Earnings Update: Residential REITs (Q1 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 3rd, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Residential REITs (Q1 2024)

As we presented in Earnings Report: Residential REITs (Q4 2023), our thesis is that after the current wave of new supply is absorbed over the next year or so, the U.S. will return to its previous state of structural housing shortage.

That is, while the surge of supply we are experiencing right now eases the underlying housing shortage for a year or two, it is not enough to cure the shortage.

Immigration levels have strongly rebounded from their COVID-era lows, total is near record highs, mortgage rates hover near 7%, and home prices continue to rise.

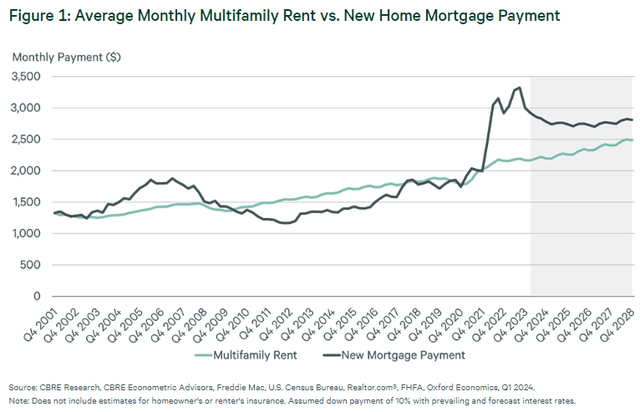

The combination of these factors has resulted in a major market shift. During the 2010s, the monthly cost of buying a home via mortgage financing was consistently cheaper than renting. From 2022 through at least 2028, though, the cost of homebuying is expected to remain much higher than the cost of renting.

Either mortgage rates or home prices would have to decline considerably from here to change these conditions.

This is ultimately why we view the current supply headwind as temporary.

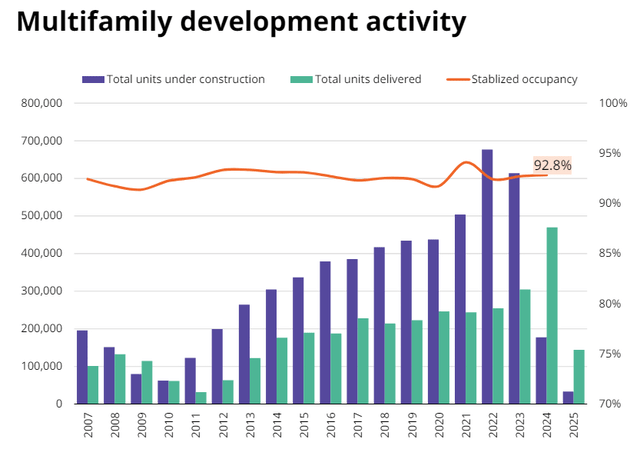

The elevated multifamily construction pipeline does look intimidating, especially seeing the big spike in deliveries reaching the market this year.

But note that due to higher interest rates and construction costs as well as the end of the post-COVID rent surge, construction has totally collapsed. Deliveries in 2025 are expected to fall some 70% from 2024's level, and this decline in deliveries should extend even further into 2026.

Thus, in 2025-2026, there will be a dearth of brand-new apartments coming online and attracting the highest quality renters. Assuming renter demand remains fairly steady, this situation should give landlords ample space to push rents.

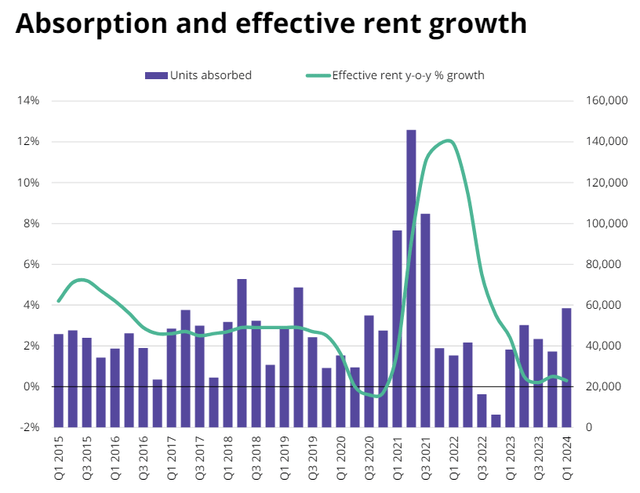

Renter demand certainly remains strong as of today. In Q1 2024, multifamily absorption (units leased) came in stronger than anytime in over 2 years.

