Farmland Partners Could Be Our Next STAR-Like Success Story

One of our most successful investments of all time has been a REIT called iStar (STAR).

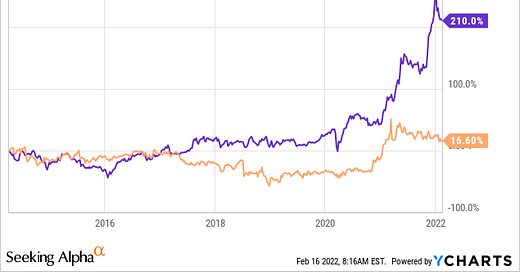

It was the most discussed opportunity at High Yield Landlord back in 2020/2021 with a total of 10 articles, including 3 management interviews. At one point, it was our largest holding, representing over 10% of the total portfolio, partly because it rose from $11 all the way to $25 per share in slightly over one year:

iStar was such an unusually rewarding investment because it was going through a major transformation that the market had missed.

For context, iStar had been a troubled mortgage REIT for most of its history. It had a complex portfolio that was difficult to value, it didn't have a clear direction, and it had a poor track record of value creation. Not surprisingly, the market didn't see much appeal to it and priced it accordingly.

However, behind the curtain, big things were happening. iStar was in the process of reinventing itself as an asset manager focusing on ground leases.

It founded the first publicly-listed ground lease REIT called Safehold (SAFE) and it was a major success. It grew from 0 to nearly $5 billion of assets in just a few years and since iStar was its manager and biggest shareholder, it directly benefited from this success.

Because all of this happened so quickly, the market had failed to recognize the value creation and still saw it as a boring mortgage REIT in late 2020 when in reality, it had become an exciting and rapidly growing ground lease asset manager. The key to our success was simply that we recognized this transformation ahead of the crowd.

We are sharing this background with you because we think that Farmland Partners (FPI) is potentially in a similar situation.

Today, Farmland Partners is perceived by the market as a boring farmland REIT with a troubled past (more on that later) and a lack of growth. As a result, it has priced it at a 20% discount to net asset value.

However, recently, FPI acquired a company called Murray Wise Associates in an effort to become more than just a REIT. Its ambition is to become a one-stop-shop for farmland investing with:

A wholly-owned farmland portfolio (what it currently owns)

Private fund asset management services (new business)

Property management services (new business)

Auctions & Brokerage (new business)

The market today isn't giving any credit to FPI for this proposed transformation, but as we will discuss below, we think that FPI is ideally positioned to grow a sizable asset management business that will be worth a lot of money already in the near future.

Just like iStar a few years ago, FPI is today perceived as an unappealing REIT and it is priced accordingly, but as its fee income from services starts to show, we expect a repricing that will generously reward those who buy ahead of the crowd.

Below, we first give you a quick overview of farmland as an asset class. We then discuss FPI's past and present so that you understand where it came from and what it currently owns. Finally, we discuss why we are so optimistic about the potential value-creation of its transformation.

Farmland as an Asset Class

Farmland has historically generated some of the highest rates of return of all asset classes, and it has done so with the least amount of risk and volatility:

The above returns of farmland are actually underrepresented because they are unleveraged. If you financed a portion of your purchase with a cheap mortgage, you could have done even better.

Farmland has historically been such a rewarding asset class because:

The supply of farmland is limited: We are not making any more of it and some farmland is converted into other uses every year.

The demand is growing rapidly: The global population is rising and just as importantly, the middle class is getting a lot larger, which leads to more consumption.

Yields are improving over time: While the supply of farmland is limited, the yield of the existing high-quality farmland may improve over time thanks to new technologies.

There is no capex: Unlike traditional real estate, the returns that you get from farmland are real. Cap rates may be lower, but you don't lose an important portion of the cash flow in capex/maintenance.

Recession-resilience: Whether the economy is good or bad, we need to eat and there is no alternative to that. Farmland is the only asset class with a 100% occupancy rate.

Warren Buffett sums up the opportunity in a 2014 Berkshire (BRK.B) investor letter that highlights one of his farmland purchases:

"I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop, and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm."

Today, all of this remains true and therefore, we expect farmland to continue generating attractive returns, especially relative to its risk profile.

