, if Walmart vacated this property, you can see how we could more than recapture the lost NOI just from redeveloping the out-lots, attributing zero value to a 220,000 square foot, effectively industrial building across from an international airport.

What most people don't understand with these ground leases is that the property includes the whole premises, not just the building. That's beneficial to the tenant, because they can modify the parking lot for curbside pickup, add drive-through lanes, and so on. And it is beneficial to us if we were to gain full control of the property.

So, effectively, the worst-case scenario for many of our ground leases is that the tenant stays and continues to pay us rent.

Austin: You've acquired around $2.7 billion in real estate assets since the beginning of the pandemic, which is around half of ADC's at-cost portfolio. But cap rates for your target assets were actually higher before the pandemic than they are now. What made ADC decide to massively ramp up acquisitions at the beginning of COVID-19?

We saw a massive hole in the market. While most of commercial real estate owners were scrambling to collect rent and dealing with the depths of the pandemic, we saw a huge opportunity, given the position of our balance sheet and the quality of our portfolio. [ADC's rent collection never fell below 90% even during the worst of the pandemic, and ADC collected most of its uncollected but deferred rent by the end of 2021.]

And so, we effectively transformed this portfolio once again during the pandemic. Today, with Walmart as our largest tenant, our top tenants list is a who's who, best of breed retailer tenants list.

We were the only participant effectively during the worst of the pandemic. It enabled us to create what we think is a portfolio that is first class, approaching 70% investment grate and over 14% ground leases. Our percentage of both of those [investment grade tenants and ground leases] has gone up considerably. So, if you look at our overall portfolio transformation, we think it's been remarkable.

Austin: Are electric vehicles a threat to your gas station/convenience store properties? If not now, could they be in 5-10 years?

It's a question I get all the time. I actually believe that electric vehicles will be a benefit to large-format convenience stores, such as Wawa, QuikTrip, and Sheetz.

Larger format convenience stores have effectively become fast food restaurants and coffee shops with noxious uses in their parking lot, in the form of gasoline.

The average C-store operator, if they're not a distributor, is only making 10-15 cents per gallon on average. The true EBITDA and profit generation is within the four walls of the building in the form of liquid gold, talking about coffee, not gasoline.

And so, if you eliminate the noxious uses, referring to gasoline, and by no means will we see the pumps disappear overnight, although I do think the vast majority of new cars sold in this country by 2030 will be electric, but used cars is a much bigger market than new cars. But I think EVs are an opportunity for these larger-format C-stores to penetrate the off-premises food consumption market, primarily breakfast, dinner, as well as convenience operations.

Our focus is on the best convenience stores, generally 4,000 to 5,000 square feet, like Wawa, QuikTrip, Sheetz. These operators are dominant in their regional areas, they're some of the strongest private companies in the nation, and their primary EBITDA generation is inside the store, not outside the store.

Austin: You believe your sandbox of best-in-class national and regional retailers offers you a runway for further growth, but these are some of the most highly sought-after properties by what STORE Capital's former CEO Chris Volk called "a conga line" of family offices, high net worth investors, and private funds. And yet, in 2021, ADC acquired ~$1.4 billion of mostly investment-grade retail properties at an average cap rate of 6.2%. That cap rate is 20-40 basis points above average retail net lease cap rates, as reported by The Boulder Group and the Stan Johnson Company. What is your secret to acquiring above-average quality properties at above-average yields?

First off, I'm not sure I'd call it a "conga line." But I would tell you that we believe the world of retail is being bifurcated as we speak into the haves and the have-nots.

The haves can invest in what is critical today: omnichannel fulfillment, whether that's at the store, micro or macro fulfillment; labor, we see rising wages in this country, and being competitive on labor is expensive. And this is a price-transparent world where we can all go on an iPhone and see what the price of something is online in about 10 seconds.

Our magic sauce is that we are the largest granular acquirer in the country of generally $4-5 million price point, single-tenant retail assets. We do approximately 290 acquisitions a year. We have a proprietary ARC database system that we built to facilitate this growth. And we have a very talented, diligent transactions team that can handle the 80-100 transactions that we have going on at any one time.

And remember how big our investable universe is. Net lease is 65% of US retail gross leasable area. The best retailers in the country are usually in a net lease, freestanding format, whether that's large stores like Home Depot, Walmart, Target, Lowe's or the smallest of formats like Starbucks, Chik-fil-a, McDonald's, or the middle of the road size like Kroger, Publix, Tractor Supply, Aldi, HEB.

The best retailers in the country are predominantly in net lease format stores, and it is also the oldest and most fragmented sector in this country. Before the automobile, people took the horse and buggy up to the corner store. That sort of store would be net leased today.

