Earnings Update: Retail REITs (Q3 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on December 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Retail REITs (Q3 2024)

In our last Earnings Update For Retail REITs (Q2 2024), we explained why retail real estate is so positively positioned right now.

In short, while there was a resurgence of in-person shopping after the pandemic, there was never any significant pickup in construction of new retail centers (unlike other hot sectors of commercial real estate like multifamily and industrial).

Ultra-high construction costs combined with still-depressed rent rates due to a decade of oversupply and low rent growth make for poor development returns. Developers just can't make most new construction pencil out.

As you can see, all types of retail space have seen falling deliveries over the last 7-8 years:

In Q3 2024, deliveries of retail space totaled about 4.3 million square feet across the nation, the lowest level in over a decade.

With interest rates still elevated and construction costs continuing to rise, we aren't likely to see a rebound in retail development anytime soon.

As CBRE put it:

Construction will break when there is a clearer equilibrium between rents and development costs – and we’re simply not there yet.

Meanwhile, demand from retailers remains strong.

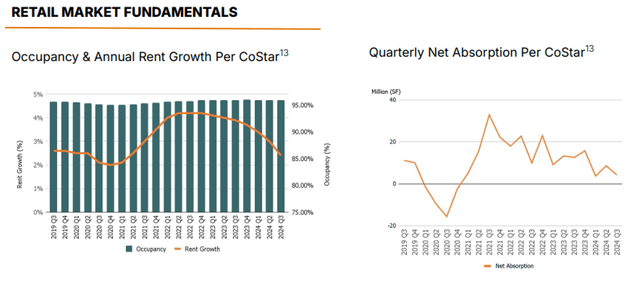

Net absorption has been positive for 15 consecutive quarters, and it has been sliding over the past few years simply due to the scarcity of available space for lease.

The dark occupancy bars in the chart above on the left make it difficult to see the fluctuations in retail occupancy over the last several years, so let's zoom out and look specifically at shopping center REIT occupancy rates.

Since 2010, shopping center REIT occupancies rose in the first half of the 2010s, fell in the second half, then made a resurgence in the 2020s.

The "retail apocalypse" trend of net store closures and falling occupancy reached its crescendo in 2020, as COVID-19 killed a final wave of struggling retailers.

Since then, however, physical retail sales have made a striking resurgence, and occupancy rates have soared higher.

The few areas of retail experiencing weakness and store closures don't leave long-lasting vacancies in their wake. Instead, vacancies are quickly backfilled at double-digit rent growth rates.

For example, probably the most conspicuous area of retail suffering weakness and store closures right now is the pharmacy space. But as CBRE shows in the image below, there are plenty of retailers expanding their store count and looking for exactly the square footage that pharmacies average.

When demand outpaces supply, the result is predictable: the price increases.

In this case, the price is the rent rate.

Since Q4 2021, retail rent growth has been consistently above its long-term average on a year-over-year basis:

Outside of a short period of time in 2016, retail rent growth remains its strongest in over a decade.

And as we have mentioned several times in previous earnings updates, the Sunbelt region of the US remains the strongest area for rent growth, given that it has experienced the greatest level of population growth even while supply growth has been fairly muted.

As you can see, 8 of the top 10 major metro markets for rent growth are located in the Sunbelt.

Phoenix and Las Vegas have benefited from out-migration from California, while the Southeastern states like Florida, Georgia, Tennessee, and the Carolinas have benefited from population flows from the Northeast. Meanwhile, Texas has boasted steady, above-average population growth for many years due to its business-friendly environment and lack of state income tax.

This is good news for our largest shopping center REIT investment, Whitestone REIT (WSR), which exclusively owns shopping centers in Sunbelt markets.

Let's now turn to our five retail REITs' Q3 2024 earnings results: