Alexandria Real Estate: Investment Thesis September 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on August 7th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Alexandria Real Estate: Investment Thesis September 2024

Alexandria Real Estate Equities (ARE) is the sole pure-play life science landlord/developer in the public REIT space, and it is also the undisputed leader in US life science real estate. And the United States is by far the largest market for life science research & development.

ARE has a number of solid and enduring competitive advantages that make it the top player in this space:

Many unbeatable locations directly adjacent or in close proximity to top-tier research universities such as MIT, Stanford, and UC San Diego.

A growing emphasis on mega-campus ecosystems, or "clusters," that have been shown to facilitate greater innovation and productivity and are thus preferred by biotech tenants. Right now, mega-campuses account for 3/4ths of total rent, and management aims to increase that to over 90% within a few years.

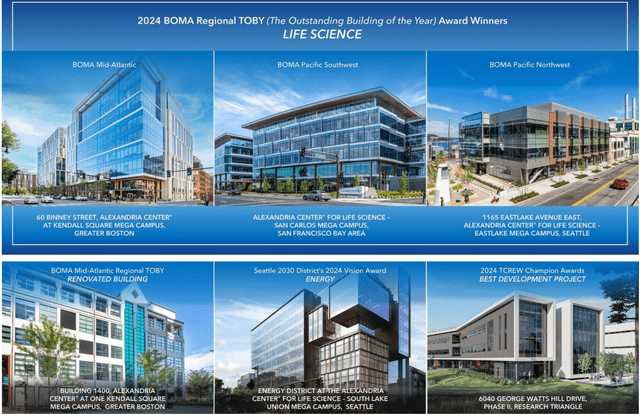

An exclusive focus on high-quality, highly amenitized, state-of-the-art Class A buildings.

Strong brand power and tenant loyalty due to its long-established association with quality.

Landlord-friendly lease terms such as triple-nets, relatively long durations, annual rent escalators averaging 3%, and often single-tenancy in buildings.

Deep expertise in the life science industry, which is aided by ARE's small VC funding segment, giving the company a glimpse into industry trends.

An experienced and shareholder-aligned management team, led by co-founder and chairman Joel Marcus.

A fortress balance sheet that includes a BBB+ credit rating, 97%+ fixed-rate debt, 13-year weighted average debt maturity, and over $5 billion in liquidity.

A strong cost of capital, including a weighted average cost of debt of 3.9%, the ability to recycle properties at significant gains, and (historically, at least) a high equity valuation.

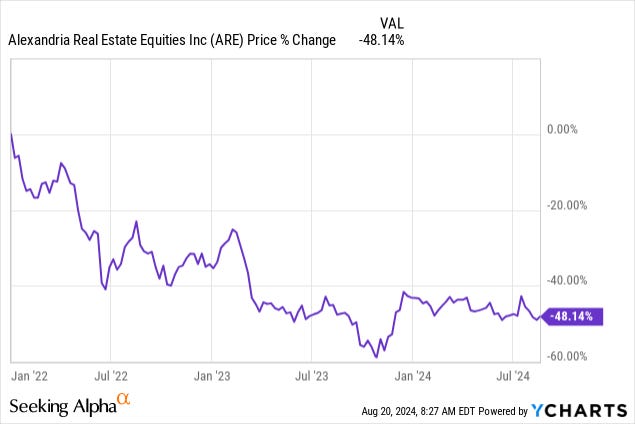

So, if ARE is such a high-quality REIT, why is its stock price almost 50% off its high?

Why is it trading at a recessionary valuation of a little over 12x AFFO? Compare that to its 5-year average (not peak!) multiple of 25x.

We have high conviction that the current malaise being suffered by ARE -- brought on by a mismatch between supply of and demand for life science space -- will prove to be a temporary phenomenon.

In the decades to come, aging demographics and a growing global middle class should provide a sustained tailwind to the life science industry. This should, in turn, translate into sustained demand growth for ARE's high-quality life science real estate.

We view ARE's depressed valuation as an excellent time to load up on shares, because the long-term outlook remains highly favorable.

In what follows, we'll delve into life science industry fundamentals, the life science real estate market, and ARE's indispensable role within it.

What Is Going On Right Now In Life Science?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.