Interview With Armada Hoffler Properties' CFO & COO

Important Note:

Armada Hoffler Properties (AHH) is a position in our Core Portfolio. We invested in the company because about half of its portfolio (as measured by NAV) is invested in rapidly-growing apartment communities, which are doing very well, but undervalued by the market because most investors dislike "diversified REITs". Currently, it is priced at just 11x AFFO, which is about half of other apartment REITs, which are undervalued as well. It also offers a 7% dividend yield, which is among the highest yields of all REITs with significant ownership of apartment communities, and the dividend was recently hiked by another 12%. You can read our investment thesis by clicking here.

We have previously stated also that we like their management because they have a track record of significant market outperformance and a lot of skin in the game. Recently, Austin had the opportunity to talk to them, and in what follows he shares the main takeaways of their conversation. Please note that the focus is intentionally on risk factors as we are trying to test our thesis.

Interview With Armada Hoffler Properties' CFO & COO

After publishing a public article on Armada Hoffler Properties (AHH) on October 11th (which you can find here), the REIT's Chief Financial Officer, Matthew T. Barnes-Smith, reached out to me over private message to thank me for the article and to say:

On the balance sheet section you posed some questions around the maturing debt and derivatives over the next couple of years.We would really like to share our plan and answer those questions for you if that is something you would be interested in.

In that article, I highlighted some of the upcoming debt and interest rate hedge/cap maturities (at least as of information from August 2022) that looked to me like refinancing risks that investors needed to keep in mind. It was nothing major or balance sheet-breaking, but it was a headwind.

Well, apparently that was outdated information. Matt wanted to update the information I had presented in the article.

When I got on a video call with Matt, I was pleasantly surprised to find that AHH's Chief Operating Officer, Shawn Tibbetts, had hopped on as well. Tibbetts seems to be the next in line for CEO, according to this article.

I suspect the stock's steep dive in recent weeks made them more eager to reach out and make their case to the investor community.

Then again, looking year-to-date, AHH's stock price is actually down a little less than the broader REIT index (VNQ):

I was not expecting to have a long conversation. I thought it would be a 5- or 10-minute call to update me on the recent refinancing activity. Fortunately, though, they seemed happy to answer my questions.

This was the first positive I took away from the conversation - their openness and transparency. Of course, they wanted to put a positive spin on everything, but they nonverbally communicated confidence and nonchalance. I could ask anything, and they would answer plainly. Either they were marvelous actors, or they truly believe that AHH is more solid and secure than the market gives them credit for.

Unfortunately, since I didn't expect a longer conversation, I did not record the call and thus can't turn it into a transcript. But here are my notes from the conversation.

On Upcoming Debt & Derivative Maturities

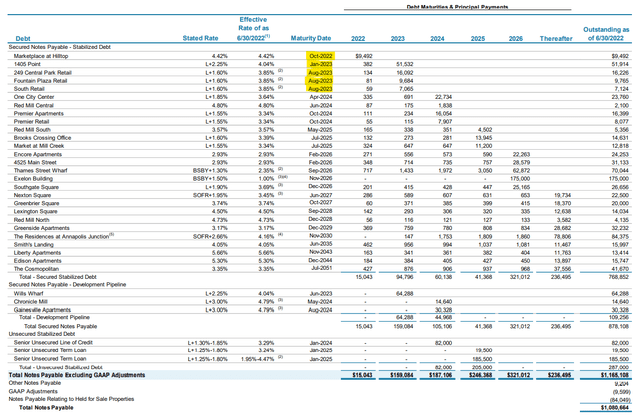

In the article, I mentioned that AHH has no unsecured debt maturing until January 2024 but it does have a few mortgages maturing in the remainder of 2022 and throughout 2023.

That was outdated information.

On October 6th, AHH amended its credit facility agreement, extending the $250 million revolver to a maturity in 2027 and adding a $300 million unsecured term loan maturing in 2028. The proceeds of that term loan were used, in part, to pay off all debt maturing in 2022 and 2023.

What about the interest rate cap agreements that are keeping AHH's effective interest rate below 3%? As of Q2, AHH had several hedge contracts expiring next year, which would then have pushed the respective effective interest rates up to the 5.5% to 7%.

Matt told me that they have already extended these interest rate cap agreements for 2023. While he did not tell me the exact interest rate at which they are now hedged, he made clear that the rate did not jump up to 5.5% to 7%!

So, all debt and interest rate hedge agreements are now fixed through the end of 2023, and Matt said that they are working on fixing all 2024 maturities in the coming months.

Moreover, notice that most of AHH's debt is in the form of partially amortizing mortgages, which means that a portion of the principal is paid down over the life of the loan. Just how much principal is paid down before the maturity date depends on the amortization schedule, which is the length of time it would take to pay the entire sum of principal if the maturity date was the same as the end of the amortization schedule.

Typically, amortization schedules range from 15 years on the low end to 25 years on the high end. A shorter amortization schedule means that more principal is repaid each month but that free cash flow is lower accordingly. A longer amortization schedule means that less principal is repaid each month but that free cash flow is higher.

I forgot to ask Matt about AHH's amortization schedules, so I emailed him about this and will update HYL members accordingly.

This matters because AHH's fixed charge coverage ratio (including all debt service plus preferred stock dividends) of 2.5x may be as low as it is only because AHH is paying down a lot of the principal on its mortgages each month.

For that reason, you can't really compare the fixed charge coverage ratio of a REIT with all unsecured, interest-only bonds to a REIT like AHH where most of its debt is in the form of partially amortizing mortgages.

On Cost of Capital

I pointed out that AHH's debt and preferred stock share of total capitalization looks fairly high and asked Matt how much he thinks about how to bring AHH's cost of capital down.