Meanwhile, the nationwide average effective rent growth remains anemic, though slightly positive, because of the sheer magnitude of new units being delivered.

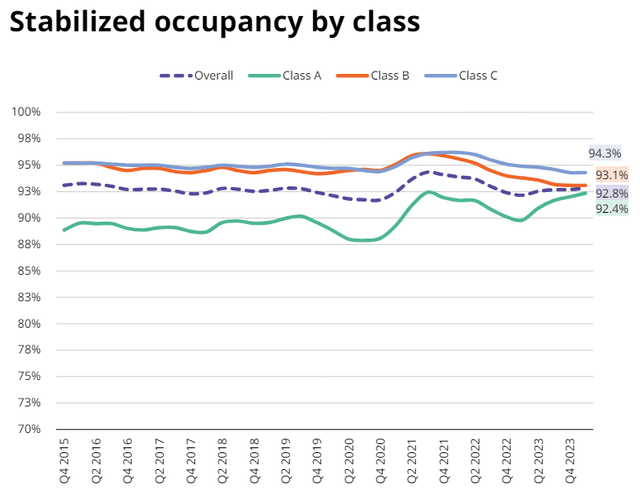

Despite the bulk of new deliveries being Class A (almost by definition), occupancy of Class A apartments has rebounded back to its Q3 2021 high, likely as a result of would-be homebuyers remaining stuck in the rental market for longer than they otherwise would be.

Meanwhile, elevated rent concessions at new Class A communities have allowed many Class B renters to move into newer, nicer Class A apartments.

These factors have narrowed the spread in occupancy between Class A and B apartments, but Class B does continue to maintain higher occupancy.

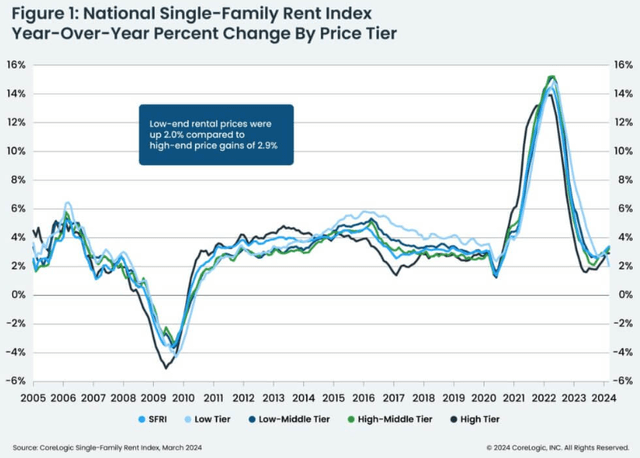

Turning to the single-family rental ("SFR") market, though we currently do not own any SFR REITs, we will note here that as of March 2024 (CoreLogic's most recently reported data), SFR rent growth is rebounding back toward its pre-COVID average of 3-4%.

The middle-priced tiers are performing slightly better than either the lowest or highest tiers.

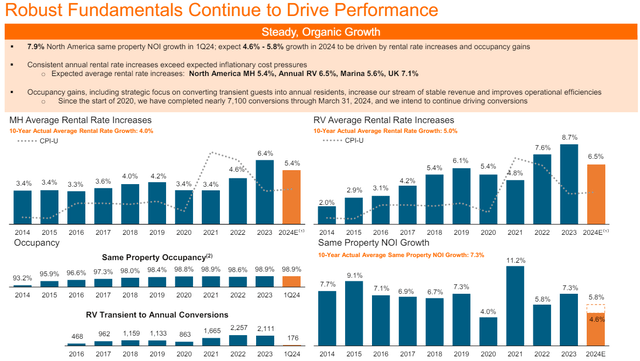

As for mobile homes/manufactured housing and RV spaces, rent growth remain steady and higher than their pre-pandemic average.

The wave of retirements over the past several years have resulted in a large number of MH renters and "van life" nomads creating demand for Sun Communities' (SUI) real estate.

So, in short, while the big surge in apartment deliveries renders a headwind for multifamily over the next year or so, the rest of the residential rental space shows the housing market returning to the pre-COVID housing shortage. Sometime next year (depending on the level of deliveries in each respective market), multifamily should also begin to show signs that the housing shortage has returned.

With that said, let's take a look at the Q1 2024 results of our 6 residential REITs:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.