Bill Ackman And GGP: Important Lessons From One Of The Greatest REIT Investments In History

In hindsight, we were too early investing in the mall space. Our investments in Brookfield Property REIT (BPYU) and Macerich (MAC) had already dropped by 20 - 40% before the coronavirus crisis hit the market, which then dragged then down much lower. We are now sitting on a large unrealized losses and the outlook surely does not look promising for malls.

We are in a pandemic-induced economic shutdown with social distancing measures forcing most malls to close down. People are sitting at home in quarantine. Unemployment is soaring. GDP is collapsing. And e-commerce is given a temporary monopoly on most non-essential goods.

Put simply malls were hit with the worst possible black swan you could think of. This is much worse than your regular recession.

Even then, we remain optimistic about the long-term potential of Mall investments, and believe that at these prices, they offer a once-in-a-decade opportunity to earn 3x - 4x your capital in the recovery.

We now own 3 mall REITs and they each have one thing in common: they focus on the best of the best malls in the most densely populated areas with significant redevelopment and densification potential. However, each also has something unique to it:

Macerich (MAC): MAC owns the best assets.

Brookfield Property REIT (BPYU): BPYU is the best diversified.

Simon Property Group (SPG): SPG has the best balance sheet.

Each has it own unique angle and we believe that owning of a combination of all 3 companies provides the best risk-to-reward in the mall space.

Below, we first provide a summary of the long-term investment thesis, and then explain how these investments relate to General Growth Properties (GGP) in 2008, a mall REIT that turned out to be one of the greatest investments in history.

A Reminder of the Long-Term Investment Thesis

Malls are today hated by the market because they are perceived to be in a secular decline caused by oversupply on one hand, and the growth of e-commerce on the other.

There is some truth to that. However, what the market fails to appreciate is that not all malls should be put in the same basket.

US Mall Distribution by Quality:

Class D, C, and some B malls will suffer in an oversupplied market with e-commerce stealing market share. However, as these properties close down and / or transform into other uses, the supply of malls goes down, leaving the owners of Class A flagship properties in a stronger position.

The traffic is then redirected towards the best properties with the superior location, better retailers, and offering the greatest experiences.

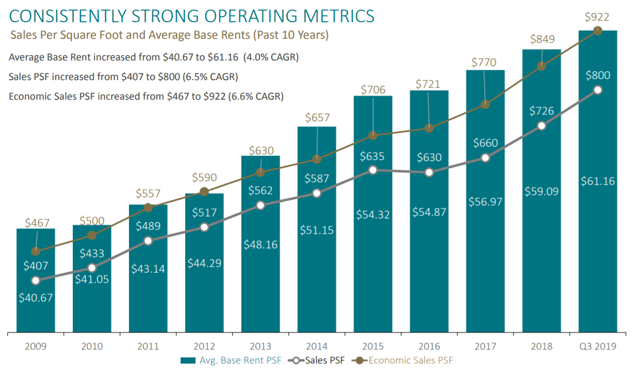

To prove to you that this is true, all you have to do is take a look at the evolution of sales per square foot and rents at MAC properties:

Year-after-year, MAC has kept hitting new record highs in terms of sales per square foot and rents at its malls. This was happening in a time period of exploding e-commerce growth and it did not prevent these Class A malls from achieving good results.

So clearly, both, the e-commerce, and Class A malls can co-exist. In some weird ways, Class A malls may even benefit from the growth of e-commerce as it puts an end to new supply, and it leads to consolidation among the existing malls with only the strongest surviving and gaining the traffic of weaker malls.

But mall consolidation is only part of the story here. The market has overlooked the rapid transformation that is happening inside malls.

Malls used to be pure shopping destinations that would be anchored by a few large department stores focusing predominantly on fashion retailing.

This is not the case anymore. For years now, malls have replaced dying retailers with other uses to diversify away from fashion and become more resilient.

