Helios Towers: Potential for 20%+ Annual Returns - By Vienna13 Capital

Today, we are sharing a write-up from one of our members on Helios Tower (HTWS).

Vienna13 Capital is the portfolio manager at a family office, and I recommend that you follow him here on Substack and on X, where he often discusses REIT investments.

Here is his investment thesis for Helios Tower:

Executive Summary

Helios Towers PLC is essentially a predictable, durable, and growing cash flow stream generated by mission-critical infrastructure trading at a 50% discount to European peers and a 66% discount to US peers, despite higher anticipated revenue growth, lower leverage, and equal tenancy ratios. While there is plenty of re-rating potential, the stock can credibly deliver double-digit (even > 20%) IRRs without any re-rating, as shown with conservative assumptions in this report. Management communication about the initiation and details of shareholder distributions act as a near-term catalyst.

Helios Towers stands out as a compelling investment in the thriving telecom infrastructure sector, delivering exceptional growth potential and resilience. With over 14,000 cell tower sites across Africa and the Middle East and a robust tenancy ratio of 2.05x, Helios is capitalizing on the explosive demand for mobile data in the region. The company’s business model is a standout: by leasing passive infrastructure to multiple bluechip mobile network operators (MNOs), Helios achieves remarkable operating leverage, with co-location boosting ROIC and delivering substantial margin flow-through. This efficiency not only undercuts MNOs’ ownership costs by up to 30% but also positions Helios as a mission-critical partner in expanding mobile connectivity. The broader sector tailwinds only amplify this opportunity. Cell towers remain the backbone of mobile networks, complementing rather than competing with satellite technologies like Starlink, while global data demand soars.

Financially, Helios is hitting its stride. A strategic pivot in 2022/2023 toward organic growth has transformed it into a cash-flow-positive powerhouse, with free cash flow accelerating and leverage steadily declining. Backed by a seasoned management team and a UK listing, Helios mitigates typical emerging market risks through mainly hard-currency contracts, CPI and power escalators, and long-term agreements.

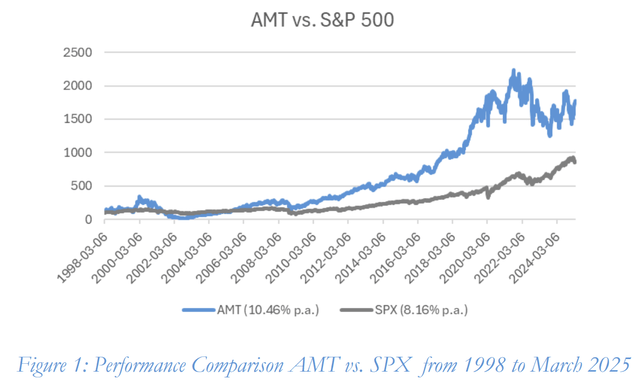

Cell tower companies

Before we delve into Helios Towers, let’s start off with some general observations on telecom infrastructure/cell tower companies. Most importantly, have cell towers historically been rewarding investments? The clear answer is yes. Look at American Tower (AMT) as the prime example. AMT has outperformed the S&P 500 by 230 basis points per annum since 1998.

Given this impressive performance, let’s look briefly into the business model of cell tower companies. What do they do? They buy or lease land and build cell towers (including infrastructure such as power, cooling, lightning protection, and, if necessary, security and equipment room). They own the passive parts. They lease this passive infrastructure to mobile network operators (MNOs) who own and attach the active infrastructure (antennas, radio units, baseband units, cables and feeders, backhaul equipment, and network-specific electronics).

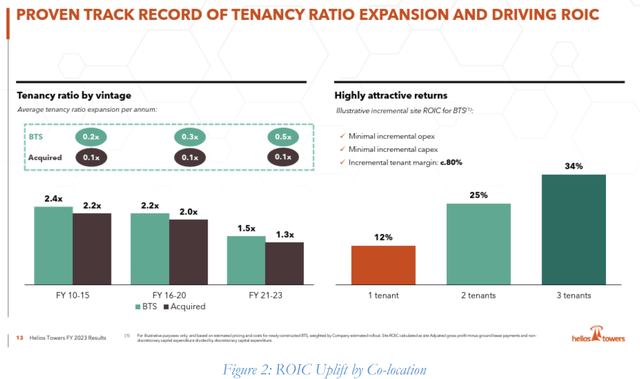

Independent tower companies lease their passive infrastructure to more than one mobile operator (while non-independent tower companies are reliant on only one mobile operator and, thus, lack the ability to lease the same infrastructure multiple times). This is highly attractive as incremental margins and incremental ROIC increase substantially with each added tenant. The following slide from a Helios Tower deck illustrates the increase in ROIC.

The ROIC almost triples, with three tenants per site compared to one. Since this is the most attractive feature of the business, keep this in mind when comparing valuation to other cell tower companies that might look cheap on a multiple basis but lack the ability to lease up towers multiple times due to their being dependent on (majority-owned by) one MNO.

