Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on March 4th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

============================

A New Chapter for Crown Castle

Crown Castle (CCI) is a cell tower REIT that we own in our Retirement Portfolio.

For most of its history, it has been perceived as a "blue-chip REIT" because it owned some of the best cell towers in its peer group, had an investment grade-rated balance sheet, and its management had a great track record.

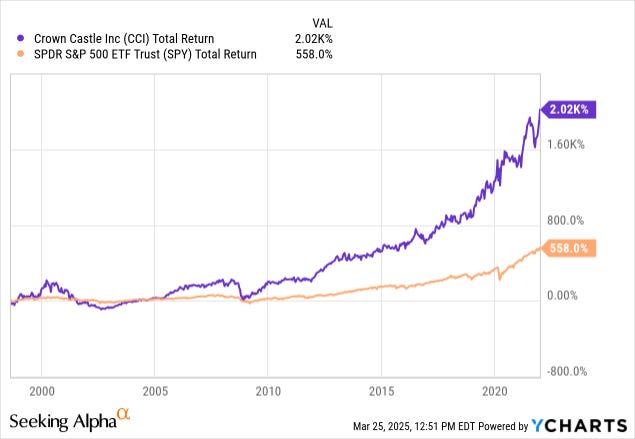

It has massively outperformed most REITs and even the S&P500 (SPY):

But the company has faced issues in recent years and this has caused its share price to crash.

Firstly, T-Mobile's acquisition of Sprint led to tenant consolidation and some lease cancellations.

Secondly, interest rates surged at an unprecedented pace, and CCI, unfortunately, came into this rate-hiking cycle with some variable rate debt.

Finally, CCI had been growing a fiber and small cell division in the past many years, but its returns had come below expectations, putting uncertainty on the future prospects of this business and the broader capital allocation policies of the company.

This caused the share price to crash 56% at its lowest point:

Upfront disclaimer: We got involved too early, as we often do, because we cannot time the bottom.

We have argued that the stock had become undervalued because of what we saw as a temporary slowdown in its growth.

The impact of the lease cancellations would dissipate in 2026.

Interest rates would eventually return to lower levels.

Finally, we were confident that the capital allocation policies would be adjusted as needed based on the new findings. After all, this company has historically been very friendly to shareholders.

But we were not alone in seeing the opportunity.

The crash in its share price also got the attention of the world's biggest and most sophisticated activist investors, namely Elliott Management. (By the way, they cannot time the market either as they also bought their stake too early...)

They recognized that the company was undervalued because of temporary issues that could be resolved by:

Selling the underperforming assets (the fiber and small cells)

Refocusing on its best assets (the cell towers)

Paying off debt

Buying back stock

Readjusting the dividend payout to retain more cash flow

Changing the leadership

And that's precisely what they did.

Just recently, the company announced the end of its "strategic review", selling its fiber and small cell assets for $8.5 billion.

The company is expected to use $3 billion of these proceeds to buy back shares and the rest to pay off debt.

This will reposition Crown Castle as the only REIT with a pure-play focus on US cell tower REITs and its leverage will be at around 6x, allowing it to maintain an investment grade rating.

Following the asset sales, the dividend is also being readjusted at a ~75% AFFO payout ratio (excluding the amortization of prepaid rent), which should allow the REIT to organically reinvest in growth going forward while still resulting in an above-average yield for a cell tower REIT.

The market loved the news, sending the share price nearly 30% higher. (Note that some of this surge happened already before on speculation of an imminent deal)

This is exactly what the activist investors thought would happen.

They thought that value could be created by increasing the quality of the business as this would be rewarded with a higher valuation multiple.

Even if the cash flow drops to a lower level, the higher multiple would more than make up for that, resulting in a higher share price.

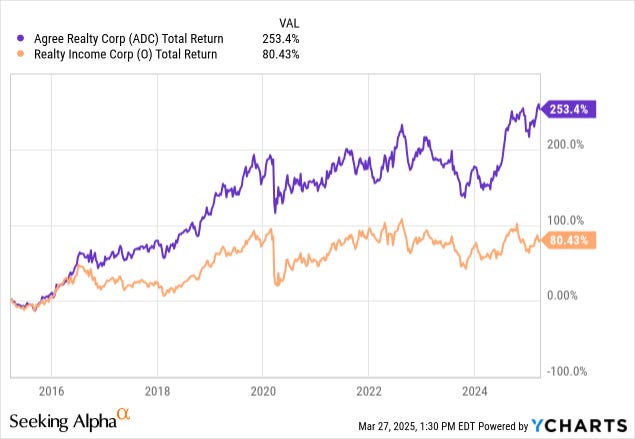

It is very similar to what W.P. Carey (WPC) also went through recently when it sold its office properties. It initially didn't get as much love, but it has already recovered since then. It is a good reminder that there is more to REITs than their dividend. They are total return vehicles, and the level of the dividend has no impact on the actual value of the assets or their performance. Therefore, while the decision to cut or hike the dividend may lead to short-term volatility, it is unlikely to materially alter the long-term direction of the company. Another example is Agree Realty (ADC), which cut its dividend in 2011 but was still the most rewarding net lease REIT in the following decade. Most investors are total return-oriented, and they care more about the fundamentals and actual total return prospects than just the dividend:

But what now?

Is Crown Caste still a Buy after the recent rally?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.