Earnings Update: Net Lease REITs (Q1 2024)

We love the net lease model. It provides lots of benefits to the landlord/investor.

Long lease terms typically 10-20 years in length (plus multiple 5-year optional extension periods) provide high revenue and cash flow stability and predictability.

Tenants are typically responsible for all or most property expenses such as maintenance, insurance, and real estate taxes. This protects the landlord/investor from inflationary operating expense increases.

Contractual rent increases typically range from 1-3% annually, depending on the tenant and property type. This provides some organic NOI growth.

Smartly locking in long-term debt can drastically reduce refinancing risk.

You might think that this form of real estate ownership sounds more like an asset-backed corporate bond rather than a traditional operating property. And in many ways, that is true. On a fundamental basis, net lease is the closest thing to a corporate bond in the real estate space.

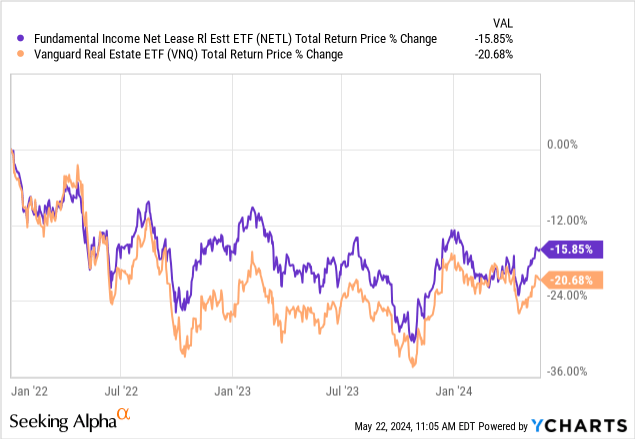

Although net leases themselves are arguably the closest things to bonds in real estate, net lease REITs (NETL) do not trade any more like bond proxies than the rest of the real estate sector (VNQ).

Since the beginning of 2022, when interest rates rapidly rose off a very low base, net lease REITs have slightly outperformed the real estate sector as a whole.

While this is a bit surprising on its face, we think there are a few rational reasons why net lease REITs have performed slightly better than the rest of real estate:

Net lease REITs tend not to trade at very high FFO multiples. Generally speaking, highly valued REITs (in terms of high multiples) have sold off the most amid rising interest rates.

Most net lease REITs have smartly structured their balance sheets to insulate themselves as much as possible from higher interest rates. Generally speaking, the REITs with weaker balance sheets (near-term maturities, floating rate debt, etc.) have sold off more than REITs with stronger balance sheets.

For these reasons, net lease REITs tend to handle rising rate environments fairly well.

At the same time, if and when rates sustainably decline, net lease REITs should disproportionately benefit. Lower rates means a lower cost of capital. Since net lease REITs are more reliant than the average REIT on growth via acquisitions funded by capital raising, lower rates / lower cost of capital should disproportionately benefit them.

This leads to another reason we love net lease REITs: They play defense well during rising rate environments, and they play offense well during falling rate environments.

With that said, let's get to the Q1 2024 earnings results for our 7 net lease REITs.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.