Interview With Gladstone Commercial (Buy Rating Upgrade)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on October 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Interview With Gladstone Commercial (Buy Rating Upgrade)

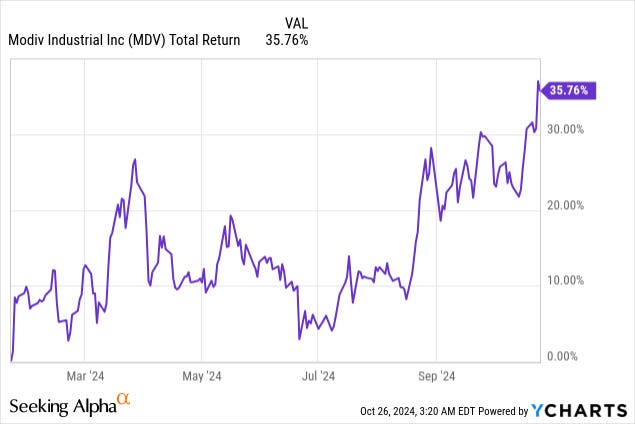

Earlier this year, we initiated a position in Modiv Industrial (MDV) and since then, it has already earned us a 36% return:

Back then, we identified that Modiv could reprice at materially higher valuation multiple because it was in the process of transforming itself into an industrial REIT, but the market had slept on it.

Shortly after, the company announced some major asset sales to buy more industrial assets and it completely rebranded itself, changing its name, logo, and even its website.

This caused its valuation multiple to expand, pushing its share price more than 30% higher in just 9 months.

I am bringing this up because I think that investors may be presented a similar opportunity with Gladstone Commercial (GOOD).

It finds itself today in a very similar position as Modiv a year ago. It has been assets for years to redeploy the proceeds into industrial properties, and within 12-18 months, they now expect to generate 70%+ of their revenue from industrial net lease properties.

We suspect that as they keep increasing their exposure to industrial properties and eventually complete a similar rebranding, they will achieve a materially higher valuation multiple, leading to strong returns for investors who buy it today.

Right now, they are still priced at a substantial discount just like most other industrial REITs:

Today, we own a stake in the Series O preferred shares of the company and it has been a great investment for us so far. We invested in the shares about a year ago and it has earned us a ~35% return.

Now, we are also interested in the common equity of the company. To learn more about it, we reached out to the company's management for an interview. We had the chance to talk with Arthur S. Cooper, President of Gladstone Commercial:

Here are the main takeaways from our call with them:

The first takeaway is that I would gladly double down on the preferred equity if given the chance to buy it below $20 per share. The preferred equity has surged recently so we may need to wait a bit, but if we get a dip, you can expect me to buy a lot more of it. What the management told me was very reassuring for preferred equity holders. They have already lowered their leverage from 63% in 2012 to 45% today and further deleveraging continues even as they also increase their liquidity and accelerate their growth prospects.

They agree that there are clear similarities between them and Modiv. The main big difference is that they are far larger in size with a $670 million market cap versus just $180 for Modiv. This explains why it is taking longer for Gladstone Commercial to complete its transformation. They expect to get to 70%+ industrial within 12-18 months and I would expect it to reach closer to 80% within 24-36 months from now. The trend is clearly higher and higher and they have no plans on stopping because they are seeing some great opportunities for net lease industrial properties.

Just like Modiv, they are focusing mainly on net lease manufacturing properties because it is a property sector that enjoys significant demand tailwinds with the trend of onshoring. But despite that, cap rates and lease terms are surprisingly attractive for landlords, especially when dealing with non-credit tenants, because there are relatively few landlords that specialize in this space. Here, the size Gladstone Commercial and its relationship with Gladstone is a major competitive because they manage many private equity funds, giving them access to a proprietary pipeline to close sale and leaseback deals at high cap rates upwards of 8%. These are typically non-credit tenants, but Gladstone has access to their financials and it does its own in-house credit analysis of its tenants.

Already today, they are able to close deals that are immediately accretive to their FFO per share and if they can just earn a slightly higher valuation multiple, they could accelerate their growth prospects and their transformation.

I would not be surprised if they eventually rebrand themselves as "Gladstone Industrial" or something of that sort. The rebranding of Modiv has clearly improved their market sentiment and I think that it would also benefit Gladstone because most investors still perceive it today as a diversified net lease REIT. Rebranding themselves would send a clear signal to the market on the company's intentions.

Gladstone Commercial is externally managed, which is typically a red flag for REIT investors as it can lead to greater conflicts of interest. But in this particular case, I think that the interests of the management are well aligned with those of shareholders. One of the biggest shareholders is the Gladstone family and all executives of the company hold a large stake in the REIT to align interests. Moreover, unlike many other externally managed, the executives of Gladstone Commercial work only for this specific REIT. Their attention is not split between many different entities which could lead to greater conflicts. Finally, they are reasonable with their fees and have at times voluntarily even waived fees to increase the cash flow for shareholders. Their relationship with Gladstone is also clearly beneficial since they manage a lot of private equity investments and it gives them access to a proprietary pipeline of sale and leaseback deals that they wouldn't have otherwise. Finally, the analyst Dane Bowler views them as one of the best management teams in the REIT sector and has been a long time shareholder of the company. I have met him and greatly respect his views.

We give it a Buy rating. We think that the combination of rising exposure to industrial assets, a rebranding, further deleveraging, and cuts to interest rates will eventually lead to a higher valuation multiple, unlocking potentially about 30% upside from here. While you wait, you also earn a 7.6% dividend yield that's sustainable.

We have added the company on our watchlist and will monitor it closely. We are not investing in the common equity just yet because we feel that it would duplicate similar exposure which we already get through Modiv Industrial. We would also gladly double down on the preferred equity at a later dip if one takes place.

Please click the ♡ button and share to help us grow. Thank you!

============================

Refer a Friend and Earn Rewards

If you find our research valuable, please show your support by sharing High Yield Landlord with friends and family. You will earn rewards for your referrals.

============================

Access Our Course to REIT Investing

Don't forget to take our 10-Module Course on REIT investing! The entire course is available to members for free as part of your membership.

============================

Access Our Portfolios Via Google Sheets

Our three portfolios are available through Google Sheets. These sheets provide detailed information on position sizes, risk ratings, and key metrics to help you make well-informed investment decisions:

============================

Access Our REIT Market Intelligence Sheet

This exclusive tool includes a list of all equity REITs grouped by property sector, providing all the information you need to make better decisions: FFO multiple, dividend yield, payout ratio, credit rating, and much more.

============================

Access Our Portfolio Tracker

The HYL Portfolio Tracker is a Google Spreadsheet designed specifically for members of High Yield Landlord. It helps you track all your HYL investments in one place with a simple format. It is very easy to use, so don't miss out on this free feature!

============================

Access Our Live Chat

Our live chat room is where the HYL community comes together to share market news, discuss investment ideas, and help new members get started. Members can post questions and receive prompt answers from other real estate investors and our team.

============================

Finally, feel free to contact us anytime. You can send me a direct message on the chat or email me at jaskola@leonbergcapital.com

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.