In our recent review of the healthcare property sector, we explained that we are very bullish on medical office buildings going into 2025.

That's because their valuations are surprisingly low for assets that are recession-resistant and enjoy growing demand from the rapidly aging population.

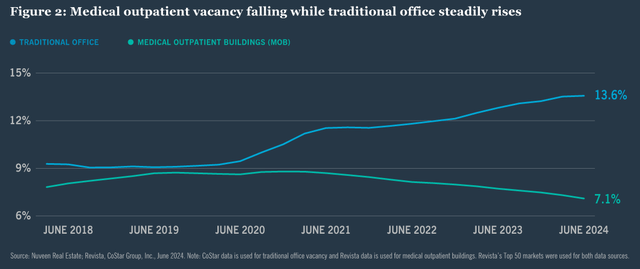

Perhaps, this is because the market fears that a wave of empty traditional office buildings could be soon converted into medical office buildings, leading to more supply and lower rents. But the reality is that in most cases, such conversions are far too expensive, especially in today's environment, and this explains why the vacancy rates of medical office buildings have kept declining even as that of traditional office buildings has been surging:

To quote Nuveen:

From a physical standpoint, medical outpatient buildings require a substantially different buildout, including increased plumbing, higher floor load capacity, ample parking ratios, differentiated HVAC/electrical loads, biohazardous waste removal, and different floorplan.

In some limited cases, yes, traditional office is convertible into medical office, and some office landlords are doing so.

But in most cases, it is way too expensive and for this reason, we think that the REITs that own medical office buildings are today unfairly discounted.

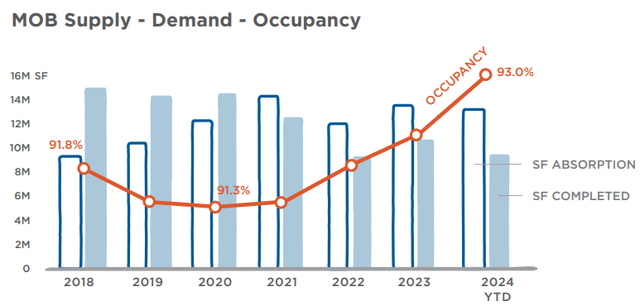

The demand is growing rapidly, but the supply growth is limited, and as a result, these properties enjoy strong secular tailwinds that warrant higher valuations.

The former CEO of Healthcare Realty (HR) put it best in their most recent earnings call:

"Medical office building market fundamentals are strong with demand for outpatient space outstripping supply. We are benefiting from the secular tailwinds of aging demographics and the shift in care to outpatient settings. Taking advantage of this backdrop, I'm proud of our leasing team for producing their fifth consecutive quarter of over 400,000 square feet of new signed leases in the multi-tenant portfolio.

I'm also pleased to report our team delivered another quarter of strong multi-tenant absorption, totaling 159,000 square feet or 49 basis points. This occupancy gain was driven by 565,000 square feet of new lease commencements, coupled with strong tenant retention of over 80%. This is tremendous execution by all members of our team. We've gained 164 basis points of occupancy over the last four quarters. With one quarter to go in our published five quarter occupancy bridge, we are on pace to be at the high end of our 150 to 200 basis point goal.

NOI growth was also solid in the third quarter. We achieved same-store property year-over-year growth of 3.1%... We expect NOI growth to accelerate as timing differences moderate and free rent burns off...

Our core business is performing extremely well. This performance is generating a number of tailwinds into 2025... [emphasis added]

Its same property NOI growth is above 3% and expected to accelerate further in the coming years.

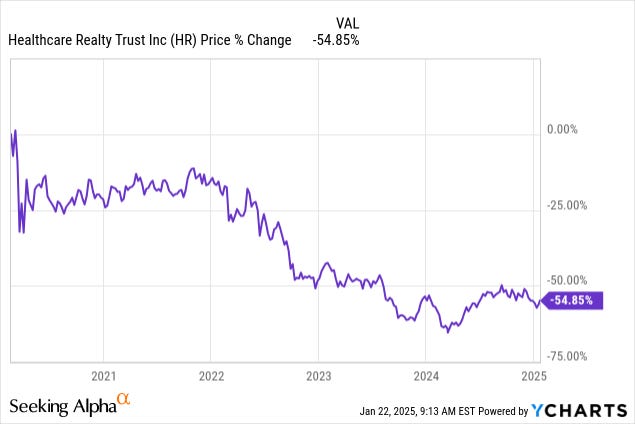

That's a clear sign of undersupply and yet, the market seems to fixate over the word "office" in "medical office building" and has heavily discounted Healthcare Realty (HR) as if it was facing some secular headwinds:

The fears of office conversions make even less sense in the case of Healthcare Realty given that it owns mostly Class A properties that are located in the medical clusters of rapidly growing sunbelt markets. As such, its medical office buildings enjoy significant barriers-to-entry in their superior locations and physicals characteristics. The office conversions are not competing with them.

Therefore, we think that Healthcare Realty (HR) has been unfairly beaten down with its equity trading at a near 30% discount to its net asset value, despite enjoying strong long-term growth prospects.

And we are not alone to see the opportunity.

The management has been aggressively selling assets to buy back shares to take advantage of the discount and create value for shareholders. They again did more of that in the most recent quarter:

"Through October, proceeds totaled $875 million. Based on this success, we are increasing our full year proceeds range to $1.05 billion to $1.15 billion, up $100 million at the midpoint. Since our last call, we've repurchased over $150 million of additional shares, bringing year-to-date repurchases to nearly $450 million at a weighted average share price of $16.48.

