Earnings Update: Healthcare REITs (Q4 2024)

The United States spends about 17% of GDP on healthcare, which is about 4-6 percentage points higher than the next highest developed nations.

Many Americans are dissatisfied with our healthcare system (Gallup polling shows satisfaction with the US healthcare system at a 24-year low), but for better or worse, the system is unlikely to be fundamentally overhauled anytime soon.

The House of Representatives recently passed a budget framework that calls for $880 billion in spending cuts (over 10 years) that are likely to come from Medicaid. That could ultimately have an impact on healthcare real estate, as Medicaid is the primary funding source for an array of patients and types of care.

In particular, Medicaid covers a large portion of long-term care, which flows to senior housing and nursing homes.

To be clear, the Senate still has to pass a budget, and the Wall Street Journal reports that Senate Republicans are likely to modify the framework to some degree. Once the Senate passes their own version, it will then get passed back to the House for another vote.

Even if Medicaid cuts pass in both chambers of Congress, keep in mind that $880 billion over a 10-year period amounts to only about 10% of total Medicaid spending.

To the degree that Medicaid cuts do pass, they are likely to be concentrated among the able-bodied adult population, rather than low-income parents/children and long-term care.

Omega Healthcare's (OHI) SVP of Operations, Megan Krull, expressed confidence on the REIT's Q4 conference call that if any Medicaid cuts are passed, they are most likely to pertain to Medicaid expansion that covers non-elderly adults.

About 1/3rd of all Medicaid spending is for long-term care. Another roughly 1/3rd goes to non-elderly adults, mostly the disabled. Another ~15% goes to children.

A roughly 10% cut to Medicaid spending could slightly reduce patient demand at hospitals (which receive about 1/3rd of total Medicaid spending), especially in low-income and rural areas, but would likely be minimally felt in all other areas of healthcare.

We remain highly bullish on healthcare real estate as a long-term investment, especially the senior housing/care and medical outpatient sub-sectors.

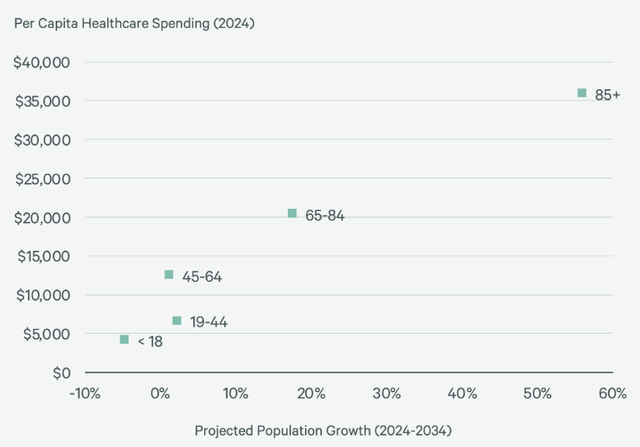

The old-age population is projected to grow rapidly in the coming decades, and this group accounts for the vast majority of healthcare spending.

This spending on care for older patients is spread across the healthcare spectrum, from hospitals to outpatient offices to long-term care facilities. And, of course, older people also exhibit the highest demand for pharmaceutical products, which in turn should translate into solid demand for life science lab space.

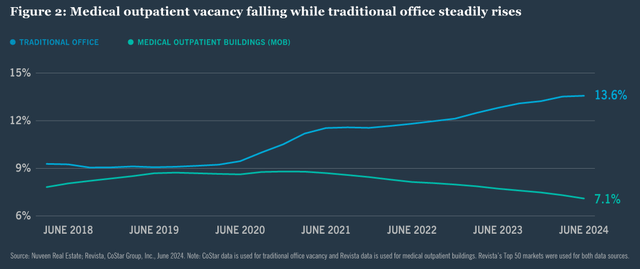

One of the biggest trends in healthcare real estate over the last decade or so has been the shift in care from hospitals to outpatient settings. This trend continues.

Meanwhile, across the healthcare real estate spectrum, construction starts remain extremely limited, as the combination of financing and construction costs make new projects untenable.

Combined with strong growth in tenant demand, this should result in a multi-year period of occupancy and rent growth for all forms of healthcare real estate.

With that, let's turn to the Q4 2024 results for our four US healthcare REITs:

Alexandria Real Estate (ARE): click here for our investment thesis

Healthcare Realty Trust (HR): click here for our investment thesis

Medical Properties Trust (MPW): click here for our investment thesis

Sila Realty Trust (SILA): click here for our investment thesis

Afterward, as usual, we'll ask which one makes the best buy today.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.