Why does it make sense for mobile operators to lease from a cell tower company? Usually, tower companies are better suited to build, run, and maintain the passive infrastructure. , So mobile operators can focus on their core business instead of being a real estate company in parts. Moreover, due to the efficiency of tower companies and the fact that they can lease to different mobile operators, lease rates for a given mobile operator are much cheaper than their cost would be to run and maintain it themselves (if they owned it they would not sublease it to a direct competitor; there are estimates that Helios Tower’s lease rates, for instance, are up to 30% cheaper than the cost of ownership would be for MNOs). Moreover, it makes their business models more “capital light”.

Are cell towers sought-after assets?

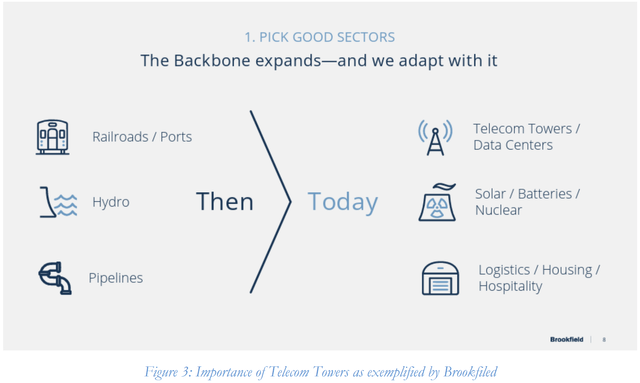

Look at Brookfield Corporation (Brookfield Asset Management), for instance, as one of the premier alternative asset managers of the world. How do they define “good sectors” that constitute the backbone 3 of the modern economy. See the slide below from their recent analyst day, where they state that telecom towers are clearly important infrastructure assets for them.

As an example, Brookfield (together with partners) recently acquired a large cell tower business in India for 2.2 bn USD and owns a portfolio of 257’000 cell tower sites in India alone. Similarly, DigitalBridge Group recently acquired JTOWER Inc, the industry leader among cell towers in Japan, for a significant premium to the last traded price. All this suggests that cell towers are indeed desired assets among long-term-oriented investors.

Is it a growing market?

The growth in global mobile data consumption is still substantial and will stay elevated for years to come. The projected growth rate depends on the source and timing, but conservatively, one can expect at least 15% CAGR until 2030. 5G traffic currently accounts for around 3,4%, while it is expected to account for 80% in 2030. This growth is driven by increased smartphone usage, video streaming, and IoT devices supporting everything from basic calls to 4k video streaming and real-time gaming.

Cell towers are the backbone of the wireless communication networks supporting this increase in mobile data demand. They have the coverage (broad coverage of up to tens of miles) and capacity (thousands of simultaneous connections), spectrum utilization (Towers host antennas that leverage licensed spectrum bands, which are optimized for long-range, high-throughput data transmission—vital as data usage shifts toward higher frequencies like 5G’s mid- and high-band spectrum.) and are essential for the 5G rollout, which promises speeds 100 times faster than 4G and low latency. The 5G rollout relies heavily on existing tower infrastructure, especially for mid-band deployments that balance speed and coverage. Towers are being retrofitted to support 5G antennas and radios, bridging the gap until denser small-cell networks mature.

On Helios Towers PLC

Helios Towers is a leading independent telecoms infrastructure company (mainly cell towers) operating across Africa and the Middle East. The business model promotes tower infrastructure sharing and enables mobile network operators to deliver mobile connectivity more quickly, reliably, and cost-effectively. In turn, this supports the expansion and quality of mobile connectivity, driving development in the targeted markets. Helios operates over 14’000 sites with an average tenancy ratio of 2.05x. Cell towers are either acquired from MNOs (currently this is not on the agenda, see below under strategy shift) or build-to-suit, which means build from scratch, but only after one anchor tenant signed a contract, so that rent flows from day one after completion of the site. Existing cell towers are offered to other MNOs so that they can co-locate their active equipment and share the passive infrastructure. This is the economically most attractive part since additional rent can be collected for a minor incremental cost (lease-up delivers ca. 80% EBITDA margin flow through). The third element of the business model is to drive operational improvements of existing sites to drive returns through power optimization.

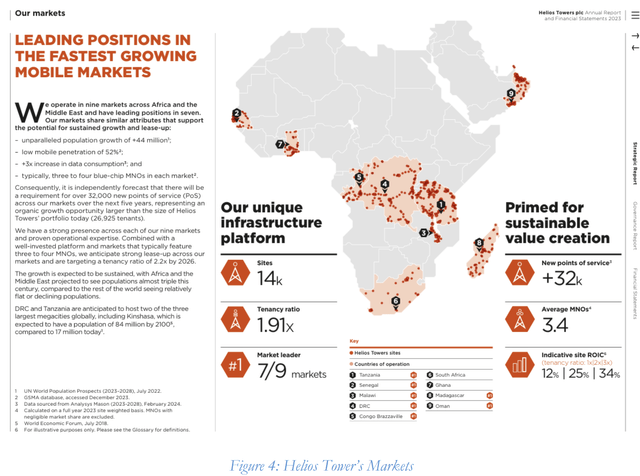

The following slide from their 2023 annual report shows the markets Helios operates in. (As mentioned above, the tenancy ratio has increased and is now 2.05, and sites are higher than 14’000.)

