An Update On Our Farmland Investments

I have previously explained that I invest quite a bit in farmland to diversify my portfolio. I see it as a form of insurance against major black swans and other catastrophic scenarios.

For many people, gold and bitcoin serve this purpose, but I think that farmland is superior because:

Unlike gold and bitcoin, It is absolutely essential to our survival. Regardless of wars, recessions, financial crises, etc... people will still need to eat. It is our most basic necessity.

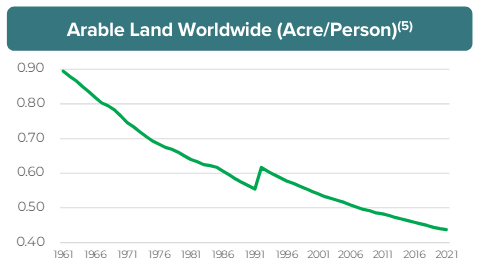

Its supply is strictly limited and even gradually declining due to better use conversions, deteriorating water access, and climate change.

The demand is consistently rising as a result of population growth and the expansion of the middle class in developing countries. We are expected to reach nearly 10 billion people by 2050 and the global middle-class will also be far larger by then, resulting in much greater food consumption.

Most farmland owners are the farmers themselves and they have a very long-term mindset and as a result, the value of farmland is very stable even in black swan events. This isn't true for gold, bitcoin, and most other popular portfolio diversifiers.

Unlike gold and bitcoin, farmland is a productive asset that generates substantial rental income while you wait. Therefore, you are not simply speculating on someone willing to pay more for it in the future.

Farmland is a real asset with a real use case that's absolutely essential to our society and therefore, it cannot be inflated away. Higher inflation leads to higher food prices, higher revenues for farmers, and higher farmland values.

Finally, it is the only property type with near-zero vacancy, ultra-low capex, much lower fungibility risk, and close to no risk of obsolescence, which makes it a lot safer than most segments of commercial real estate.

For these reasons, I like to invest 5-10% of my portfolio in farmland.

I don't expect to earn huge returns from it, but that's not its purpose anyway.

Rather, it serves as a form of insurance against a major catastrophic event like WW III, which I view as much more likely than most others.

It essentially serves the role of gold in my portfolio, but it pays me income, and I expect it to be less volatile and offer better returns over the long run.

I get my exposure to farmland in two ways:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.