Of course, we cannot know how farmland will perform in any given year, and future returns may be lower given that valuations have risen, but that's also true for all other asset classes.

If you are patient, use moderate leverage, and buy good farmland that's well-managed, in all likelihood, you will earn good returns in the long run and also enjoy valuable diversification benefits over time.

Despite that, today, most investors still don't invest in farmland and the market is completely unpenetrated.

In most cases, it is the farmers themselves who own the land, which is very capital-inefficient, and the institutional ownership is just 2%.

But this is now starting to change.

Today, the average age of farm owners is 60 years old, and increasingly often, the next generation isn't interested in becoming farmers. This means that a huge number of farmers will likely either decide to sell or rent their land over the coming decade.

This will lead to market consolidation with institutional investors buying the land from smaller retiring farmers and also offering sale-and-leaseback solutions to larger-scale farmers that will need to become more capital-efficient to grow their businesses.

This is a huge opportunity for farmland REITs because we are still early in the institutionalization of farmland as an asset class.

Farmland Partners: The Past

FPI came public in 2014 as one of only two farmland REITs. The other one is Gladstone Land (LAND) and it also had its IPO around the same time.

I remember that both appeared to be exciting opportunities at the time.

They were both set to consolidate a historically unpenetrated but highly rewarding asset class.

However, what happened next was quite surprising.

Gladstone Land (LAND) succeeded, but Farmland Partners (FPI) didn't.

Since 2014, LAND more than tripled its investor's money whereas FPI barely broke even when counting dividends.

This huge disparity in performance is rather exceptional when you consider that both IPOed around the same time and focused on the same asset class.

FPI's underperformance is even more astonishing when you consider that it owned mainly row crops like corn and soybeans, which have historically performed better than permanent crops, which is LAND's main focus.

What went wrong at FPI?

In the early years, it struggles to grow because of three main reasons.

Firstly, it was too small in size at a $100 million market cap and the G&A burden was too significant for a public company focused on a lower-yielding asset class.

Secondly, farmland prices and rents mainly stagnated in the years following its IPO, which hurt its market sentiment.

Finally, the public market simply wasn't ready for farmland. It still needed some education to understand its appeal and as a result, FPI persistently traded at a discounted price that limited its ability to pursue accretive transactions.

That led to stagnation from 2014 to 2018. During this time period, FPI still managed to do one important thing. It resolved its size issue by merging with American Farmland (AFCO), another farmland REIT that at the time faced the same issue.

Just as it was finally ready to gain some traction, FPI was the unfortunate victim of a short attack that caused its share price to crash in 2018 and its market sentiment continues to suffer from it to this day. The stock price dropped by nearly 40% in a single day when the short article was posted:

I say that FPI was the "victim" because the author of that short report later admitted to falsifying information and was forced to retract it and return a multiple of his trading profits to Farmland Partners.

"Mr. Mathews has now acknowledged the defamatory statements contained in his article were false, including unfounded statements that FPI manipulated its publicly filed financial statements, misstated cash flows and ability to cover its dividend, and failed to properly disclose purported related party transactions in the company's audited financial statements. Mr. Mathews also acknowledges the falsity of the article's baseless headline claiming FPI faced a threat of insolvency." You can read the full press release by clicking here.

Today, the share price is already nearly double what it was back then, which shows that the market recognizes that FPI was the victim of a short and distort scheme.

But unfortunately, this short attack also led to a class-action lawsuit that was filed immediately after the article was published and piggybacked on statements of the short report. The author of these statements has admitted that they were wrong, but despite that, the lawsuit carries on, hurts FPI's market sentiment, and costs it a lot of legal expenses.

FPI's CEO explains that this is the most unfair situation he has ever been in and that they will continue to vigorously defend the baseless lawsuit.

Given that they already won their court case against the short-seller, I am optimistic that they will win this one too, but in the meantime, it continues to hurt FPI by eating up its cash flow and discounting its valuation.

A very unfortunate situation to be in and it explains why FPI's share price has done nothing since its IPO, despite the significant land price appreciation. It also explains why LAND outperformed FPI so massively since 2018:

This is the background that you need to understand as you evaluate FPI's present and future.

