Announcement: Field Trip To Canada To Research Canadian REIT Opportunities

Announcement: Field Trip To Canada To Research Canadian REIT Opportunities

At its core, the value of real estate is a function of its supply and demand. If you own a property in a supply-constrained market with rising demand, you are likely to see growing rents and values.

And from both perspectives (supply & demand), Canadian real estate investments are very well positioned.

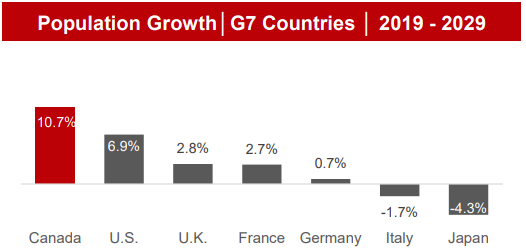

Canada ranks #1 in terms of expected population growth in the G7 countries. In the coming 10 years, the total population is expected to rise by ~10%, and most of these people will be moving to big cities:

Other countries don't come even close to Canada. How do they achieve this?

They have a well-developed economy, stable political environment, educated workforce, and a streamlined immigration system. This last point is especially important because a lot of foreigners are moving to Canada these days. Over the next 3 years alone, Canada is expected to welcome another ~1.2 million new immigrants.

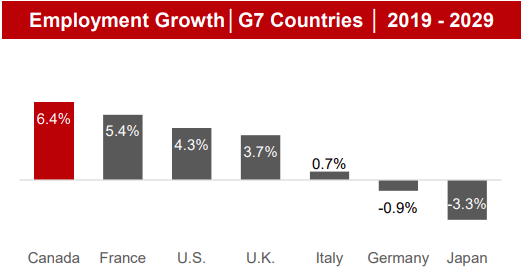

Similarly, employment is expected to grow the fastest of all G7 countries:

More people > more jobs > more demand for real estate.

But despite this rapid growth in demand, the supply of new real estate is more constrained in Canada than in the US. They have tighter zoning laws and more conservative lending practices to mitigate the risks of oversupply. Moreover, their major cities are already highly urban, limiting the supply of new land for development.

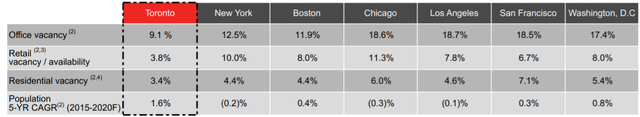

To give you an example, here is how Toronto compares to other major US cities in terms of vacancies and expected future growth:

Toronto comes ahead on all fronts and the difference is substantial.

With that in mind, we would gladly invest more heavily in Canada, but because we lack boots in the ground, we have struggled to identify opportunities so far.

In an effort to finally learn more about Canadian REITs, I have committed to a 2-week long field trip to Canada.

Yesterday, I took my flight to Montreal, and over the coming two weeks, I will also travel to Ottawa, Toronto, and Vancouver. Most of my time will likely be spent in Toronto where most Canadian REITs have their headquarters.

I will meet local management teams, conduct interviews, and also tour properties to get a better feel for the market, and ultimately, to identify the Best Canadian REIT opportunities for members of High Yield Landlord.

Finally, if you are based in one of these cities, feel free to reach out and I will be happy to meet over a coffee or beer to talk about REITs!

Greetings from Montreal,

Jussi

Good investing from your HYL Research Team,

Jussi Askola