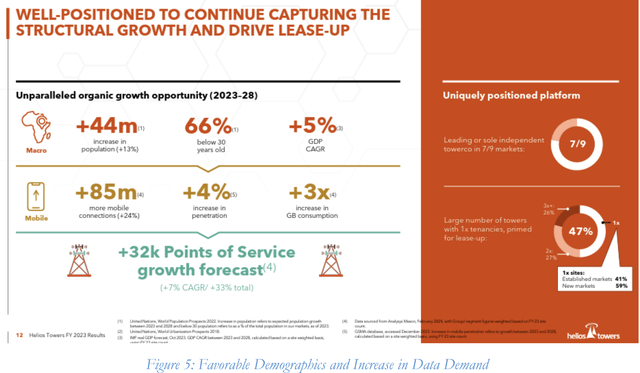

Helios operates in markets with above-average population growth. This is often a double-edged sword for the corresponding economies, as a demographic dividend relies upon a well-educated and employed society. However, for a telecom infrastructure provider, there is a much clearer relation between demographics and attractiveness of the business model, since basically every communication and transaction (including payments and banking) requires mobile data in Africa. Thus, the sheer increase in population size directly drives data requirements. In a report by the GSMA global telecoms industry body, it is predicted that mobile data traffic in sub-Saharan Africa, for instance, will quadruple over the next five years, and mobile internet penetration will increase to 37% by 2030 from 27% in 2023. As can be seen from the previous slide above, Helios is the market leader in almost all markets they are present in, and these markets typically feature three to four MNOs (so tenancy ratios between two and three, probably something like 2.5 on average, are clearly achievable).

This might be the moment where many will think: WHAT?… AN EMERGING MARKET COMPANY… AFRICA… MACRO RISK... FX RISK… DEFAULT RISK…GOVERNANCE RISK. While I have a background as an EM investor and, thus, might be biased towards playing down the EM risk, there are many objective reasons why this business does NOT deserve an EM discount. What about FX risk of lease contracts: 78% of EBITDA is in hard currency largely due to four of nine markets being innately hard currency (DRC, Oman, Senegal, and Congo B). But there is high inflation in these countries, right? Well, basically, all lease contracts have annual CPI escalators and annual or even quarterly power escalators. Thus, inflation risk and risk of rising power prices to operate the site are largely passed on to the MNOs and, consequently, margins are relatively insulated from these macro dynamics.

Contracts are solid and modeled after the best-in-class contracts of the likes of American Tower Corporations. The tenants are blue chip MNOs (most of them are large multinational corporations like Airtel Africa, Vodacom, Axian and Orange) and contracts have long maturities (10 years plus at initiation) with current average remaining maturity of roughly 7 years.

Helios has been operating in Africa for many years now and has built a premier reputation in terms of power supply (minimal downtimes despite challenging power infrastructure), security, and service quality. The company is listed in the UK, and the management team is comprised of mainly UK residents. So, yes, the markets Helios operates in face some challenges that are not present when building a cell tower in Upstate New York, but it also offers more growth potential. Moreover, one might argue that Helios is actually more skilled when it comes to providing tower infrastructure than US peers, because US peers “just” connect cell towers to the existing and reliable power grid, while Helios has to be a skilled power company too in order to achieve the uptimes they have historically (~99.99%), despite the challenging power infrastructure in their main markets.

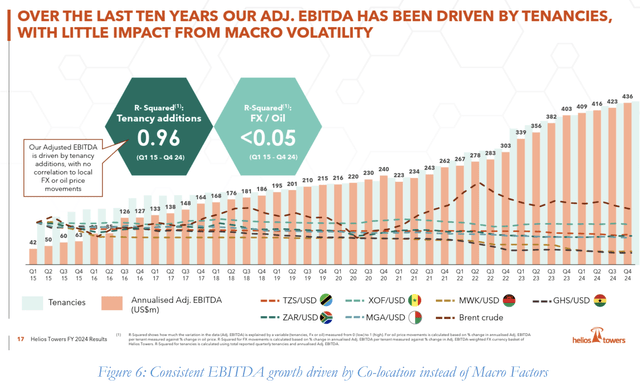

The following slide not only shows the consistent growth in EBITDA of Helios but also the fact that this growth is mainly tied to tenancy additions and largely insulated from macro volatility:

Helios operates in EM markets, but in addition to the fact that this actually directly increases the growth potential for a tower company, contract structures and governance of Helios reduce almost all of the typical headaches of EM investing, like exposure to commodity volatility, politics (as an aside: even in politically challenging situations governments usually prefer to have basic access to data and information, so having an intact data infrastructure and not messing with the companies behind the data infrastructure is aligned with government interest).