Farmland Partners: The Present

FPI's poor historic performance may cause a lot of investors to conclude that it is a lower-quality REIT that's poorly managed.

But to the contrary, it has all the characteristics of a superior REIT with a portfolio of high-quality farmland, a strong balance sheet, and a shareholder-friendly management team.

Below we highlight all three to prove our point and then move on to discuss the future of FPI.

Portfolio

Today, FPI's portfolio spans over 160,000 acres of farmland in 16 states and it is estimated to be worth over a billion dollars. As such, it has now reached a size significant enough to enjoy considerable economies of scale in the management, but also competitive advantages in the sourcing and financing of properties and the negotiations with tenants:

Importantly, FPI mainly owns row crop farmland, which is generally worth a lot more than permanent crops for each dollar of rent generated.

If Class A multifamily properties are the blue-chip assets of commercial real estate, then row crop assets are the equivalent for farmland.

They are lower-cap assets that generate highly consistent and predictable cash flow with minimum capex and obsolescence risk. That's unlike permanent crops which may need to be replanted once in a while, causing the yield to suffer a period of time.

Balance Sheet

Historically, FPI has been forced to use more leverage than it really planned to. That's because it had to grow the portfolio to reach a sufficient scale but could not issue equity at a reasonable cost.

The best solution at the time was to take on low-cost mortgages and issue convertible preferred equity, which was also expensive, but still cheaper than common equity at the time.

But recently, FPI converted this preferred equity into common equity at a price that was 45% above what it was at the time of the issuance.

The conversion has pros and cons, but we think that the pros far outweigh the cons. It slightly reduced the NAV per share since the common equity was still priced at a discount, but it greatly expanded FFO per share by removing the 6% preferred yield, and it reinforced the balance sheet for a return to growth going forward.

Right now, the balance sheet is about 60% equity and 40% debt, which is a good mix for high-quality farmland. It's not too much, but it's just enough to boost the growth of its NAV.

Management Team

Finally, despite getting a lot of criticism from frustrated shareholders over the years, the management has done a reasonably good job and proven to be shareholder-friendly.

As noted earlier, they avoided dilutive common equity issuances at most times and instead chose alternative capital sources like preferred equity to grow the company.

Moreover, they bought back a considerable amount of common stock following the short attack, and insiders also made significant additions to their positions.

The CEO is actually the second-largest shareholder, owning $30 million worth of shares, and he has bought more shares every year since the company's IPO. I stop at 2018 because the list would be too long:

Now that they have reached enough scale, they have also taken steps to better educate the market about farmland, which is needed to eventually reach a premium valuation. As an example, they hired Green Street Advisors to produce a Farmland Primer, which you can access by clicking here. This is exactly what VICI Properties (VICI) did for the casino sector and it helped them reach a premium to NAV.

So to recap, despite its turbulent past, FPI is a good REIT with a solid portfolio, a decent balance sheet, and a shareholder-friendly management team. This finally brings us to the most important topic of this article: the future.

Farmland Partners: The Future

We like FPI in its current form. But the main reason for our investment is the belief that it is set to become much more than just a landlord.

Right now, there is unprecedented demand for farmland as an asset class. I know this first-hand because I made an angel investment in a farmland crowdfunding platform called FarmTogether about a year ago. Our multi-million-dollar deals are often filled in a just few hours. In one year, our assets under management went from ~$50 to $175 million, and we could have done a lot more if we wanted to, but we refused to lower our acquisition standards.

Why is there suddenly so much demand for farmland?

Investors are finally getting educated about it after a growing number of legendary investors have made sizable investments in the sector. This includes Bill Gates, who is now the largest farmland owner in the US, Michael Burry of 'The Big Short' who claims to invest a large chunk of his net worth in the asset class, and even Warren Buffett.

Moreover, the fear of inflation, the low interest rates, global uncertainty, and market volatility are also strong reasons for investing in farmland.

It is a safe-haven / portfolio stabilizer that can provide meaningful income and protect against inflation. Right now, inflation is at a 40 year high even as interest rates are exceptionally low, market valuations are high, and volatility is on the rise.

Not surprisingly, this is all driving a lot of demand for farmland and I think that FPI is ideally positioned to capitalize on this demand.

Why do I think that FPI has such great potential as an emerging asset manager?

