Good News for RCI Hospitality

RCI Hospitality (RICK) was my most rewarding investment from 2020 till 2023.

I started buying shares at around $15 and saw it rise all the way to $100, all while buying more shares at each step along the way.

What made it so insanely rewarding during this two year time period?

It is two things:

Firstly, its starting valuation was very low, allowing for significant multiple expansion in the following period.

Secondly, the company went on an acquisition spree, which significantly expanded its free cash flow.

The market then rewarded this growth with a higher valuation multiple, which combined with the growth, resulted in significant upside.

I am bringing this up because I think that the next few years could resemble the 2020-2023 period.

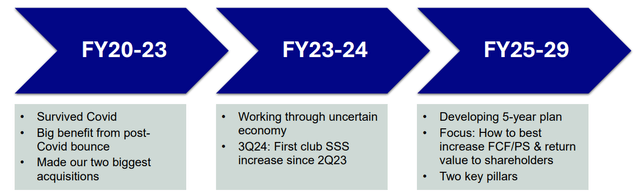

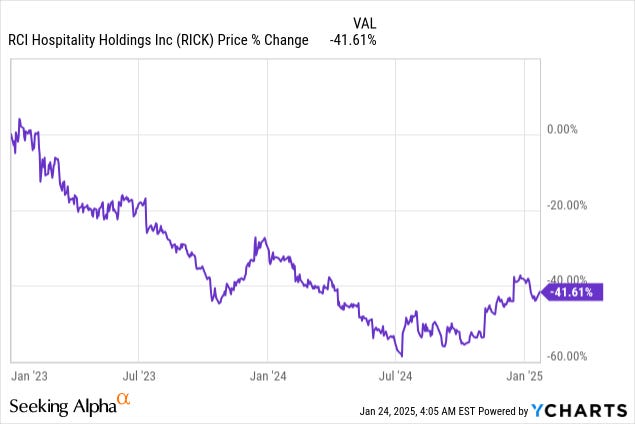

RICK has just gone through a 2-year long bear market, just like most other listed real estate companies. The surge in interest rates hurt their market sentiment and caused their valuations to drop to historically low levels.

But RICK dropped even more than the rest because it also faced some sector and company-specific headwinds. The reopening of the pandemic initially led to a boom in business for clubs as people were getting stimulus checks and wanted to go out and have fun. Moreover, international borders were still closed, leading to more domestic travel to destinations like Miami and NYC were many of RICK's clubs are located. But some of this business wasn't sustainable in the post-covid normalization period and this caused RICK's same-property performance to suffer. This also prevented it from acquiring new clubs because sellers were basing their valuations on those boom years, which weren't sustainable. The high interest rates of course didn't help either.

All in all, it caused its share price to drop from nearly $100 to just $54 today, pricing it at a low multiple of just around 9x its free cash flow:

However, we think that RICK is now about to turn the corner.

Its same-property performance has stabilized with 3 consecutive quarters of positive growth at its clubs. This is a clear sign that the post-covid normalization period is now coming to an end, debunking some of the bears who claimed that clubs were now in a permanent decline. The pandemic simply lead to some bumpiness with an initial surge in business followed by a normalization period. The same happened for a lot of other businesses.

But even importantly, RICK has now finally announced its first club acquisition since October 2022.

Earlier this week, it announced that it would acquire Flight Club, which is one of the leading clubs in the Detroit market, just 5 miles from the Airport.

And the economics of this acquisition are a perfect example of why we like RICK so much.

When you think of a typical REIT, they often acquire properties at a ~7% cap rate, which generally provides a ~100-200 basis point spread above their cost of capital. They raise capital at 5-6% and invest it at 7%. Rinse and repeat.

The potential for value-add is also relatively limited in most cases and the same property growth is mostly a function of the local market and varies depending on the current supply and demand dynamics.

Now compare that to RICK.

It is acquiring the club at $11 million and it is currently generating $2 million of cash flow, which implies that it is getting an ~18% cap rate.

The yield is so much higher because there is a relative lack of buyers for these clubs. There are plenty of investors willing to buy apartment communities, but very few who are willing to buy clubs, yet alone capable of managing them. This relative lack of investor demand puts RICK in a strong position to acquire clubs at low valuations and high yields.

But it gets a lot better.

Firstly, we should note that the $2 million of cash flow is backward looking. This is a property sector with significant value-add potential and historically, RICK has commonly been able to increase the cash flow of its new club acquisitions by about 20% by reducing costs thanks to their large scale, and boosting revenue thanks to their superior marketing, pricing, and system know-how. The CEO of RICK confirmed this in their press release.

Therefore, the forward cash flow yield is likely closer to 22% based on $2.4 million of forward cash flow.

Now, we now need to break down the $11 million purchase price.

RICK is paying $6 million of it in cash and getting a $5 million seller financing note at an 8% interest rate.

So it is really just paying $6 million for the club. The rest is a seller note backed by the club itself, which is put in a special purpose vehicle to limit liability risk.

The annual interest expense is $400k. Adjusted for that, the forward annual cash flow should be around $2 million, resulting in a 33% annual cash-on-cash return. Even if we are conservative and assume that they get zero value-add benefits, they still earn a 27% annual cash-on-cash return based on $1.6 million of annual cash flow.

No other property type offers comparable returns. The returns are only so high because the stigma and managerial difficulties are keeping most potential buyers away from this space. Other property sectors are far more competitive and naturally, this lowers the expected returns.

RICK is the only acquirer of scale with access to public capital and this makes it the buyer of choice for most of these clubs. It gives it a durable competitive advantage to keep consolidating this space, earning exceptional spreads over its cost of capital, and resulting in alpha-rich returns to its shareholders.

Earlier, we said that the average REIT is happy to get a 100-200 basis point spread on its new investments. RICK is getting about a 10x larger spread than that.

Hopefully, this deal will now gets the ball rolling and reset more realistic expectations for club sellers, allowing RICK to go on another acquisition spree in the coming years.

If it does, then 2025-2028 could closely resemble 2020-2023, leading to significant returns for shareholders as cash flow expands and its valuation multiple recovers.

As a reminder, RICK recently set the goal to roughly double its free cash per share over the next 5 years. You can read more about this guidance by clicking here.

Closing Note

RICK's business has earned significant alpha to its shareholders ever since it changed its capital allocation strategy in 2016. However, as you can see in the chart below, the one downside of holding its shares is that it can be highly volatile and will at times go through extended periods of underperformance, testing the patience of its shareholders:

The pandemic, of course, exacerbated this volatility, driving a boom in its business, which was subsequently followed by a normalization period.

Now, we think that RICK is again on the cusp of another acquisition spree, which should significantly expand its cash flow and multiple, leading to a lot more outperformance in the years ahead.

We have significantly reinforced our position at these discounted levels and will remain patient in the years ahead.

On a side note, I may meet Eric Langan, CEO of RCI Hospitality, in March when I visit the US and will then seek to film an exclusive in-person interview for the members of High Yield Landlord. Stay tuned for that.

Finally, please note that we exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.