As a result, today’s class A malls have become mixed-use destinations with diversified components:

Shopping component: flagship fashion stores and goods that are better bought in store due to need for physical examination or assistance: luxury goods, cosmetics, expensive electronics, etc…

Entertainment component: restaurants, bars, coffee shops, movie theaters, spas, bowling, casinos, fitness etc…

Service component: barber shops, beauty salon, phone repair shop, library, grocery, amazon lockers, etc…

Other use component: apartments, hotels, office, storage, etc…

Malls are today still pictured to be “shopping” destinations that are at great risk of further e-commerce growth. This is wrong. The reality is that malls have become shopping / entertainment / service / other use destinations that enjoy consistent traffic that is mostly insulated from e-commerce growth.

It is simple logic: if a mall is located in a high-growth urban center, and the service, entertainment, other uses bring consistent traffic, then the shopping component can also thrive in a highly digitalized world.

And it does not stop there.

Because high quality malls are located on some of the most valuable sites in the world, they have the opportunity to densify their properties with new constructions on top and adjacent to their current properties. Here are two examples:

Before:

After:

Before:

After:

The mixed-use densification strategy uses retail as a catalyst to develop live, work, stay and play destinations which are extremely appealing to residents, workers, guests and retailers:

Apartment Residents: You have everything within a short walking distance. Your grocery store, your fitness center, your entertainment, and potentially your job or transportation system to it.

Office Workers: The office workers have plenty of dining options, coffee shops, and options for meeting places.

Hotel Guests: You have unparalleled shopping, dining and entertainment without having to even leave your property.

Store Retailers: They get a constant flow of traffic from the apartments, hotels, and office buildings that are connected to the mall.

For these reasons, studies have shown that people are willing to pay a hefty rent premium to occupy space, whether it is residential, office, hospitality or retail when it is in mixed use building.

Mall owners benefit as (1) it unlocks the immense value of their land and (2) boost the traffic and sales in the entire mall.

As an example, BPYU is building apartments at one Rouse mall outside of San Francisco, where housing is scarce. It has been reported that it could make the land 10 times more valuable than it is today. BPYU, MAC and SPG are working on similar projects at most of their properties.

So to summarize, we believe that well-located Class A malls have a bright long term future ahead of them. This is because:

Mall consolidation benefits them.

Malls have diversified away from pure fashion.

Malls mostly offer goods that are better bought in store.

Malls are densifying to create live, work, stay and play destinations.

Malls are located in densely populated area with high growth.

And finally, even if all of this was not enough to save malls, we believe that retailers will always want to have flagship stores in the best properties to build their brand equity and boost online sales. This alone would justify paying high rents far into the future.

The key is to invest in only the highest quality properties. It is no coincidence that we are investing in MAC, BPYU and SPG. They own by far the best properties in the publicly traded REIT space.

The market expects a secular decline. We expect secular growth. This is not just our opinion. Insiders of MAC, BPYU, and SPG have bought a combined ~$25,000,000 in shares of their own companies in March alone!

Other well-known value REIT investors including Cohen & Steers and Third Avenue are also seeing the same opportunity. In a recent quarterly letter, Third Avenue noted that:

“A business that owns a portfolio of market-dominant shopping centers in dense urban markets may screen as a “value” investment with a historically low cash flow multiple due to the out-of-favor nature of “brick and mortar businesses today. Nonetheless, the company’s securities may actually represent “growth a dirt cheap price” as enterprise takes steps to reinvest in their well-located centers and replaces obsolete department store space with higher-value alternatives such as experiential retail concepts, apartments, hotels, offices, self storage, fulfillment centers.”

For all these reasons, we remain optimistic about our long-term mall investments. However, there will be a lot of pain in the short run. The coronavirus crisis is hitting malls very hard as we explain in the introduction.

But it is exactly in these times, when it looks like the world is ending, that the best investments are made. MAC, BPYU and SPG are today offered at ~70% to 90% discounts to estimated NAV, which is even lower than during the 2008-2009 crisis.

This brings us to the story of General Growth Properties (GGP), a mall REIT that went bankrupt in 2008 and still end up turning into one of the most profitable REIT investments in history. We believe that the story is relevant to what is happening today and there are some lessons to be learnt.

The Greatest REIT Investment in History

One of the most lucrative REIT investments ever was made by Bill Ackman, a famous hedge fund manager, in the mid of the financial crisis.