Last year, FPI launched its first private fund and it quickly scaled it to $53 million of fee-generating assets under management. In my mind, that was the proof-of-concept that FPI needed before expanding aggressively in this space.

Shortly after, they announced that they were acquiring Murray Wise Associates (MWA*) to double down on their efforts to grow an asset management business.

That's a big deal because Murray Wise Associates is run by Murray Wise himself who is commonly referred to as the "father of farmland investing". He wrote one of the best-known books in the field and founded Westchester Group, which is today the largest institutional farmland owner of farmland in the world with $8 billion of assets under management. Murray sold this business years ago to TIAA and that's when Murray Wise Associates was created as a spinoff of Westchester Group's brokerage, auction, and farm management business.

Now, Murray is joining forces with FPI to launch a joint asset management business with the goal of replicating what he already once did with Westchester Group.

I believe that the combination of FPI and MWA creates a formidable platform to build a sizable farmland asset management business.

Together, they have the leading intellectual team for farmland investing with Murray having over 50 years of experience, and Paul Pitman, CEO of FPI, having 30 years of experience in the field. They also own over a billion worth of farmland through FPI, and now through the addition of Murray Wise Associates, they will also have a brokerage, auctioning, and farm management business, which will only increase their penetration in the marketplace and enhance their ability to source new acquisitions opportunities.

Since FPI is a permanent vehicle with over a billion worth of wholly-owned assets, it will also be able to co-invest with its future partners and take a true long-term mindset to align interests. Comparatively, the few competitors that they have don't enjoy the same amount of experience, scale, servicing capabilities, or ability to co-invest permanent capital.

I think that sets FPI apart as a future leading asset manager in the farmland sector. Interestingly, FPI has entered into an incentive compensation plan with Murray and some key employees, the receipt of which is tied to achieving certain profitability and AUM objectives within three years after the closing of the deal.

That clearly tells you what's the goal and I think that the future value creation could be very substantial. That's because asset management businesses that focus on farmland can be exceptionally attractive.

What makes Farmland an ideal asset class to grow an asset management business?

As we explain in a recent article: not all asset management businesses are created equal. Some asset classes are highly competitive and lack pricing power. Think for instance about passive equity strategies such as those offered by Vanguard and BlackRock (BLK). It is not particularly demanding to offer such services and the fees reflect that. The expense ratio on the SPDR S&P 500 Trust ETF (SPY) is just 0.09%.

To justify higher fees, you need to operate in an investment segment that's more complex, less competitive, and yet, still very desirable for investors. In other words, you need to offer something special to have pricing power.

Secondly, some asset classes are declining in popularity due to their poor risk-to-reward prospects going forward. To give you an example, if you specialize in Treasury bonds, it will be tough to convince investors to pay for your services in a world of ultra-low rates and high inflation.

Then some asset classes are also more liquid than others and this may impact the term of your fund. As an example, if you manage an ETF, your investors can come and go at any time, resulting in less consistent fee income. On the flip side, if you own illiquid assets and your fund has a multi-year lock-up, your fee income will be very sticky.

So all these things need to be taken into account as you evaluate asset management businesses. Ideally, you would want to have:

Strong pricing power in fees

Long terms so that the fees are consistent and predictable

Rapid AUM growth from the lack of competition but growing demand

Low management intensity due to the passive nature of the investments

And farmland is a perfect example of that.

There are few asset managers that specialize in farmland, and yet, it is a very strong asset class that's growing in popularity, particularly in today's highly volatile, inflationary, low yield world. As a result, the existing players have relatively strong pricing power in terms of fees.

To give you an example, FPI charges a 0.85% annual asset management fee on the first fund that it launched last year.

That may not seem particularly high and it isn't for what the investors are getting, but here you need to consider that the assets are fairly passive, require little attention from FPI's team, and the terms are very long.

Once the fund is set up and the land is purchased, FPI collects the rent checks, makes distributions to investors, but beyond that, the assets don't require much work from them. There are no leaking roofs and vacancies are extremely rare. Put differently, the management intensity is very low. Moreover, the terms for farmland investment vehicles are typically very long at 10+ years and therefore, asset managers like FPI can expect to earn steady fee income with little needed work for a long time to come.

