Earnings Update: Healthcare REITs (Q2 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on August 7th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Healthcare REITs (Q2 2024)

The U.S. healthcare sector offers fantastic opportunities but is also riddled with unique risks for private business.

The sector is a Frankenstein-esque mishmash of major government programs, subsidies, insurance companies, state-based insurance markets, non-profit health systems, non-profit health ministries, for-profit providers, the Veterans Affairs health system, employers who facilitate insurance, and patients.

If one were to ask whether the US has a centrally managed system or a free-market system, the answer would be: Yes.

Then again, maybe the answer would be no, it's neither centrally managed nor free market. It's rather a complicated mutation of the two.

Healthcare real estate owners are right in the middle of this mix. Though landlords generally do not need to involve themselves in all of these complexities, their tenants usually do.

For example, hospital operators have to maintain huge administrative infrastructure in order to negotiate with third-party payers and chase down customer bill payments.

Likewise, in the senior care space, there is often a mix of payers from government programs to out-of-pocket patient-residents. The government payers can certainly make or break the profitability of certain providers/tenants.

The two safest types of healthcare tenants would be (1) major health systems occupying medical offices or hospitals and (2) large pharmaceutical companies occupying a life science R&D facility. With safety, though, comes high property values and low cap rates.

Another issue healthcare providers have to deal with is labor. Healthcare is mainly a service industry, and like most services, it is heavily dependent on workers.

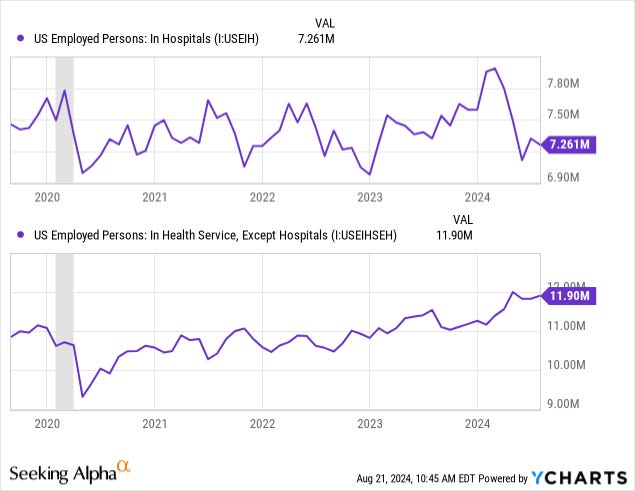

One of the problems continuing to plague hospital operators, especially smaller ones with less scale, is the ability to attract and maintain workers. US hospitals employ some 250,000 fewer workers today than immediately prior to COVID-19. Contrast that with non-hospital healthcare employment, which is almost 1 million jobs larger today than prior to the pandemic.

High turnover makes working conditions worse for the remaining workers, which then exacerbates the turnover problem. This is proving a hard pattern for hospital operators to break out of.

Wage growth elsewhere in the healthcare space has made hospital work less attractive relative to outpatient clinics or medical offices.

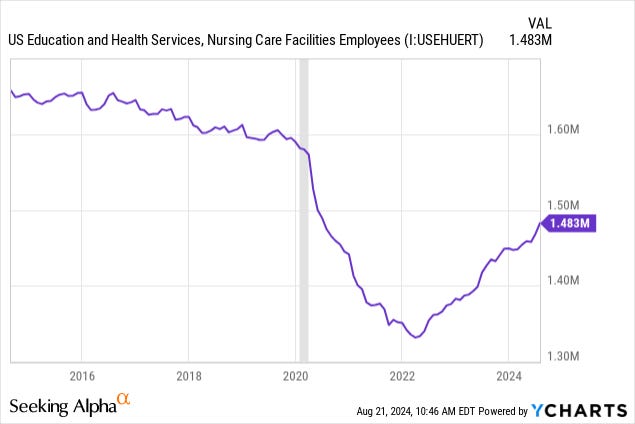

The senior care space is another area where operator scale and financial strength matter greatly. Overall employment in this industry is making a V-shaped recovery since bottoming in early 2022:

But given the low wages for most jobs in the space, turnover remains high. The biggest and highest quality operators are able to attract and retain good workers, while the lower quality players still have lots of job openings.

While the employment recovery is undoubtedly positive, the senior care space still has about 1 million jobs to regain just to return to its pre-COVID level.

Let's now turn to the Q2 2024 earnings results of our four healthcare REITs:

Alexandria Real Estate (ARE): click here for our investment thesis

Healthcare Realty Trust (HR): click here for our investment thesis

Invesque (IVQ.U): click here for our investment thesis

Medical Properties Trust (MPW): click here for our investment thesis

Afterward, we'll look at which one makes the best buy today.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.