Important Announcement: High Yield Landlord 2.0

Dear Landlords,

We started High Yield Landlord back in 2018 to help investors:

(1) Identify the most profitable real estate opportunities.

(2) Earn an ~8% cash flow yield along with long-term appreciation.

(3) Minimize investing fees and other frictional investing costs.

High-quality real estate investment research is not easily accessible to individual investors and a single subscription to a platform like S&P Global or GreenStreet can cost tens of thousands of dollars each year. The beauty of our platform here on Seeking Alpha is that we are able to achieve much greater scale (2,500+ members!) and seek to provide comparable results at a tiny fraction of the price of these other services.

We spend 1000s of hours and well over $100,000 per year researching the market for the most profitable investment opportunities and share the results with all of you here at High Yield Landlord.

Today, as we approach our five-year anniversary, we take a step back to review what we have accomplished so far and most importantly, what we can improve going forward!

Our five-year accomplishments:

Our service earned the #1 spot in the rankings for REIT services on Seeking Alpha with over 2,500 members.

We became the #1 rated service on Seeking Alpha with a perfect 5/5 rating from 500+ reviews.

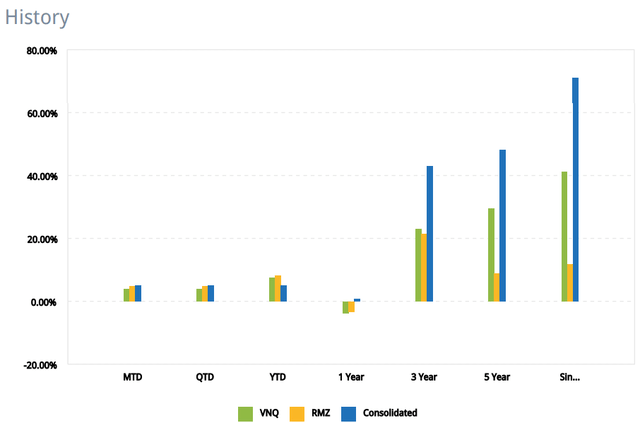

Our real-money Portfolio earned a nearly 2x higher total return than the VNQ REIT benchmark even despite the tough market that we are in:

(See other important disclaimers at the end of the article. Past performance is not indicative of future results.)

Needless to say that we are very excited about these results. In our wildest dreams, we didn't expect to grow to over 2,500 members and we would not have expected to outperform by this much either, especially in this environment.

While it feels nice to take a victory lap, you can be sure that we are not resting on our laurels.

In fact, we are about to roll out major improvements to High Yield Landlord in preparation for the future.

We call it High Yield Landlord 2.0.

Our goal is to be the best service on Seeking Alpha and here is a sneak peek at what’s to come!

(1) Access to Industry Conferences

The pandemic is finally over and in-person conferences are back.

This year, we already traveled to two REIT industry conferences, the Citi Global Property Conference and the REITWeek Conference, and got to share many exclusive interviews with management teams here at High Yield Landlord.

These conferences are expensive to attend, often costing up to 10x your annual fees for High Yield Landlord, but they give us the opportunity to meet face-to-face with managers and the insights that we gain are often invaluable.

We expect to attend many more of these conferences over the coming quarters and we will give you first-row access to them.

(2) More Frequent Management Interviews

Going hand in hand with these conferences are our management interviews.

We have done quite a few of them in recent years but we plan to do a lot more of them going forward.

This is something that we have done better at our sister service, High Yield Investor, where we have an interview with the management teams of nearly every position that we hold in our Portfolios.

Going forward, I will double down on my networking efforts to build relationships with many more REIT management teams for the benefit of High Yield Landlord. I recently got to meet 20+ REIT management teams and I will do a lot more of that in the coming quarters as I travel to go meet them:

Let me know in the comment section below if there is one particular REIT management team that you would like us to interview for you.

(3) New Authors Are Joining Forces

We recently welcomed David Ksir as a new member of our research team.

David has a private equity background with experience working for Penta Real Estate, which is one of the biggest real estate investment firms in Poland, the Czech Republic, and Slovakia. He brings a private equity approach to REIT investing and will be especially helpful as we expand our coverage of European opportunities.

We are always looking for new talent and we will double down on these efforts in the coming quarters because we want to assure that we are leaving no stones unturned while REITs are priced at historically low valuations.

(4) Content in Video Format

You probably know this already but I started experimenting with Youtube earlier this year and launched a small channel that I use primarily to promote High Yield Landlord.

Going forward, we expect to also start sharing content in video format here at High Yield Landlord.

These videos won't replace our articles, but supplement them. In some specific cases, especially when talking to REIT management teams, I think that it can be helpful to also see the facial expressions and body language of the people and we want to share that with you.

(5) Increased International Focus

Our primary focus will always remain on the US given that this is by far the biggest REIT market in the world and most of you are mainly interested in US REIT opportunities.

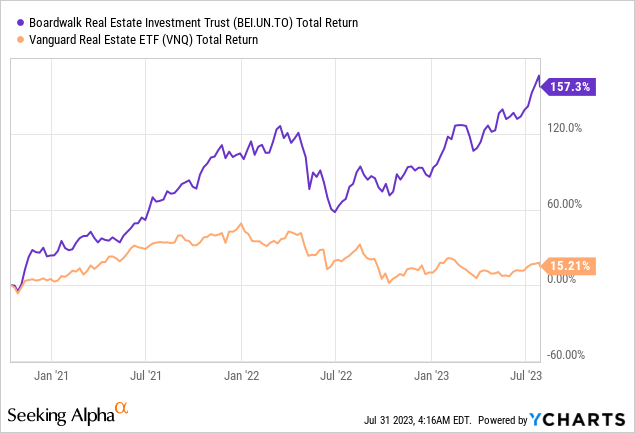

But at the same time, we also want to increase our coverage of foreign markets because that's where we often find the best opportunities. Just yesterday, we sold our biggest Canadian REIT investment and pocketed a 157% total return even despite the recent market correction.

Today, we have boots on the ground in the US and in Europe, but we still lack research capabilities in Asia and the Pacific.

Therefore, I plan to travel there in September in search of the best Asian opportunities for members of High Yield Landlord. I will visit many countries, including India, Singapore, Malaysia, Hong Kong, Japan, and Australia to meet with REIT management teams in hopes of expanding our International Portfolio.

If you happen to be in any of these countries and want to meet me, feel free to send me an email at jaskola@leonbergcapital.com and we can try to set up a meeting. Also, if there is a specific REIT in any of these countries that you are interested in, let me know in the comment section below.

Bottom Line

We are very excited about our success so far, but we know that we can do even better.

The market conditions have been tough over the past year and a half, but over a multi-year time period we have always done well, and these are the best times to accumulate larger positions while REITs are discounted.

Therefore, we are now doubling down on our efforts to make sure that no stone is left unturned.

If you have any additional suggestions/recommendations on how we can improve our service, please let us know by leaving a comment below. Thank you so much for your continued support!