With that in mind, the 0.85% AUM fee becomes very compelling because it is high margin and it scales very well.

FPI has done this with $53 million already as a test run, and now it will double down with the integration of MWA to its platform.

If they can replicate that with billions of capital, which I think they will, the value creation could be very substantial in the coming years. You don't need to do detailed modeling to understand that a 0.5-1% AUM fee on billions of capital could be massive.

That's especially true because the market is still completely missing this part of the story and as a result, it is giving zero value for what could soon be a valuable business. This brings us to the valuation section:

Farmland Priced at a Discount.

Asset Management Business Given for Free.

The market today still sees FPI as a boring farmland REIT with limited growth, a small dividend, and a shaky past. As a result, it is priced at an estimated 20% discount to NAV. That valuation would make sense if FPI was poorly-managed, but clearly, that's not the case and therefore, the discount isn't justified.

That's particularly true since farmland is such a hot asset class right now. Gladstone Land (LAND), the only peer of FPI, is currently priced at a 100%+ premium to its NAV. That's a massive discrepancy and you could easily make the argument that FPI has better assets (mainly row crop), superior management (internally-managed), and a superior growth strategy (becoming a one-stop-shop).

What are the catalysts to unlock value?

A big one would be the resolution of the lawsuit that we highlighted earlier in the article. That alone should go a long way in closing the gap and repricing FPI at a materially higher level.

But beyond that, I think that the transformation into a one-stop-shop with a substantial asset management component will create the most long-term value for shareholders.

Today, we are still very early in this transformation and therefore, the market isn't even recognizing it, but as they begin to scale their AUM in the near term, the perception of FPI could change rapidly as it becomes more similar to a Brookfield or Blackstone type company.

That's why FPI reminds me so much of what iStar was a few years back. The market saw it as a troubled mortgage REIT with a questionable past, but as STAR went into the asset management business, and scaled its ground lease vehicle, the market eventually recognized the value creation, and its share price exploded to the upside. We more than doubled our money on that investment in just one year:

Could FPI be our next STAR-like investment?

I believe so and that's why I have built a position in the company.

Of course, there are differences between STAR and FPI, but the similarities are significant:

Asset management transformation with rapid AUM growth potential

Pioneering a new emerging asset class with high demand

Unpenetrated niche with little competition

High insider ownership

Outspoken CEO

Troubled past

Small cap

Discount to NAV

Buybacks

Low yield

Etc.

The good news is that today, the market is literally giving zero value to the asset management business. The share price is actually down 10% since they announced this transformation.

So essentially, how I see FPI is that we are buying an interest in a portfolio of farmland at a 20% discount that should reprice at a large premium once the legal matters are resolved, and we are also getting the asset management business for free.

This asset management business is today still fairly small, but 2-3 years from now, it could already be substantial and the market is not yet paying any attention to it.

While we wait for this growth to occur, the farmland that we own also continues to appreciate and since FPI is leveraged, the impact on its equity value is exponential. Dane Bowler has previously noted that 5% appreciation is farmland results in 10%+ upside in its NAV because of how its balance sheet is structured.

This is not a dividend investment by any means, but there is also a small 2% dividend yield while you wait, and the management continues to buy back shares to force value accretion.

Risks

The biggest risk in FPI is the legal side. We are optimistic that the lawsuit will have a positive outcome given that it is based mainly on statements made by a short-seller that admitted his wrong-doing. But I could be wrong and the lawsuit could also drag on for much longer than expected. This would continue to drain a portion of the company's resources, slowing down its growth, and potentially delaying the value recognition.

The flip side of things is that this may give us a longer window of opportunity to accumulate a larger position before the ultimate repricing. Therefore, this could really turn out to be a blessing in disguise if you buy into the thesis and have a long-term orientation.

Bottom Line

Some of my favorite businesses are asset management companies. If you are able to convince investors to invest with you, then it can be a very profitable, capital-light business that generates sticky earnings and enjoys rapid growth potential as you scale your assets under management.

I think that FPI is set to build what could become one of the biggest asset management businesses in the farmland sector, but the market still hasn't recognized that and priced at a 20% discount to NAV, the risk-to-reward is particularly compelling.

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.