Austin: With compressing cap rates and little organic rent growth from your target property type, has ADC considered expanding outside of its wheelhouse to achieve better spreads or higher rent escalations? Or perhaps looking at buying portfolios and then pruning the properties you don't want to keep?

We're not going to get outside our retail sandbox. That said, we disclosed recently that we have a $181 million diversified portfolio of 55 assets under contract. And we have another $80 million portfolio under contract as well. That's on file publicly with the SEC.

We're always looking for portfolio opportunities. The key is we're not going to go up the risk curve into the B and C credit-rated players. And so, finding a portfolio of adequate quality is always the challenge. We happened to stumble on two in December.

Austin: What is ADC's disposition philosophy? Does ADC ever sell merely because someone is willing to pay a ridiculous price for a certain property? Or do you only sell assets that no longer fit your investment criteria?

We start with the premise that every day we hold an asset is a conscious decision not to sell it. If ridiculous prices come around, we are happy and willing sellers. It's all real estate at the end of the day. We're not intrinsically tied to any property.

However, active marketing and selling of properties tends to be focused on non-core assets, where we either didn't like the underlying real estate trends, the store performance, or some other anecdotal information that led us to a disposition.

Austin: Is it a goal of ADC to earn further credit upgrades? Or do you feel that ADC has a sufficiently low cost of debt at the BBB/Baa2 level?

We're currently on positive with Moody's, which will be resolved in the short to medium term. We've recently priced preferred equity at the lowest yield in the history of REITdom, outside of Public Storage. [4.25% perpetual preferred (ADC.PRA)]

Our $1 billion credit revolver is currently priced as a BBB+ company, given our leverage metrics. And then the fixed income market for our public bond issuances price us as a BBB+ company. And so, we think today we're currently underrated. While it's not a stated goal to earn an upgrade, we think it's a natural evolution given our balance sheet management and portfolio construction.

Austin: What do you view as a 5-year forward dividend growth rate for ADC?

Five years is a long time! Imagine if I'd answered that five years ago.

Our goal for the next three years is to deliver upper single-digit AFFO per share growth, double-digit shareholder return, and dividend growth that roughly matches AFFO growth while staying within our stated payout ratio of 75-85% of AFFO.

Changing the dividend to a monthly payout, as well as updating our website and putting out white papers that outline our thought processes, is all part of an effort to develop more of an individual shareholder base. We are highly institutionally owned, and we think it's worth the time and effort to form a stronger individual shareholder base.

One of the threats we've identified in our SWOT [strengths, weaknesses, opportunities, threats] analysis is what we call the disintermediation of Wall Street, some people call it the democratization of Wall Street. We continue to believe that individuals, not institutions, are going to hold power over the fate of equities in this country.

We identified this before 2020, before the Reddit mafia, before Robinhood took off. If you look at the power structure of Wall Street, that power structure is effectively unraveling before our eyes. I wouldn't be surprised to someday see direct issuances by public companies to individual investors via brokerage firms, totally skipping the investment banks.

Austin: I've noticed that there is some overlap between your name and the name of the company. You've also mentioned that no one in the Agree family, namely you and your father Richard, who founded the company, have ever sold a share of ADC stock. Can you talk about how you see this as an advantage for ADC? Do you feel that it gives ADC a long-term orientation?

When you have your name on the door, and you have your skin in the game, not only in the form of deferred compensation via restricted equity and performance units, but also in the form of the millions of dollars of open-market purchases that myself and my father have made in the last few years without ever selling a share, it's a good setup.

This management team, and my family, we have our skin in the game for the long haul. The compensation structure we have in place includes 5-year vesting restricted stock. Most companies have moved to three-year vesting. This compensation structure exists to encourage long-duration thought processes for a long-duration lease business.

I tend to like companies where management is aligned to the long-term performance, not rewards for short-term pops. This company is about predictability, transparency, and consistency for the long term, and that is, I think, how the net lease model works best.

Austin: Anything else really important that I've missed?

I think risk has generally been underappreciated in the midst of the fastest reopening and economic rebound from any recession in the history of modern economics. And now, we have numerous risks rearing their heads all at once, from fiscal policy to monetary policy to geopolitics and the threat of war. This is the stuff that pops bubbles.

If you can't appreciate risk, then you can't appreciate risk-adjusted returns. So, if the market is returning to a healthy appreciation of risk, that can only be good for Agree Realty.

We enter the new year, as we always do, well-prepared to execute on any opportunity that comes our way, with a strong balance sheet and roughly $1.5 billion of liquidity. Due to our credit revolver and nearly $400 million of available forward equity [locked in at $68.15 per share], we have no need to issue equity at the current market price, so we can really take advantage of our large and healthy pipeline.

My expectation is that risk-adjusted returns come back to being normal. That can only be good for us.

Good investing from your HYL Research Team,

Jussi Askola & Austin Rogers