The origin story

Helios was founded in 2009 and had prominent early backers such as Helios Investment Partners (private equity fund focused on Africa), Soros Strategic Partners (an entity of the Soros fund management empire), RIT Capital Partners (associated with Lord Rothschild’s family interests) and Millicom and Bharti Airtel who are telecom operators that provided not only financial backing but also became early operating partners. In 2019, after growing the business consistently and successfully, Helios Towers IPO’d at the London Stock Exchange. The stock was sought after and was up 50% quickly until the interest rates landscape changed substantially in 2022 and REITs or REIT-like structures, such as Helios, crashed in general. This change in interest rate levels also led to a strategy shift in late 2022.

Strategy shift in 2022/2023

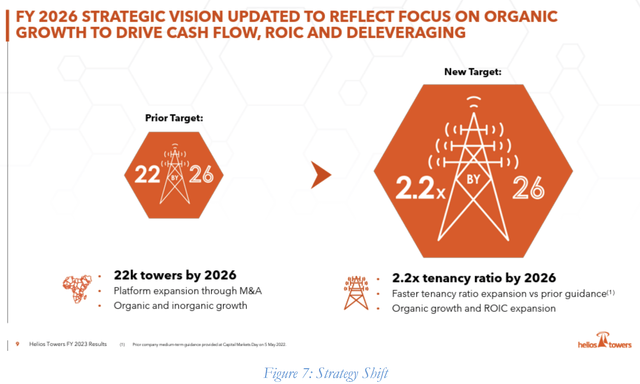

Prior to the IPO and immediately after the IPO, Helios aimed to grow the site count organically and inorganically through m&a. They formulated the strategy 22 by 26, which meant 22’000 towers by 2026. However, after the end of 2022, they considered their phase of inorganic growth as complete. They had entered several new markets after raising debt (and converts) and equity and already had a decent footprint and base to expand from organically through co-locations. Moreover, the interest rate landscape changed at that point. They reacted meaningfully and shifted the focus exclusively to organic growth through lease-up and some built-to-suit projects. The target is now dubbed 2.2 by 26, meaning an average tenancy ratio of 2.2 by 2026. This made the business less capital intensive and more tilted towards increasing the bottom line (usually, newly acquired towers through m&a deals lower the average tenancy ratio, which temporarily lowers 7 ROIC and margins and uses cash instead of producing cash). With the new strategy, it was clear that operating leverage would be visible more quickly, the need for capital raises would vanish, and ROIC and margins would improve quickly.

This is what has happened since. Two years after this strategy shift was implemented, free cash flow (after all capex; not just maintenance capex) turned positive as well as earnings, and margins and ROIC have moved up. Helios is now a cash generative (with quickly rising FCF) business and is still growing double digits organically. The leverage has come down and will quickly come down further, and the focus will shift toward shareholder distributions starting in 2026. In conclusion, management reacted responsibly to the changed fund raising and interest rate environment and has made the business even more resilient and more attractive in my view.

Comments on management

The management team is young but very experienced. CEO Tom Greenwood has been in the position for almost three years now. He joined the company in 2010, so he has been around basically since the very beginning. He was COO and CFO before being appointed CEO. He is 42 years old and worked for PwC before joining Helios. Greenwood owns ~0.5% of Helios Towers, valued at above 7 million, so he has skin in the game. Manjit Dhillon is the CFO and joined the company in 2016. Previously, he held roles at Deloitte, Goldman Sachs and Lyceum Capital. While he also holds Helios stock, his stake is rather low for a CFO (~250k, according to Bloomberg).

The management team is very consistent in their communication and, more importantly, consistent between their communication and subsequent actions. They usually guide conservatively in their communication to market participants and then tend to exceed the guidance.

But what about Starlink?

One concern that I feel some market participants have about the cell tower businesses in general, and players like Helios Tower specifically, is the improved services provided by satellites exemplified by Starlink. My brief take on this is that despite massive improvements over earlier attempts, the capacity (number of people next to each other who can use the service at the same time) is still far away from the capacity of cell towers and, thus, will be rather a complementary service than a competitor. There was a question on this topic in the most recent earnings call of Helios Towers, and I show the essence below:

Question by analyst: One of the attractive characteristics behind your business model is, of course, that mobile telephony is the dominant driver of connectivity across emerging markets because of the poor economics of fixed line. But there is a new player in town, which is satellite. I am just wondering to what extent you feel some of the operators are starting to think differently about network topography, whether it is essential to run mobile more deeply into rural areas or whether they might consider partnerships with satellite operators? I am interested in your thoughts on that kind of subject.

Answer by CEO Tom Greenwood: Great question. Lots of news about that at the moment. And the satellites are a very kind of interesting area because I think what they do, they provide a complement and essentially increase the size of the pie of the connectivity market worldwide. So there’s a huge difference between the spectrum capacity possible in a satellite beam versus a terrestrial beam, just to the extent that they will never be sort of directly comparable from a quality of service point of view with any sort of reasonable number of people using devices under the beam. So to put some numbers around it, a satellite beam has a diameter of half a kilometer or one kilometer or something like that. And they’re both using the same sort of spectral capacity. So, the ability to use satellites is very important for rural locations. It’s very much for areas that power and terrestrial networks can’t get to, like shipping and an airplane and some of IoT. And certainly, you can have a viable satellite business, particularly on the scale, because of all of that kind of growing demand in those areas. But the minute there are enough users in a location. You’ll need a terrestrial antenna. So, to the extent there are satellite companies doing partnerships with mobile operators, we think that’s great, that opens up some ubiquitous coverage to areas that simply were impossible or uneconomical to cover currently. But as and when there becomes a reasonably small mass of users in those areas, there will need to be terrestrial power put up. So, in some circumstances, that could actually potentially see some acceleration of tower deployment, we think, in some rural locations.