He bought a 25% stake in General Growth Properties (GGP), an overleveraged mall REIT, ahead of its bankruptcy in 2008.

Back then GGP was one of the largest mall REITs in the US. It specialized in high quality properties, just like MAC, BPYU, and SPG. GGP’s average sales per square foot was $427 at the time, which compares to $700-800 for MAC, BPYU and SPG today.

However, GGP was in much deeper trouble because of its overleveraged balance sheet at a time when refinancing was not possible following the collapse of the banking system. It led GGP share price to drop from $40 to ~$1 and this is when Bill Ackman stepped in and started heavily investing:

Just for the sake of comparison, MAC has dropped from an all-time high of ~$90 in 2016 to $7 today. BPYU has dropped from $26 to $9. And SPG has dropped from $230 to $50. MAC's case is the most similar to GGP.

Bill Ackman then made the case that malls are very attractive businesses in the long run:

All of this still applies to MAC, BPYU and SPG. In fact, these three companies own even higher quality assets after unloading their weaker properties and redeveloping remaining malls into mixed use destinations over the past decade.

The Bankruptcy

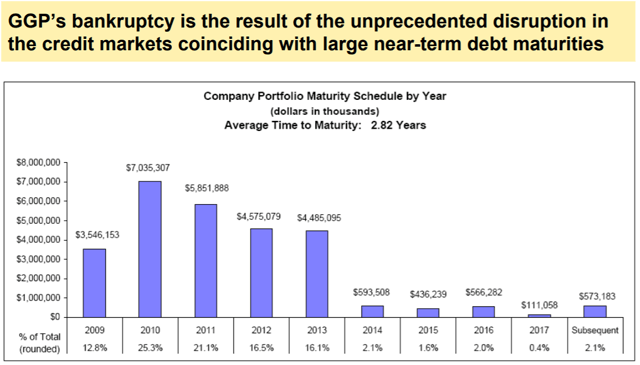

As noted earlier, the main issue of GGP was not its assets, but is balance sheet. The company was overleveraged and could not refinance its debt maturities in 2008:

Even before the company filed for bankruptcy, Bill Ackman was pushing the company to do so. This is generally a terrible idea for a shareholder, but Ackman argued that in this exceptional situation, it would leave shareholders intact:

“Unlike most bankruptcies where equity holders lose most, if not all, of their value, we believe GGP’s bankruptcy provides the ideal opportunity for a fair and equitable restructuring of the Company that preserves value for all constituents: secured lenders, unsecured lenders, employees, and equity holders.”

The rational here was that GGP had a solid business and more assets than liabilities. The business was solvent, but it was faced by a temporary liquidity issue. As long as lenders allowed an extension of the debt maturities, the business would recover and everybody would be made whole.

On the other hand, if the lenders decided to liquidate the assets, they may not have recovered all principal because no one was buying malls in the mid of the financial crisis. Even at fire sale prices, it would have been difficult to sell such large ticket investments.

Therefore, Bill Ackman made the case that GGP would be a unique bankruptcy in which all parties are incentivized to work together to preserve value for secured lenders, unsecured lenders, employees, and shareholders.

He was correct. GGP was granted an extension for its loans, which provided sufficient time to use cash flow to gradually deleverage the balance sheet and repay its existing creditors in full.

Ackman started buying it when it traded at $1.58 and bought all the way down to 35 cents. In other words, Ackman saw his investment collapse by nearly 80% before it recovered and earned him an enormous return:

Ackman took the ultimate contrarian bet that a massively overleveraged mall REIT would survive 2008-2009 and it paid off big time for him.

How does this apply to Mall REITs today?

Better assets

MAC, BPYU and SPG own today better assets than GGP did in 2008. They have spent a good part of the past decade selling weaker assets and redeveloping their remaining stronger properties to become mixed use destinations. Their portfolios are now focused on only Class A real estate is densely populated area with diversified uses. Their malls are also nearly 2x more productive in terms of sales than those of GGP in 2008.

