Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

Whitestone REIT (WSR)

Easterly Government Properties (DEA)

NewLake Capital Partners (NLCP)

Let me know if you have any questions for them and I will make sure to ask them for you. You can put you questions in the comment section below.

Thanks!

=============================

Earnings Update: Industrial REITs (Q2 2024)

On Wednesday, July 24th, Lineage Logistics (LINE) became the newest REIT to go public on a US exchange, raising $4.4 billion in their IPO.

LINE owns temperature-controlled warehouses similar to those owned and operated by Americold Realty (COLD), its closest peer.

While it is good to see a new REIT see the light of day, we are waiting to get more information about LINE before making a decision to buy it, avoid it, or put it on the watchlist.

In the meantime, let's take a look at where the industrial real estate market sits today.

While tenant demand is receding after the tidal wave of industrial leasing seen during COVID-19, the pipeline of industrial construction is also shrinking.

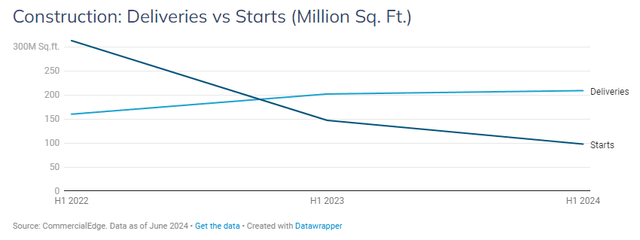

According to CommercialEdge's July industrial report, the industrial development pipeline has declined now for 6 straight quarters. To quote the report: "More than 1.1 billion square feet began construction between 2021 and 2022, but starts fell to 357.5 million last year."

Starts in the first half of 2024 are about 1/3rd the level seen in the first half of 2022 and down 50% from the first half of 2023.

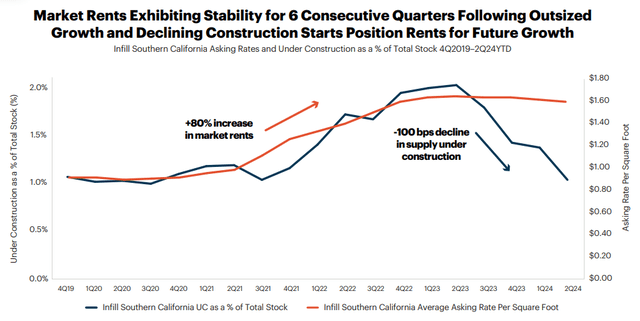

This decline in industrial construction is broad-based across the country, including the extraordinarily supply-constrained market of Southern California.

Here's a slide from Rexford Industrial's (REXR) most recent presentation:

So while deliveries are elevated this year, new supply of industrial space will decline considerably in 2025 and 2026.

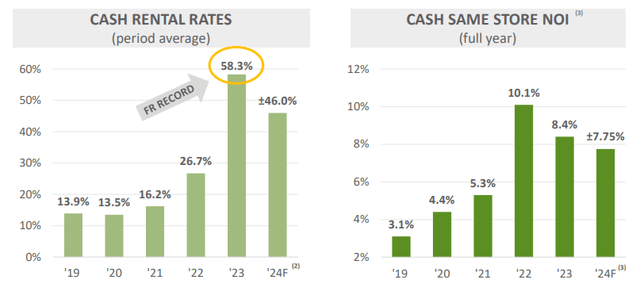

Over the last several years up to today, you can see the mismatch of supply and demand play out in the cash rent and NOI growth of one of our newer holdings, First Industrial Realty (FR).

As demand dramatically outpaced supply in 2022-2023, rent and NOI growth surged. But as demand recedes and a wave of supply comes online this year, growth rates are understandably slowing.

And while tenant demand for space has cooled this year, construction of manufacturing facilities in the semiconductor, battery, and EV industries is expected to provide another wave of demand over the balance of this decade.

Thus, we believe the current rise in industrial vacancy rates will be a temporary phenomenon. "Temporary" may mean another 3-4 quarters, but in our view, the long-term supply-demand outlook remains favorable.

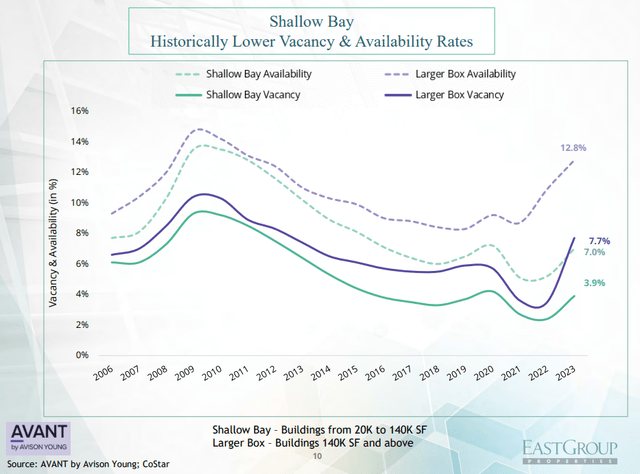

Moreover, it should be noted that all three of our industrial REITs primarily focus on small-format, infill facilities with average space sizes around 25,000 to 50,000 square feet. The industrial format suffering higher vacancy rates in today's environment is big box buildings typically located outside of population centers.

Smaller format (or "shallow bay") industrial buildings enjoy better locations, higher barriers to entry, and greater mission-criticality for their tenants.

Best of all, given 5-10 year leases, the leases scheduled to expire over the next few years offer mark-to-market (upside to market rent rates) of 40-60%. In other words, even if market rent rates stay flat or even slightly decline, these REITs will continue to enjoy cash rent growth rates of 40%+ on leasing activity over the next year or two.

Keep that in mind when you see the valuations of industrial REITs. A 20x FFO multiple may sound high, but if you adjust for below-market in-place rents that will be marked to market in the coming years, the forward FFO multiples decline considerably to 15x or even lower.

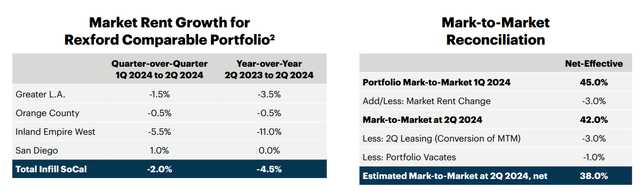

REXR's stock price has seen the worst performance recently because market rent rates have been declining in Southern California, bringing its mark-to-market from 45% at the end of Q1 to 38% at the end of Q2.

But keep in mind that given Southern California's extremely supply-constrained market, a rebound in demand would automatically translate into market rent growth.

With that said, let's get to the Q2 2024 results of our three industrial REITs. In the end, we also discuss which one we believe to be the best opportunity right now.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.