Question by another analyst: Going back to Starlink am I understanding correctly that you don’t see that as a risk to the TAM that you’re addressing, if anything, it is on top of? And if that is not right, I’d just be interested to understand, with your coverage rollout growth plans, how much of that you see is potentially exposed to alternative models like satellites.

Answer by CEO Tom Greenwood: On the points around satellite companies, the real sort of use cases there are, as well as for things like shipping and airplanes and very rural locations, there are essentially two ways of doing it. One is direct to device, where largely the satellite company partners with the mobile operator to use a bit of the spectrum that the mobile operator has. Or it’s a dish service where you have an antenna dish, put on your house or your building which uses the satellite frequencies and the spectrum capacity, the spectrum density of the beam allows for a small number of users on a single beam, which enables people largely living in very rural locations to benefit. Obviously, you can use it in a city, but only those few handful of people can use it in a city before it stops working. So, yes, it’s very much complementary. And it could, as I mentioned before, lead to a potential accelerated rollout of some sites and some locations. This is partly because direct-to-device, if it happens, could get a few people using phones who didn’t before, and then you need to put a tower up as soon as there’s a small critical mass. That being said, the pricing point for people in rural locations in Africa is just not viable. But that’s a potential evolution, albeit difficult. And the other one is actually using backhaul. So... and look, satellites have been used for backhaul for 30 years to 40 years, so this is nothing new, per se, to use satellites for backhaul. It’s just with the NEO satellites; the pricing point is low, and the connectivity is better than previous versions of it. So that could open up more sites and locations where there is no fiber in the ground, and there is no line of sight to the next tower to ping the microwave signal, and usually the maximum distance you can use for that is about 20 miles to 25 miles due to the curvature of the Earth. So in the past, there was some limitation of where you could put the net tower because you were more than 25 miles from the previous one, whereas with the potential for better satellite backhaul, that could open up a few more locations to do it in. So there are a few ways where there could be complementary elements to do it, and that’s great. It’s exciting for us and, obviously, the communities. But in order to deliver real good quality to any kind of mass of people, you need terrestrial antennas because of the capacity requirements on the spectrum.

Helios by the numbers

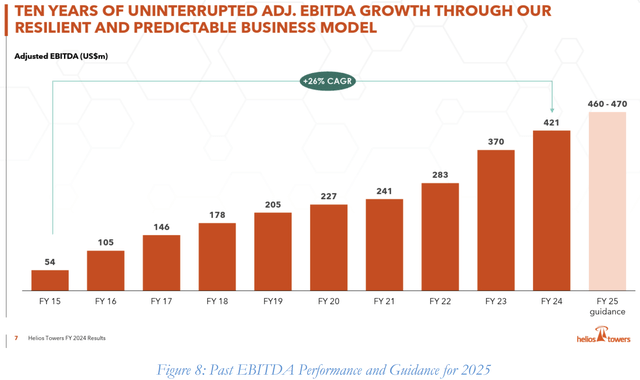

Next up, let’s dive into Helios' financials. Helios has delivered very consistent growth before and after the IPO, as can be seen from the following slide (and as discussed above, it has a long growth runway ahead as 9 well).

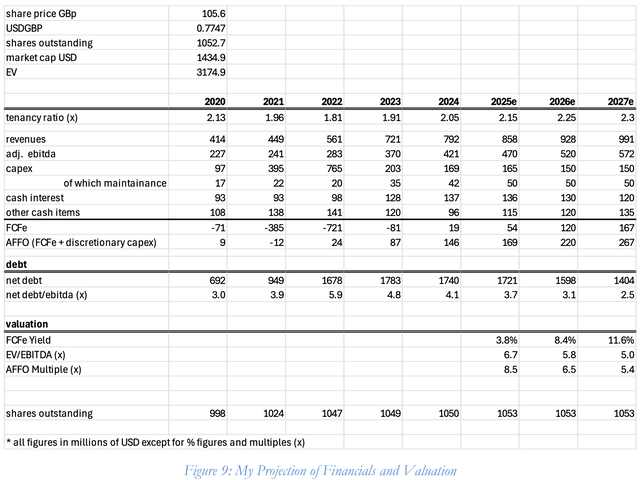

Below is a summary of relevant financials over the last couple of years, as well as my projection for 2027. Looking at tenancy ratios, net debt and FCFe (free cash flow to equity; so free cash flow after interest cost and all capex) it is clearly visible that Helios did a lot of m&a in ’21 and ’22. The new sites had to be leased up, which lifted margins and cash flow again. Looking at ’24, the operational leverage becomes obvious. Without any m&a, just by increasing co-locations, the cash flow profile flipped, and the business is now generating cash (and EPS, which I left out in the table). This cash flow will increase substantially over the coming years so that the FCFe margin will approach 20% of revenue.