On a leverage-neutral basis, this represents a reinvestment spread to the company of over 100 basis points, a highly accretive outcome for earnings, cash flow and NAV. As we look ahead, there is currently a deep and liquid market for medical outpatient buildings and HR has ample access to that market via third-party asset sales and its joint venture partnerships. We will target the highest long-term risk-adjusted returns for shareholders through a dynamic capital allocation framework which will always take into account the valuation and future growth embedded in our own portfolio." [emphasis added]

But despite all these asset sales and share buybacks, the stock price hasn't moved much. It still trades at a similar discount and this recently prompted the famous activist investor, Starboard Value, to buy a ~6% stake in the company.

Now, the company is revamping its top executive team and board. The CEO has already stepped down, as has the CFO, and several board members have retired.

Starboard Value and Healthcare Realty also signed a cooperation agreement, bringing in a new board members, all of whom have significant experience in REIT M&A.

This includes former CEOs of Kimco Realty (KIM), VEREIT (VER), and Federal Realty Trust (FRT).

KIM and FRT are large REITs that have taken part in a lot of different M&A deals, acquiring and merging with other players, whereas VER sold itself to Realty Income at a significant premium.

This seems to indicate that Healthcare Realty is now considering strategic alternatives to unlock value for shareholders and they confirmed this in their press release:

“We are pleased to have reached an agreement with Starboard and appreciate their collaborative engagement, valuable input and shared commitment to enhancing performance and driving value for our shareholders. David, Glenn and Don bring meaningful experience and fresh perspectives to the Board, and we look forward to working with them as we continue to take actions that will drive sustainable value and execute on strategic initiatives that further positions Healthcare Realty for long-term growth." [emphasis added]

Starboard added that:

“We commend the Board and management team of Healthcare Realty for their constructive dialogue and believe these highly qualified, independent directors bring extensive industry experience and a collective goal of enhancing shareholder value. This outcome is a positive step forward in supporting the Board’s efforts in positioning Healthcare Realty for consistent execution, advancement of its financial and operational objectives, and maximization of shareholder value.” [emphasis added]

What's next?

My expectation is that HR will still remain a standalone company and seek to close the gap between its share price and its net asset value. There will be however added pressure to make this happen as fast as possible. They will sell more assets and likely keep buying back shares to reach this objective.

If they still fail, I would expect M&A to be the next step.

Healthcare Realty has several options there.

Firstly, it already has a significant joint venture with KKR (KKR), which is one of the world's leading private equity firms. They have sold significant JV interest to KKR in recent years and they have shown clear interest in buying more. KKR likes this space and they have the means to acquire the entire REIT and would likely do so if they could get it at a small discount their estimate of fair value. It would be a win-win for both parties.

Secondly, the large diversified healthcare REITs like Welltower (WELL) are today trading at very large premiums relative to HR. They could acquire HR at a significant premium and it would still be accretive to their FFO per share and allow them to significantly expand their medical office portfolio.

Finally, HR could consider merging with Healthpeak Properties (DOC) to drive further efficiencies in G&A. Both medical office REITs find themselves in similar situations, trading at discounts to their net asset value. Moreover, both REITs have gone through mergers in recent years so this would be nothing new for them. If they now merged together, it would create a $20+ billion medical office leader and the synergies in management, leasing, and access to capital could create significant value.

The path HR takes will depend on which option does the best job of maximizing shareholder value, and it is reassuring to know that Starboard Value is there to look out for our best interests.

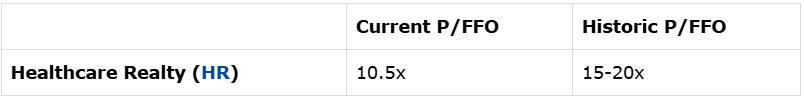

We think that ~16x FFO would be fair for a REIT of HR's quality and that implies that it has ~50% upside from here.

What about its dividend?

This is one of the reasons why HR is so heavily discounted. The market worries that HR will need to cut its dividend.

Its dividend yield is 7.7% but its payout ratio is over 100%.

Here is what the management commented on their dividend in the most recent quarter:

"Due to the timing mismatch between capital spend and cash rent from new leasing, our payout ratio was 106% in the quarter. Excluding the impact of absorption capital, our payout ratio would have been 98%. Over the course of 2025, we expect our payout ratio to decline below 100% and approach 90% adjusted for absorption capital...

... And just trying to really look forward and say how is management, how is our Board looking at where we’re headed? Is this sustainable this dividend? And our belief based on the forward look is absolutely a sustainable dividend and we can grow into it. In fact we can get to a payout ratio that is quite good going forward as the throughput of all this absorption capital converts to obviously NOI and then FFO per share. So it’s really saying how are we looking at that and where are we headed is the idea." [emphasis added]

Since then the CFO, CEO, and several board members have changed of course, and there is no guarantee that the new executives and board members will think alike.

This is what appears to concern many income investors. If the dividend gets cut, it could lead to a sell-off, at least initially.

But remember that Starwood Value has invested $100s of millions in HR and it certainly didn't do so to destroy value. They would only pushed for a dividend cut if they thought that it would help them to unlock value for shareholders by accelerating their deleveraging, growth, and perhaps, preparing them for an M&A deal.

As of right now, I don't expect a dividend cut, but the risk is higher than usual.

Closing Note

We continue to like the risk-to-reward and we are happy with our current position size at 6% of our Retirement Portfolio.

For a BBB rated sector leader with class A properties and strong long-term growth prospects, the REIT is priced at an unusually low valuation, and we now have an experienced activist investor invested alongside us.

The upside potential could be up to 50% and we earn significant dividend income while we wait.

Nice one, Jussi 💪🏻