Interview With Easterly Government Properties (Strong Buy Upgrade)

Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Safehold (SAFE)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them, and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

Interview With Easterly Government Properties (Strong Buy Upgrade)

Easterly Government Properties (DEA) is a unique REIT that focuses on specialty government properties such as FBI headquarters and VA outpatient properties:

Last year, we interviewed their CEO and noted that there was a lot to like about the company. In short:

Their leases are long, at 10 years, and backed by the full faith and credit of the US government, resulting in highly secure rental income.

The office fears appear overblown because they own highly specialized and mission-critical government buildings.

They anticipate strong releasing spreads as leases expire because the replacement cost of their properties has increased significantly.

The management was confident in their growth prospects and believed they could maintain their dividend, despite not fully covering it.

Finally, their valuation had become historically low relative to their net lease peers, potentially offering an opportunity for upside.

Even then, we still didn't initiate a position, in part because we feared that it would end up cutting the dividend.

Here is what we wrote back then:

"The REIT has a bit more leverage than average, its payout ratio is high, and interest rates have surged in recent years, putting the company at high risk of cutting its dividend, which would likely cause its market sentiment to suffer."

He also warned about a potential dividend cut in separate public articles here, here, and here.

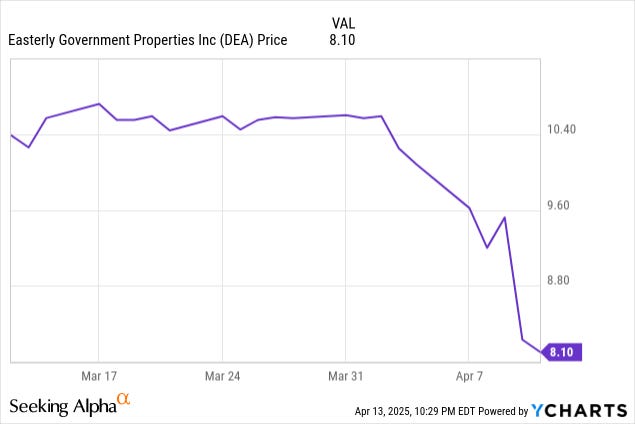

Well... The dividend has now finally been cut, and it has caused the share price of the REIT to crash down to lower levels:

Cutting the dividend is never a popular action, but we believe that it makes DEA far more attractive as an investment opportunity, especially following the recent dip.

Its dividend has now been reset at a sustainable level with a 60% payout ratio, which should allow it to self-fund its acquisition pipeline with retained cash flow.

This comes at a time when opportunities for government-owned properties are expanding, driven by the DOGE initiative, which has prompted the government to sell more assets in an effort to unlock value.

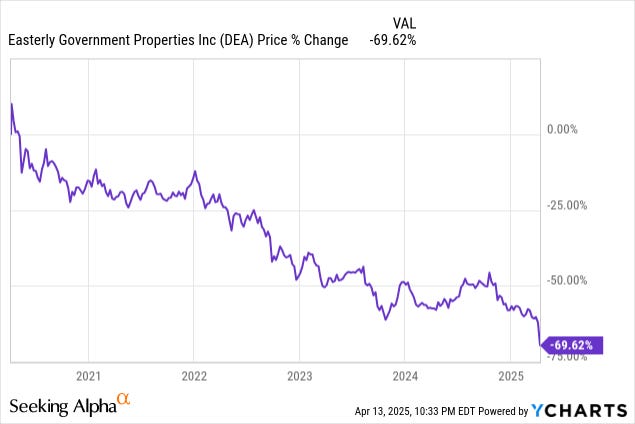

Moreover, its valuation has now dropped to its lowest level ever. Its share price is down an astonishing 70% over the past 5 years:

Its FFO multiple is just 6.7x, which is one of the lowest in the entire REIT sector, and even post-cut, its dividend yield is still nearly 9%.

Is it now time for us to initiate a position?

To learn more, we reached out to Darrell Crate, CEO of Easterly Government Properties (DEA), to discuss their future prospects.

Below, we share the main takeaways from our conversations:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.