In terms of valuation, Helios trades on high single-digit/low double-digit FCFe yield for ‘26/’27 numbers, or EV/EBITDA multiples of around 5. I also created AFFO by adding back discretionary CapEx to FCF to have a figure that is comparable to standard measures for US REITs, including US cell tower peers. This is clearly a very undemanding valuation for a mission-critical business (without cell towers, no text message, banking app, or ordinary call will work in the target region) with durable and predictable cash flows (long contract maturities as mentioned above) and a prudent management team.

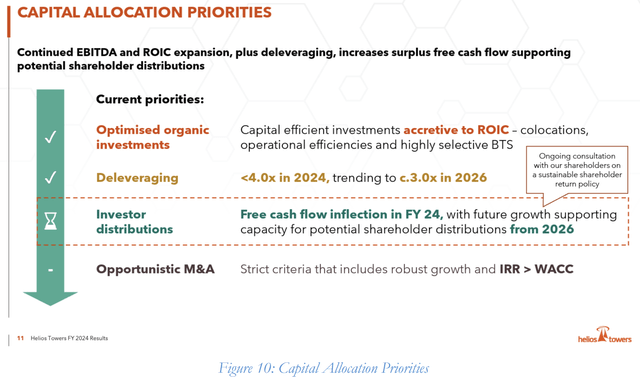

Note that the projection in the table does not incorporate dividends or buybacks. However, management has repeatedly stated that they will reach their target leverage ratio at the end of ’25 and will initiate shareholder distributions in ’26. This will likely be a mix of dividends and buybacks. This would mean that the leverage ratio would come down slower than in my table in the years ’26 and ’27 but intrinsic value per share would increase through buybacks (especially through buybacks at such attractive valuations) and investors TSR would be bumped up by dividends.

See also the following slide regarding the capital allocation priorities and shareholder distributions:

Comments on debt

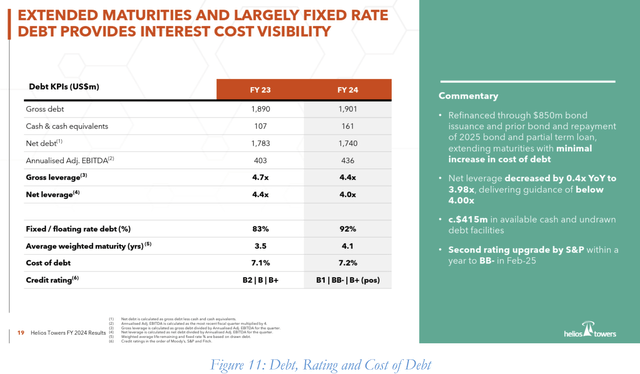

The net debt figure in my table above comprises external debt of 1673 million USD, lease liabilities of roughly 225 million USD, and cash and cash equivalents of 161m. The difference in the net debt/EBITDA figures in my table and the usual company slides stems from the fact that Helios annualizes the Q4 EBITDA for the calculation. By contrast, I use the realized EBITDA of the last fiscal year as a basis, which is lower than the Q4 “run-rate” EBITDA. The following slide shows that more than 90% of debt is currently fixed rate, there are no major near-term maturities, and Helios managed to refinance a bond due in 2025 last year to extend the maturity profile with only a marginal increase in the cost of debt. Helios’ rating was recently upgraded by S&P. The cost of debt is reported at 7.2%. The implied and annualized interest cost, excluding interest on lease liabilities, is slightly higher at ~7.8%. As a side note, the lease liabilities stem from the ground leases. In fiscal year ’24, for instance, Helios paid 48 million USD for lease liabilities (~6% of sales), comprising both principal repayments and interest.

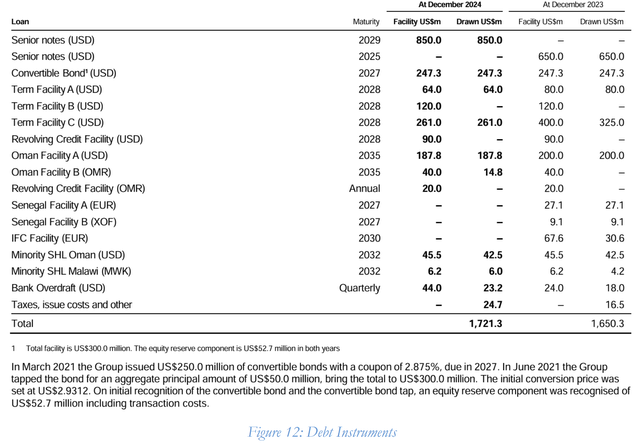

The following table shows Helios's debt instruments.

My take on the leverage of Helios is as follows: Most of the debt is fixed rate; Helios has proven that it can refinance its debt in the markets at a reasonable cost; ratings are drifting upwards; there are no major near-term maturities, and the leverage ratio is coming down considerably. The risk associated with Helios’ leverage can, therefore, be deemed low. Take the prime US peers like American Tower, for instance, who currently feature a debt/EBITDA of roughly 5.5x, which is 1.5 turns higher than Helios.

