Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Residential REITs (Q3 2024)

The American Dream has always included owning a home. But, of course, the more people own homes, the fewer people there are in the rental market.

Unfortunately for would-be homeowners but fortunately for landlords, homebuying affordability has scarcely ever been lower than it is today, and the outlook does not appear any better.

Here's how we summarized the housing market in our last Earnings Update For Residential REITs (Q2 2024):

Today, single-family home starts are at a four-year (COVID-era) low, mortgage rates are high and lending restrictive, the homeownership rate has been flat the last three years, home sales transactions are at their lowest levels since the GFC, and sentiment is low.

These differences make a crash in home prices highly unlikely today, which in turn means that homebuying affordability is likely to remain low.

There are multiple ways to measure homebuying affordability. The most common is to use some variation of home prices to household income.

Right now, the home price to income ratio sits near an all-time high -- even higher than the peak of the housing bubble in the mid-2000s:

No, we do not think the US housing market is in a bubble today.

In the mid-2000s, a housing bubble inflated despite rapid growth in the supply of housing because of the ultra-loose homebuying conditions and the government's push to increase the homeownership rate.

Today, houses have become largely unaffordability because of a decade of underbuilding combined with elevated levels of demand from wealthy Baby Boomers and the Millennial generation reaching their prime single-family home years of life.

There was a short burst of elevated construction in the wake of the pandemic, mostly in multifamily housing (apartments), but that was not enough to overcome a decade of underbuilding.

Moreover, the number of housing units in the construction pipeline is falling rapidly as housing starts recede back to pre-COVID levels.

Home prices are not falling.

Mortgage rates are staying stubbornly high (at least for now).

The growth in supply of new homes is about to start declining.

And with interest rates still elevated and apartment rent rates still flat, development of new multifamily housing is not rebounding.

Deliveries of new multifamily housing are projected to plunge over the next few years:

All of these factors combine to make for a very attractive setup for residential REITs over the next few years.

Moreover, as the supply side improves, the demand side is also improving.

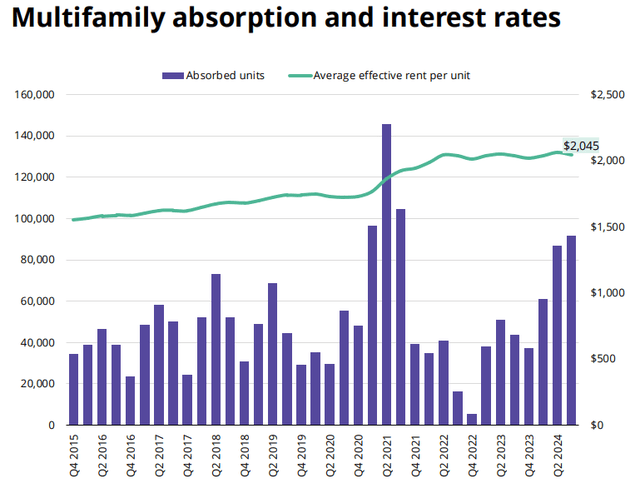

While average effective rents have flattened out over the last few years as supply is absorbed, this is actually a better situation than many feared. Some forecasters thought that a 50-year high in multifamily supply deliveries would cause effective rent rates to meaningfully dip. That hasn't happened, because apartment absorption (new + renewal leases signed) has made a resurgence:

What is behind the resurgence in apartment absorption this year?

One factor is the rebound in legal immigration as the government works through the elevated COVID-era backlogs. But another, perhaps more significant, factor is the halt in Millennials buying homes.

Between 2015 and 2019, when mortgage rates hovered around 4%, Millennial homeownership increased at an average pace of 2.2% per year. But as mortgage rates surged along with inflation in the wake of the pandemic, Millennia homeownership has basically ground to a halt. From 2020 through 2024, Millennial homeownership increased an annual pace of 0.6%. From 2023 to 2024, almost no Millennial renters became homeowners.

Millennials being basically locked out of the housing market (if they don't already own homes or have wealthy family members) has created huge demand for apartments.

With that attractive backdrop for residential REITs in mind, let's now take a look at the Q3 2024 results for our 6 US REITs in this sector:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.