Don't Buy Hotel REITs Just Yet

Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

Easterly Government Properties (DEA)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Safehold (SAFE)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

Don't Buy Hotel REITs Just Yet

Many of you have recently asked me whether now would be a good time to buy Hotel REITs.

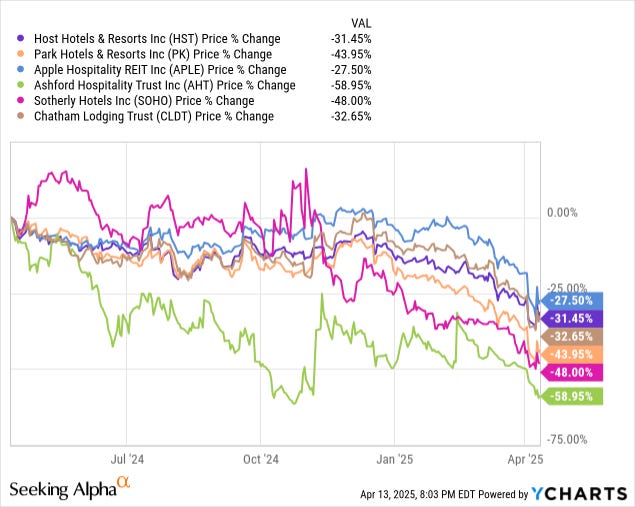

Most of them have crashed due to recession fears, and as a result, they now trade at historically low valuations:

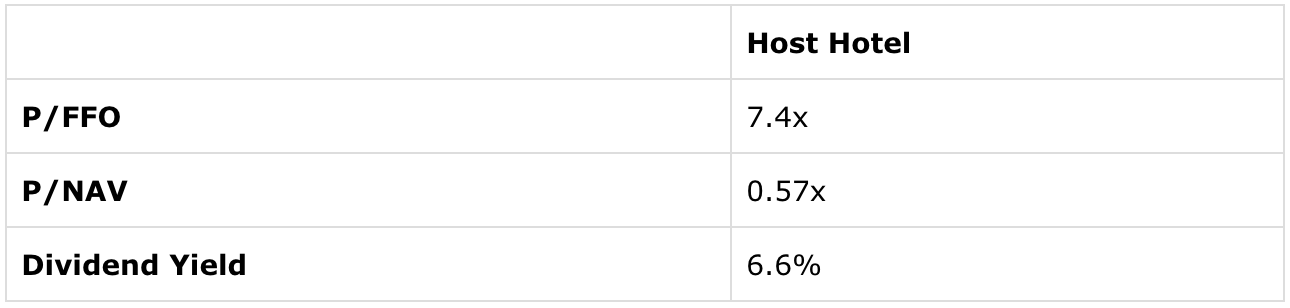

Even Host Hotels (HST), which has historically been perceived as the blue-chip of the sector, is today trading at an incredibly low valuation:

Smaller and lesser-known hotel REITs are, of course, even cheaper and could offer a significant upside in a future recovery.

Is now the time to invest while there is blood on the streets?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.