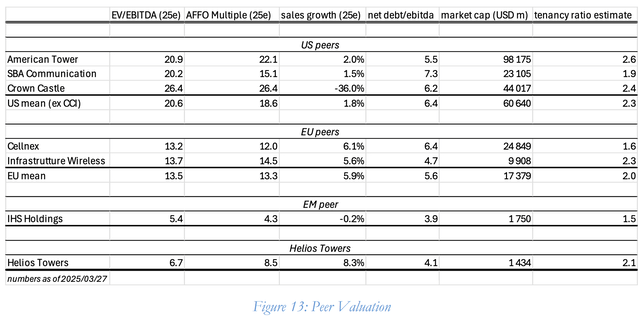

Peer analysis

The following table compares Helios Towers to major US and European peers as well as IHS Holdings as an EM peer. While there are other listed cell tower companies, I screen for independent cell tower companies, meaning companies that are not majority-owned by one MNO and do not derive the majority of their revenue from only one MNO or just from the subset of MNOs that also hold stakes in the cell tower.

It is evident that Helios towers expects the highest revenue growth of all peers, features the lowest leverage (on par with IHS Holdings), has a tenancy ratio on par with EU and US peers. Yet its EV/EBITDA is a third of US peers and half of EU peers. In terms of the AFFO multiple, it trades at a 55% discount to US peers and a 37% discount to EU peers.

Brief note on IHS Holdings: As can be seen from the table, IHS Holdings is statistically even cheaper than Helios. However, Helios is the significantly better asset, in my opinion. Among the reasons for this is the superior management of Helios as compared to IHS Holdings, the higher local FX risk implicit in IHS Holdings, and recent issues with renewals of major contracts at IHS Holdings.

While one cannot expect Helios to trade at the multiples of US peers, it is questionable in my view if a 50% discount to European peers is really justified, given the low FX and inflation risk that Helios faces (due to mainly USD contracts and CPI and power escalators in the contracts), UK listing, long track record and no materialization of any “typical” EM problems at Helios in their entire company history.

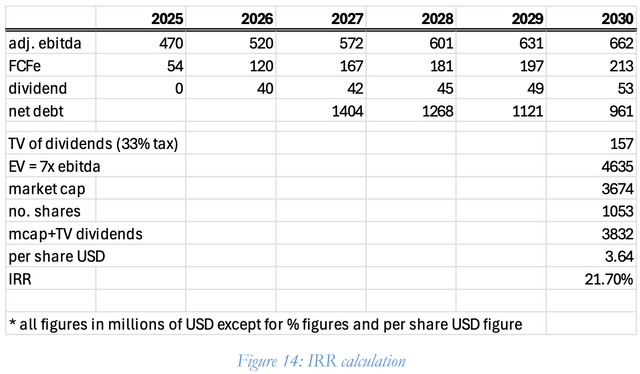

Thoughts on IRR

While I concluded in the section above that Helios trades at a lower multiple than peers, I don’t want to use re-rating as the case for the stock. There are too many “my stock trades at X and should be valued at 2X” investment thesis out there. Instead, let’s compute a possible IRR without re-rating. Using my table above with projections until 2027 and then assuming the following:

Ebitda grows 5% p.a. from ’27 to ’30 (pretty conservative)

FCFe grows 8.5% p.a. from ’27 to ‘30

Dividends are initiated in ’26, where 1/3 of FCFe will be distributed and ¼ of FCFe thereafter.

Investors pay 33% tax on dividends and invest dividends risk-free at 2%

There are no share buybacks (highly unlikely given management has talked about potential buybacks), and the remaining FCFe is just used for deleveraging

The EV/EBITDA multiple stays constant, so entry = exit multiple equal to 7

USDGBP is unchanged

This implies the following result:

As can be seen from the table, there is significant IRR potential without any re-rating. The point estimate of the IRR is unimportant as there are assumptions involved (see above). However, the important thing is that one can use very conservative assumptions and can get to double-digit IRRs without any multiple re-rating.

As an alternative thought, I assume they reach the 2027 FCFe projection, but this FCFe does not grow thereafter. Discounting this ’27 level FCFe stream back to ’25 using a 12% cost of equity implies a value of around 135 GBp per share. So even if only the immediately visible growth takes place, shares would still have around 30% upside.

Are there sector tailwinds?

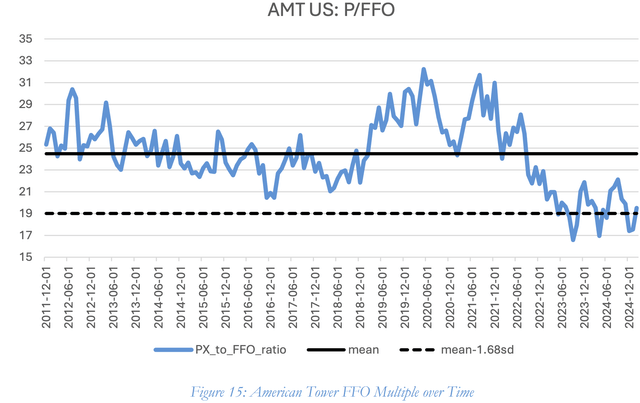

Given the cheap relative valuation compared to peers, what about the sector in general? Looking at valuations of the prime assets in the sector, such as American Tower, it is evident that also American Tower itself is currently priced at low valuations relative to its own history.

The following chart illustrates AMT's FFO multiple since 2011.

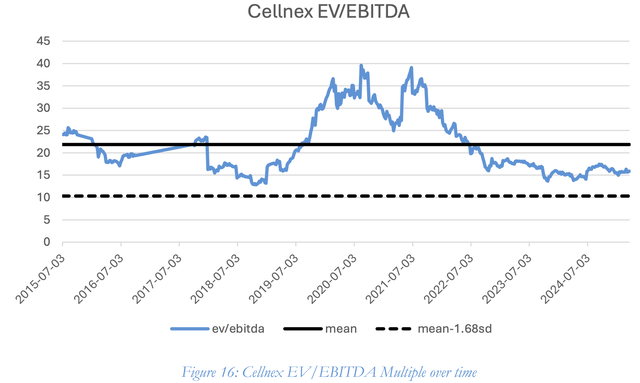

Similarly, the EV/EBITDA multiple of Cellnex in Europe is near its lows, as the following chart illustrates.

There might be several reasons for the low general sector valuations. Among these are the increase in interest rates and an overblown fear that alternative satellite-based technologies could make cell towers obsolete. The second concern addressed in the report is that cell towers will remain the backbone for mobile communication and mobile data for a long time. Interest rates have at least stabilized, and most cell tower companies have already deleveraged substantially from their peak leverage around 2022. Data demand is still growing at a healthy clip, as discussed above. AI, if anything, will only add to the trend of more data usage. In short, the sector is simply out of favor as the focus of investors was on US megacaps in recent years instead of “boring” steel towers carrying antennas. This could quickly change. The good thing is that attractive returns can be achieved here without re-rating, thanks to low entry multiples and a broad focus on shareholder returns.

Why does opportunity exist?

Both Emerging Markets and UK listed stocks have substantially underperformed US stocks over the past decade. In addition, bond proxies like REITs or REIT-like structures crashed in 2022 due to quickly rising interest rates. Moreover, satellite-based date providers like Starlink became more widely known, and people overestimated the potential of Starlink to compete with the core business of cell tower companies. Lastly, Helios has not paid dividends yet (because they wanted to deleverage), which does not cater to the “typical” income-seeking investor in listed real estate structures. As a result, the stock got neglected. As I have shown in the report, Helios might be a good investment without multiple re-rating. The pure execution of the core business strategy and the operating leverage that has already started to materialize (but will only accelerate) will suffice to get a satisfactory outcome for Helios stock. If it re-rates or gets a private market bid – even better. I like the odds.

Are there any catalysts?

Shareholder distributions will be initiated in ’26. This will likely be a mix of dividends and buybacks. The management said that they would engage with investors over the coming weeks and share their plans for shareholder distributions in due course. I expect them to release detailed plans in the second half of the year. Once a dividend (to be paid in ’26) is confirmed and a broader investor base gets an idea of the dividend yield and buyback yield, Helios will attract more traditional income-seeking investors. Moreover, the company has just turned positive in terms of EPS and FCFe (as mentioned above). Given this has just occurred, Helios “screens” somewhat expensive for quantitative investors on a trailing basis. In around 11 months, after the Q4 2025 report, at the latest, this will change due to quickly scaling EPS and FCFe. So, the announcement of shareholder distributions (later this year) and updated company “screens” reflecting a cheap valuation (early next year) are the two main catalysts.

============================

Access Our Course to REIT Investing

Don't forget to take our 10-Module Course on REIT investing! The entire course is available to members for free as part of your membership.

============================

Access Our Portfolios Via Google Sheets

Our three portfolios are available through Google Sheets. These sheets provide detailed information on position sizes, risk ratings, and key metrics to help you make well-informed investment decisions:

============================

Access Our REIT Market Intelligence Sheet

This exclusive tool includes a list of all equity REITs grouped by property sector, providing all the information you need to make better decisions: FFO multiple, dividend yield, payout ratio, credit rating, and much more.

============================

Access Our Portfolio Tracker

The HYL Portfolio Tracker is a Google Spreadsheet designed specifically for members of High Yield Landlord. It helps you track all your HYL investments in one place with a simple format. It is very easy to use, so don't miss out on this free feature!

============================

Access Our Live Chat

Our live chat room is where the HYL community comes together to share market news, discuss investment ideas, and help new members get started. Members can post questions and receive prompt answers from other real estate investors and our team.

============================

Finally, feel free to contact us anytime. You can send me a direct message on the chat or email me at jaskola@leonbergcapital.com

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

I just expanded my position last week. Maybe I should expand it some in the course of this year.