Interview With Farmland Partners (Incl. Trade Alert)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on October 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Interview With Farmland Partners (Incl. Trade Alert)

Farmland Partners (FPI) is today our only farmland REIT investment.

We like it because:

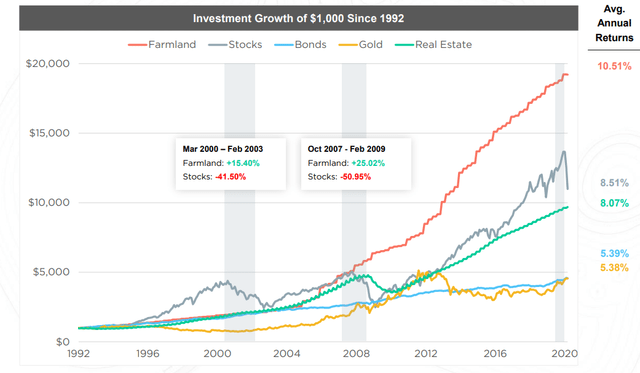

(1) Farmland has historically been one of the most rewarding asset classes, outperforming even stocks and bonds over the long run. By buying shares of Farmland Partners, we get diversified exposure via its nearly 100,000 acre portfolio that focuses mostly on row crops in Illinois and other corn belt states. This is the "blue-chip" segment of the farmland markets, which has historically enjoyed some of the fastest growth and asset price appreciation.

(2) The demand for these crops is expected to grow significantly over the coming decades as the global population keeps on growing (set to reach nearly 10 billion by 2050) and increasingly many people enter the middle class and switch to protein-richer diets. While the demand for food is rising, the supply of high-quality farmland with good soil, water access, and infrastructure is strictly limited and even declining due to better-use conversions. This bodes well for long-term value appreciation.

(3) The REIT recently acquired a small farmland brokerage firm with the goal of launching an asset management business to earn fees. We think that this venture has significant long-term potential because they are ideally positioned to grow such a business.

(4) But despite all of this, the shares are today priced at a up to a 50% discount to their NAV according to some estimates, which is rather unusual for such a safe, inflation-protected asset class with attractive long-term growth prospects. The management is actively taking advantage of this discount by selling assets and buying back shares.

(5) The management is very well-aligned with shareholders given that their company founder and the Chairman is one of the largest shareholders and keeps buying more shares in the open market.

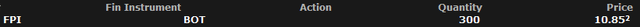

I recently got to talk with the company's CEO, Luca Fabbri, and this conversation led me to buy another 300 shares of the company, increasing our position size by 20%:

Below, I share the my main takeaways from our conversation. In case you are not familiar with the company, we recommend that you first read our investment thesis by clicking here.

My Takeaways From The Interview:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.