He laughed and replied that his entire job is trying to figure out how to get their cost of capital down. He's very focused on that, but it's a delicate balance because too much debt could weigh on investor sentiment, even if that's the cheaper source of capital than equity or preferred stock.

Part of AHH's long-term strategy to diversify its financing sources and lower its cost of capital is to slowly shift from secured debt to unsecured sources of debt, mainly term loans. Investors can expect that gradual shift to continue over time.

I asked about pricing of long-term debt for newly completed projects, expecting to hear some bad news since interest rates have risen so much lately.

Surprisingly, though, Matt said that mortgage rates on newly completed projects hasn't moved that much higher recently. There's still a healthy competition among lenders for loans secured by brand new, Class A, highly amenitized real estate with long lease terms in place. The cost of debt has risen much faster this year for existing properties with shorter remaining lease terms than it has for newly delivered properties, especially in the multifamily space.

On The Development Pipeline

I asked COO Shawn Tibbetts about how the development pipeline is coming along.

First, he wanted to emphasize that it's huge, representing over 40% of the present portfolio's NOI and about 36.6% of its stabilized portfolio, at cost. (That doesn't consider AHH's joint venture partners' ownership stakes, though.)

Most of that future NOI contribution will come from the T. Rowe Price Global Headquarters building currently under construction in Baltimore Harbor, and the mixed-use/parking garage that will go in next to it. The estimated stabilization date isn't until Q2 2024, but the building is already 93% preleased.

Virtually all of the development pipeline has already been funded and the financing costs have been fixed through at least the estimated stabilization dates from Q4 2023 to Q2 2026.

Predictably, construction costs have risen substantially, and that has made AHH more cautious on greenlighting new development projects. But with rising rent rates, they still believe they will be able to deliver their current pipeline at their typical 20% premium to market cap rates upon stabilization. In other words, stabilized NOI yields are still expected to be 20% higher than what the market cap rates would be for the same properties.

I asked Shawn if they would like to lean toward any certain property types in their future developments. Yes, they do want to lean more toward multifamily and mixed-use centers in future developments while emphasizing grocery-anchored retail in its acquisitions.

The housing shortage makes multifamily attractive, while mixed-use centers continue to be popular and exciting destinations for both residential renters and commercial tenants.

Moreover, they want to shift further South in their future developments from their traditional stomping grounds in Virginia and Maryland to the Sunbelt states of Georgia, Florida, and the Carolinas.

On Portfolio Diversification

I remarked that the market doesn't seem to like diversified REITs very much and typically values them at a discount to the sum of their parts. Does this bother the folks at AHH?

Not really. They intend to maintain a diversified portfolio, because all real estate is local and specific to its particular area and tenant desires.

On the contrary, they view diversification as a strength, because they can opportunistically pursue the best investment options available to them at the time.

On Flight To Quality In Office

I also mentioned that the market doesn't seem to like AHH's exposure to office, despite strong cash and straight-line rent growth in recent quarters. Do they see their office exposure as a liability?

No, just the opposite. All (or almost all - memory fails me here) of their office properties were developed in-house. They are Class A, highly amenitized buildings in great locations. Aside from The Town Center at Virigina Beach, where office buildings are 20 years old but 98.9% leased, AHH's office buildings are all less than 10 years old.

Management is seeing a flight to quality as companies move from lower quality sites to higher quality ones. Occupancy at AHH's stabilized office properties is over 97%, much higher than the average for the office real estate sector.

Moreover, AHH is getting a lot of interest for space in its T. Rowe Price Global HQ building, despite only just recently breaking ground on the project.

There's a big difference in performance between office you drive to versus the kind you have to take public transit to get to. The pandemic made office workers realize they don't want to keep enduring hour+ commutes every day, but workers in the average AHH building have shorter commutes in their own cars and plenty of on-site parking. As such, utilization of office space in AHH's markets and properties tends to be higher.

Also, AHH's office properties feature fairly long remaining lease terms with no lease expirations coming up anytime soon.

On Third-Party Construction Business

I asked about the third-party construction business: how much of a contributor to the bottom line is it, and does AHH expect this segment to grow?

Matt said that the third-party construction business accounts for only about 5% of NOI, and they don't really expect it to grow much or ever be a big contributor to FFO.

On The Possibility of Buybacks

Lastly, I asked if they've considered doing stock buybacks. The answer was basically "probably not."

Matt said that they are always tossing ideas around, including doing a buyback. But he doesn't think it makes much sense, for a few reasons.

First, with an AFFO payout ratio around 80%, they don't think they would be able to buy back enough shares to really move the needle. And they don't want to take on debt or use the credit revolver to do a buyback.

Second, they view their specialty as being real estate operators, not equity market timers.

Bottom Line

Overall, I was encouraged by the call. AHH has no further refinancing risk through the end of 2023, and they are working on fixing their debt costs through 2024 right now. They are being proactive on that front.

However, it should be noted that when it comes to the "diversification discount" and cost of capital issues, management has not really figured out a long-term solution. They basically admitted that the market discounts them for being diversified, but they have no plans to become more specialized in a niche.

As such, they probably won't see their cost of capital drop to such a degree as to raise the equity portion of their total capitalization and lower their leverage metrics anytime soon.

But at a price to AFFO of 11.2x, AHH is way too cheap and oversold. The market has not priced in their fixed debt costs through the end of 2023 yet. That has created a good buying opportunity.

We think AHH has at least 50% upside to fair value, and you get paid a 7.1% dividend yield to wait for that upside to manifest.

Good investing from your HYL Research Team,

Jussi Askola & Austin Rogers