Earnings Update: Residential REITs (Q2 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on August 7th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Residential REITs (Q2 2024)

To recap our thesis from Earnings Update: Residential REITs (Q1 2024), the current historically large growth in supply of multifamily housing this year is not enough to change the long-term housing shortage, even though it is enough to pressure rent growth and occupancy rates in the short-term.

The big increase in home prices and mortgage rates over the last several years has significantly increased homebuying unaffordability.

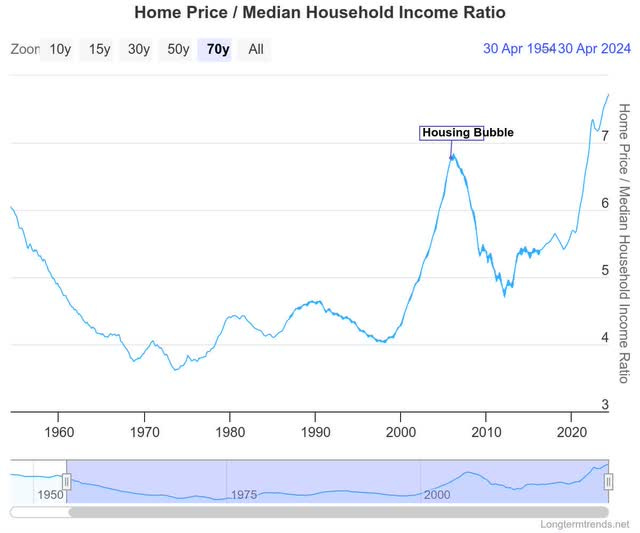

In fact, the average home price to median household income ratio is at a record high -- almost 15% higher than the peak of the housing bubble in the mid-2000s.

Now, we are not suggesting that the housing market is in a bubble.

In some ways, housing unaffordability is occurring today for the opposite reasons as during the housing bubble.

In the mid-2000s, homebuilders were building tons of homes, banks were lending liberally, homeownership was rising across the population (including a lot of people who really couldn't afford homes), housing sales/turnover was high, and sentiment was euphoric.

Today, single-family home starts are at a four-year (COVID-era) low, mortgage rates are high and lending restrictive, the homeownership rate has been flat the last three years, home sales transactions are at their lowest levels since the GFC, and sentiment is low.

These differences make a crash in home prices highly unlikely today, which in turn means that homebuying affordability is likely to remain low.

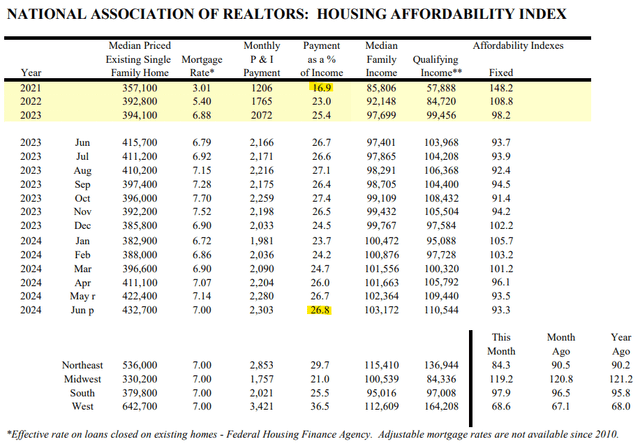

The National Association of Realtors shows an astounding 10-point jump in monthly principal & interest payments as a percentage of the median household income over the last three years.

While P&I made up ~27% of total income in June, it was about 30% of take-home pay (after payroll taxes).

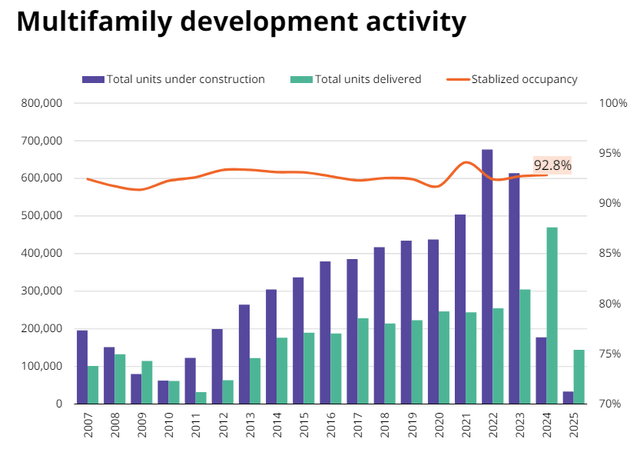

Meanwhile, here's how the supply conditions look on the multifamily side:

As you can see, we are currently in the midst of the biggest year of multifamily deliveries in 50 years.

Next year, however, we are expected to get the lowest level of multifamily deliveries since 2013.

More good news is that since homebuying affordability is so low, absorption of multifamily units is high right now. According to Avison Young, multifamily absorption in the first half of 2024 was its highest level since peak apartment demand in 2021.

So, while multifamily REITs (especially Sunbelt-focused ones) are showing a slowdown this year, we remain highly optimistic about their outlook for the next several years.

The structural housing shortage remains, which benefits the fundamentals of the whole spectrum of residential REITs, from multifamily to single-family rentals to manufactured housing.

With that said, let's take a look at the Q2 2024 results of our 6 residential REITs:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.