Dear Landlords,

High Yield Landlord is about to turn 6 years old and we figured that this would be a good time to take a step back and review what we have accomplished so far and what we can improve going forward.

We started High Yield Landlord back in 2018 to help investors:

(1) Identify the most profitable real estate opportunities.

(2) Earn a high yield along with long-term appreciation.

(3) Minimize investing fees and other frictional investing costs.

Access to high-quality real estate investment research is often out of reach for individual investors, with subscriptions to platforms like S&P Global or GreenStreet costing tens of thousands of dollars annually. Our platform offers a compelling alternative, leveraging a larger scale of over 2,000 members to deliver comparable insights at a fraction of the cost of these premium services.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with all of you here at High Yield Landlord.

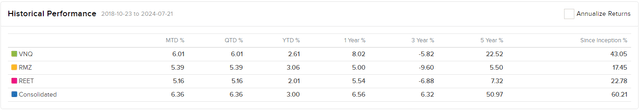

Our investment results have been heavily impacted by the recent two-year-long REIT bear market. Nevertheless, we have still managed to outperform our sector benchmark by a significant margin, and as the REIT sector continues its recovery, we expect this outperformance to widen even further:

Our service has now also been ranked #1 for REITs on Seeking Alpha for the 4th year in a row.

We have a 4.9/5 average rating from 500+ reviews.

We have also collectively raised funds for 25 trucks and delivered them to Ukraine.

I am very proud of this, but rest assured, we are not resting on our laurels. We are about to roll out major improvements to High Yield Landlord in preparation for the second half of this year.

As always thank you for all of your support over the years and let me know if you have any additional suggestions.

Here is a sneak peek at what’s coming!

(1) Increasing Membership Rate For New Members To Reduce Growth and Limit Distractions

First, let me be clear that your membership rate will not increase. All our current members are grandfathered in at their current rates, which you will keep as long as you maintain your subscription.

But we are going to hike the membership rate of future members and this should have two benefits:

(1) Limiting the number of new members joining the service will reduce distractions for me. New members often have more questions about how to get started, taking up more of my time. By dealing with fewer new members, I can focus more on what matters most—research.

(2) Some members have pointed out that our service has become so large that it sometimes leads to overcrowding new opportunities, especially when dealing with smaller capitalizations. Increasing the membership rate will limit further growth, reducing the risk of this occurring more frequently in the future.

Ultimately, I’d prefer to be part of a smaller, more qualified community of REIT investors, and a price increase should help with that.

Rest assured, your current membership rate is locked in and will not be increased as long as you maintain your subscription, despite recent inflation.

Two important notes:

If you haven’t signed up yet, you can do so today and still lock in our discounted rate and also enjoy a 2-week free trial. You will gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. Click here to learn more.

If you’re still on the monthly plan, consider switching to the annual plan to lock in the current rate. You can upgrade your subscription in your settings.

(2) Lessons Learned

Overall, we have had far more winners than losers over the years, which has allowed us to materially outperform the broader REIT sector.

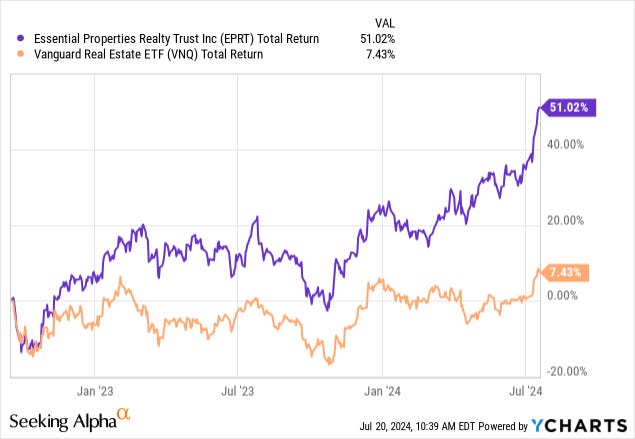

For example, our largest holding right now, Essential Properties Realty Trust (EPRT), which constitutes a substantial 12% of the Core Portfolio, has outperformed the REIT benchmark by a ratio of 7-to-1 since we invested in the company.

That compensates for losses, even significant ones, on smaller holdings.

However, it’s worth noting that we could have achieved even better results if we had avoided investing in highly speculative situations like Uniti Group (UNIT), Medical Properties Trust (MPW), Invesque (IVQ.U), and Branicks (BRNK).

In hindsight, it’s evident that nearly all of our more speculative investments have ended up losing us money.

It’s not just our picks. Highly speculative REITs, in general, have performed poorly over the years. Take REITs like Industrial Properties Logistics Trust (ILPT) and Global Net Lease (GNL), for example. Despite their ultra-low valuations, they have consistently resulted in investor losses.

We draw important lessons from this for the future:

If it sounds too good to be true, it probably is.

No matter how low the valuation, a conflicted management team can still undermine everything.

Ultimately, we believe that "quality value" is more likely to deliver alpha than "deep value" in the REIT space.

Therefore, you can expect us to focus more on high-quality REITs experiencing temporary issues rather than highly speculative plays that are vulnerable to debt markets and conflicted management.

While the potential rewards in these speculative cases might seem huge, they often turn out to be nothing more than a mirage.

(3) More Interviews in Video Format

You might already be aware, but I began experimenting with YouTube last year. The channel has grown significantly and now boasts over 20,000 subscribers.

This experience has also made me more comfortable in front of the camera. As a result, I’m planning to launch a new video series featuring interviews with REIT CEOs, which will be exclusive to members of High Yield Landlord.

Each video will also include a transcript for those who prefer a written format.

However, I believe the video format will be a valuable addition. Sometimes, seeing the facial expressions and body language of the management team can provide additional insights. Plus, it allows you to absorb our content while you commute, jog, cook, or go about your daily activities.

(4) Consistent Use of Summaries

Many of you have requested summaries for each article, particularly for Trade Alerts, to help save time. Since not every report may be of interest to you, these summaries will allow you to quickly identify which content to read and which to skip.

We will begin adding summaries to all our Trade Alerts right away and will also provide summaries for other articles as needed.

(5) Return to Conferences

Last year, I attended two major REIT conferences and had the opportunity to meet with many REIT management teams in person, leading to several exclusive interviews for members of High Yield Landlord.

Attending these conferences is a significant investment, often costing up to 10 times your annual High Yield Landlord fees. However, they provide invaluable opportunities to meet face-to-face with REIT managers and gain unique insights.

Unfortunately, I haven’t been able to attend any conferences this year. The Citi Global conference was restricted to non-clients, and the REITweek conference coincided with my trip to Ukraine to deliver trucks.

However, I will soon return to conferences. The largest European REIT conference is happening in two months, and I’ll be attending. Vonovia will even be hosting a property tour, which should be particularly interesting as it is our largest international holding.

Bottom Line

We’re thrilled with our progress so far, but we believe we can achieve even more. The past two years have presented challenging market conditions, but over the long term, our performance has been strong.

These are ideal times to accumulate larger positions while REITs are undervalued and we are intensifying our efforts to ensure we leave no stone unturned. If you have any suggestions or recommendations on how we can enhance our service, please let us know by leaving a comment below.

Finally, please note that we occasionally post some free research, but if you want to take your REIT investing to the next level, you can sign up for a 2-week free trial of our paid newsletter and gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We will soon increase our membership rates but you can today still beat the price hike:

Thank you for your continued support!

Jussi

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. Relevant disclosure to presented performance: past performance is not indicative of future results. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated, includes international REITs, and may at times invest in companies that are not typically included in REIT indexes. The performance of our portfolio is underrepresented because it is affected by withholding taxes on all dividends. At times, I may temporarily use margin if I am missing cash to executive new purchases. It is a consolidation of two accounts that I own personally: the Core Portfolio, which makes up about 90% of the capital, and a separate account, which includes some of my international REIT investments. The data is provided by Interactive Brokers and is believed to be correct, but its accuracy cannot be guaranteed and has not been audited.