Better balance sheets

Secondly, MAC, BPYU and SPG also have much stronger balance sheets. GGP had $30 billion of assets on its books, and about $27 billion of debt. Granted, the real value of the assets was greater due to depreciation, but nonetheless, this is extreme leverage. It was estimated that its LTV was approaching 75% heading into 2008.

In comparison, MAC, BPYU and SPG are much more conservative. They learnt their lesson from 2008 and are now leveraged at 35 to 55%; with SPG on the low end, and BPYU / MAC on the high end.

Greater near-term stress, but more liquidity to face it

Today’s class A mall REITs own better assets and have stronger balance sheets. However, they have greater near term stress due to the lock-down which is causing missed rent payments in the near term. Therefore, NOI is likely to take a much greater hit in 2020-2021 than it did in 2008-2009.

Fortunately, MAC, BPYU, and SPG are today better prepared to face a liquidity crisis. They have limited or no maturities in 2020 and plenty of liquidity to survive this year even if they receive only a small portion of their NOI.

Take-Away: Class A Mall REITs Should Survive and Recover... Just as They Did in 2008-2009

The main take-away is that if GGP could survive the great financial crisis with a dangerously overleveraged balance sheet, poorer assets, and a detour through bankruptcy, we are confident that MAC, BPYU, and SPG can survive too.

It is interesting to note that GGP was the only bankruptcy among publicly traded equity REIT in the modern REIT era. And since it turned out to be such a great success for all parties involved, we expect any future bankruptcies to be greatly inspired from the GGP case study.

As an example, let’s consider for a second that MAC was to file for bankruptcy due to lack of liquidity. It would a very close replication of what happened to GGP:

Cash flow positive business? Yes

Assets superior to liabilities? Yes

High quality assets? Yes

Deep discount to NAV? Yes

Shareholder advocate? Yes

Mostly non-recourse financing? Yes

Here again, we would have a solvent business with high quality assets but a liquidity problem. Therefore, the same solution would be the favored outcome: extend debt maturities and reemerge from bankruptcy to allow for deleveraging through cash flow rather than a liquidation.

To be clear, we do not expect MAC to file for bankruptcy. The point was just to show that based on the GGP experience, this would not necessarily be catastrophic.

The Opportunity

GGP was enormously profitable to Bill Ackman because it was deeply undervalued as well as extremely leveraged. The leverage adds risk, but it also amplifies returns in a recovery.

Today, MAC, BPYU, and SPG are not nearly as leveraged. However, based on long term estimates of NAV, they are enormously discounted:

Macerch (MAC) is priced at 10% of estimated NAV.

Simon Property Group (SPG) is priced at 25% of estimated NAV.

Brookfield Property REIT (BPYU) is priced at 30% of estimated NAV.

BPYU did not exist in 2008-2009, but MAC and SPG did. They both sold off similarly heading to the great financial crisis and everyone was calling for the end of malls, just like they are today. Yet, it only took them 24 months to triple / quadruple in value:

Today, these companies are faced with a more severe impact to NOI in the short run (shutdown properties), but they are better positioned to thrive in the long run (higher quality assets and better balance sheets).

We have little doubt that all three REITs will survive the crisis given what we presented in today’s market. If GGP could survive, then these companies can too.

Assuming that it takes 3 years for FFO per share to normalize to pre-crisis levels, all three companies would have the potential to triple or quadruple in value, just as they did following 2008-2009, and even then they would be exceptionally cheap.

Over the past few weeks, insiders at MAC, SPG, and BPYU have bought over $25,000,000 in shares. We are never seen such orchestrated buying in such massive quantities. These executive know the situation better than anyone else. And clear, they are not just making small additions to boost investor's confidence. They are loading up because they think that they can make a fortune.

Closing Note on The Difficulty of Being Contrarian

Going through an old comment section on GGP, I found this interesting comment. Do you see the parallel to our contrarian bets in MAC, SPG and BPYU today?

We may look stupid today with our mall investments caught up in this carnage. But a few years into the future, we expect to see a remake of the GGP story.

Remember that Bill Ackman saw his investment drop by ~80% before it finally paid off for him. Noone said that being contrarian was easy. Most investors would have capitulated and realized their losses. Bill Ackman was patient and he made a fortune.

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.