Earnings Report: Industrial REITs (Q3 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Report: Industrial REITs (Q3 2024)

As always, we have been monitoring the fundamentals of the various sectors of commercial real estate.

Today, we synthesize data and research from Q3 2024 on the industrial real estate sector and provide a summary of it below. Afterward, we'll summarize the Q3 2024 earnings results of our three industrial REITs.

Here is a bullet point summary of our findings:

New supply of industrial space peaked about a year ago and has been declining since then.

Absorption (tenant demand) also peaked a little over a year ago and has been relatively muted since then.

Occupancy rates are returning to historically average levels but are not expected to bottom out until the mid-2025.

Tenants are pushing off leasing decisions until more clarity is gained on the US election results and direction of the economy (recession, soft landing, or reacceleration).

The near-shoring / friend-shoring trend will likely persist for the foreseeable future.

Things happen with a lag in many forms of commercial real estate, including industrial. One of the biggest reasons for this is that leases last several years and often have optional extensions that allow the tenant to extend for several more years at fixed rent rates.

Market rent rates (what it would cost a tenant to sign a brand new lease today) and in-place rent rates (the average rent rate of all existing leases in a portfolio) almost always have a spread between them. That spread is called the "mark-to-market."

When market rent rates soar rapidly, as they did in 2021 and 2022, that spread becomes huge.

But when new supply hitting the market greatly outpaces the level of tenant demand for space, as has been happening over the last year or so, the spread narrows.

In 2021 and much of 2022, tenant demand (net absorption) significantly outpaced new supply, as developers simply couldn't finish new industrial buildings fast enough to meet demand. But the huge wave of new development triggered by the COVID-era demand surge then resulted in a flip-flop. In 2023 and 2024, new supply has significantly outpaced demand.

In 2022, industrial occupancy reached unprecedently high levels, with virtually zero available space. But this year, amid a continual wave of new supply deliveries, occupancy rates are falling back to their historically average levels.

According to Colliers, the US industrial vacancy rate sits at 6.6% as of Q3 2024. CommercialEdge (Yardi Matrix) puts it a little higher at 7.0%, while Cushman & Wakefield put it a little lower at 6.4%.

Here's Cushman & Wakefield's illustration of the industrial vacancy rate and triple-net rent per square foot over the last several years:

(Triple-net rent excludes operating costs associated with property taxes, insurance, and building maintenance. This demonstrates that inflation-adjusted, "bottom line" rent rates are still growing on a nationwide average basis. There are some markets, though, like Southern California, Seattle, and Northern New Jersey that are experiencing market rent declines right now.)

Multiple sources project that vacancy rates will peak (occupancy rates bottom) from early to late 2025, depending on the industrial building type and geographic market.

Fortunately, after whipsawing one way, the supply-demand balance appears to now be whipsawing the other way.

That is, amid rising vacancies and falling rent growth, new development starts have majorly declined and are projected to keep declining over the next year or so.

The five metros with the largest development pipelines are all seeing sharp declines in square footage under construction. As new space is delivered, developers are holding off on breaking ground on new projects.

Nationwide market rent growth has fallen sharply from the ~10% YoY rate reached in mid-2022 to about 2.5% YoY today. CoStar's forecast shows industrial market rent growth troughing at 2% in early 2025 before beginning to climb again.

By late 2025, says CoStar, industrial market rent growth should be back to a healthy 4-5% per year rate.

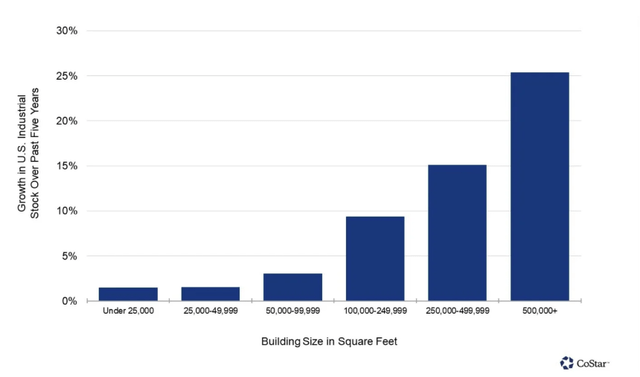

Of course, it bears mentioning that over the last five years, the vast majority of new industrial space has been large, big box buildings, typically located outside of population centers.

These massive warehouses and distribution facilities are typically leased to the likes of Amazon (AMZN), FedEx (FDX), or Walmart (WMT) on a single-tenant basis.

As you can see, there has been much less development of the smaller, "shallow bay," typically multi-tenant space often used for last-mile distribution in infill locations within population centers.

Even after the pullback in development recently, larger box space under construction still represents 4.1% of existing stock, while "shallow bay" industrial under construction represents a mere 1.3% of existing stock.

Unsurprisingly, vacancy and availability rates for this type of industrial space are meaningfully lower than for big box buildings, even though both have been rising since the beginning of 2023.

This type of industrial building is what populates two of our three industrial REITs' portfolios. We think this focus on infill, shallow bay industrial will minimize their downside from the current, temporary period of oversupply while maximizing their upside from the more favorable supply-demand environment likely to come in 2H 2025 and beyond.

Now let's turn to the Q3 2024 results of our three favorite industrial REITs: