Earnings Update: Retail REITs (Q2 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on August 7th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Retail REITs (Q2 2024)

Summary:

We downgraded FRT to a Hold rating.

We downgraded REG to a Hold rating.

We downgraded SPG to a Hold rating.

We will consider selling FRT and REG if we can identify similar, but higher yielding opportunities.

We are considering to sell SPG to double down on MAC.

WSR remains our Top Pick in this sector.

-----------------------------------------------------------------------------

Retail remains arguably the strongest sector of commercial real estate right now for two basic reasons:

Demand from tenants has greatly rebounded since the depths of "retail apocalypse" store closures during COVID-19 in 2020.

Supply of new retail space remains extremely limited.

This is a fantastic combination for landlords. When demand outweighs supply, landlords are able to push rent rates higher, reduce rent concessions and tenant improvement (buildout) costs, and remerchandise centers with higher quality tenants.

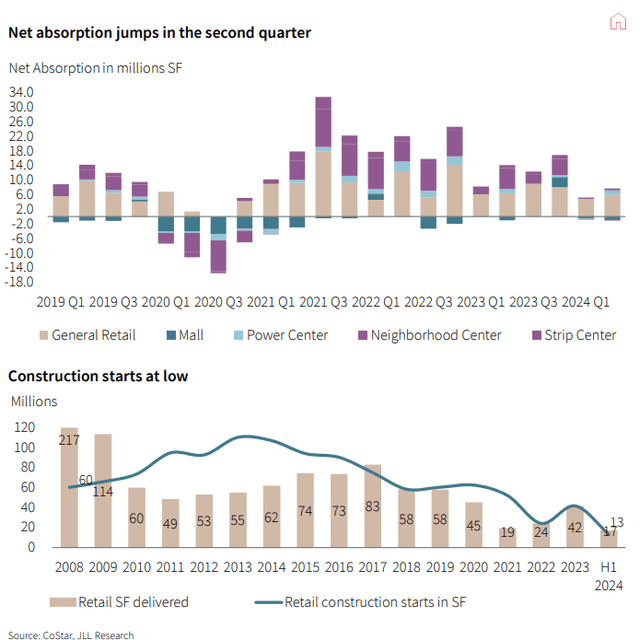

According to a Colliers retail report for Q2 2024, retail net absorption reached 7.2 million square feet in the second quarter, while the JLL retail report for Q2 2024 puts net absorption a little higher at 7.7 million square feet. That "net" number includes about 6.5 million square feet of newly delivered space during the quarter, according to Colliers.

And unlike most other sectors of CRE, retail never saw a surge in new supply following the pandemic. There is still no swell in new projects.

Quoting JLL:

Construction starts are at a record low, and availability is 210 basis points below its historical average of 6.8%. There is no immediate hope for relief, as higher construction and financing costs are dissuading developers from green-lighting new projects. Landlords are wielding much greater pricing power, often holding firm in rent negotiations.

Here are a few charts that are worth a thousand words:

It is remarkable that the strength in retail has not spurred a rise in construction in this space. This speaks to the degree to which high construction costs, high financing costs, and relatively low rent rates make most new projects unfeasible. Retail rent rates have a lot higher to go before new construction becomes attractive.

You might think based on the first chart that retail tenant demand is losing steam based on lower net absorption numbers, but keep in mind that there is very little space available to lease, especially in shopping centers.

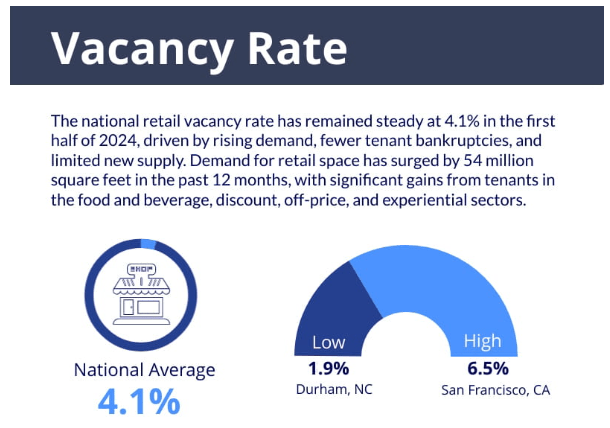

While JLL puts the availability rate (vacancy plus sublease space) at 6.8%, Colliers puts the plain vacancy rate at 4.1%, which is its lowest level in decades.

With such little vacancy and new deliveries of supply, net absorption has to decline almost by definition.

Moreover, the retail supply situation is even more favorable to multi-tenant retail than single-tenant, typically net lease retail properties.

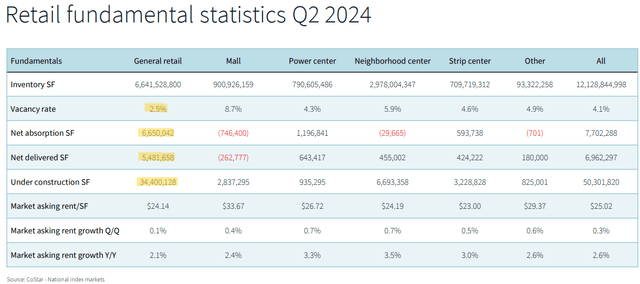

As you can see below, what JLL calls "general retail" (mostly freestanding properties) has seen the vast majority of both new supply and net absorption.

Shopping centers, especially power centers (with multiple big box spaces) and strip centers (single-anchor centers with many small shop spaces), have much smaller new competition from development pipelines.

As such, shopping centers are enjoying the fastest YoY growth in market rent rates with all types of centers averaging over 3%.

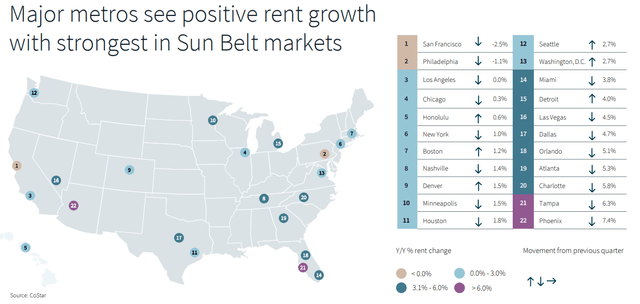

And once again, JLL reports that in Q2 2024, the vast majority of markets showing the fastest rent growth are located in the Sunbelt, with Phoenix and Tampa particularly strong:

This is great news for Whitestone REIT (WSR), our top pick in the shopping center space, because its largest market by total rent is Phoenix. WSR's Texas markets of DFW, Houston, Austin, and San Antonio likewise boast above-average rent growth.

With the preceding backdrop, let's now turn to the Q2 2024 earnings results of our 5 retail REITs:

Federal Realty Trust (FRT): click here for our investment thesis

Regency Centers (REG): click here for our investment thesis

Whitestone REIT (WSR): click here for our investment thesis

Simon Property Group (SPG): click here for our investment thesis

Macerich (MAC): click here for our investment thesis

Afterward, we'll look at which makes the best buy today.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.